Understanding who is dominating the market on a given day gives fair advantage and plays a crucial role in deciding trading strategy and executing the strategy at the better price. When the market participants behavior changes one can continually readjust his strategy and change his/her tactics depending upon who is in control.

![Market Participants]()

Variety of traders enter and trade the markets in anticipation of profits. They are motivated to take a trade by variety of reasons, emotions. The way each of the these participants combines and employs information is different. Participants rely on fundamental analysis, technical analysis, New based information, Global Events, Political events, Earnings results, orderflow, trading models/algorithms to take their trading decisions.

We can classify these market participants into 5 segments

Scalpers : Most of the scalpers holding positions are measured in seconds to a maximum of few minutes. They rely on Tick data/ lower timeframe charts 1min-5min charts. Few scalpers use orderflow/volume analysis as a part of their trading decisions. They enter and exit the market damm quickly. And most of the scalping is done in the exchanges by the high frequency traders who use speed and computer algorithms as a advantage to enter and exit their trading positions faster. Market Data is critical element for them and they mostly rely on their intuition.

Day Timeframe traders

Day timeframe traders are the one who comes into the market with no position and goes out without any position. i.e if they are buying on the same day they have to sell on the same day..viceversa. Most of the Day timeframe traders shows emotional behavior. They rely on news based information, rumors, reacts to gap situations, global events, global sentiments & Earnings result.

Most of them uses charting indicators,Chart Patterns, buy or sell signals, pivot points, advisories, tv analysts,social media to double confirm their trading decisions. Some people are highly obsessed with ichimoku cloud, Elliot Wave, GANN Analysis and few even trade against the TV Analyst opinions and social media opinions thinking that their opinions are often dumb. Few set of day timeframe traders even employ low frequency trading algorithms to avoid emotions. Their stoploss are generally tight due to highly leveraged positions.

Shorter Timeframe Traders

Their holding period is typically ranging from few days to 1-2 weeks. Their trading decisions are motivated by economics events, speculate on global events, brokerage opinions, research reports, advisories, and market rumors. Often they relies on classical technical indicators, market guru’s, Watching Dow Jones , SGX Nifty, Crude Oil, Local Currency movements and other market movements to double confirm to ensure that their trading decisions are right.

They are typically swing traders or breakout traders and very well aware about the recent economic/political conditions and have good knowledge on fundamental information and the effects its impact on market movements. Most of the time shorter timeframe traders or day timeframe players will be dominating the market.

When the market opens typically a day traders/shorter timeframe traders pile on faster. Scalpers/Day timeframe traders/Shorter timeframe traders are often subjected to stop hunting

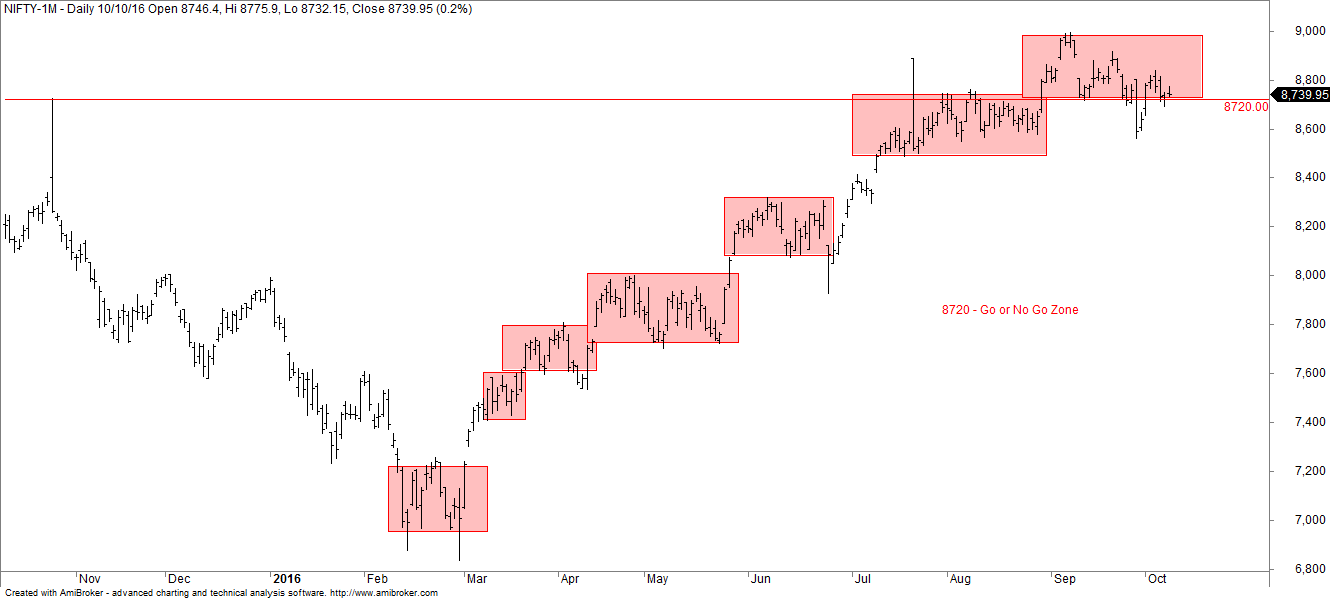

Intermediate Timeframe Traders

Thier holding period is typically ranging from few weeks to couple of months. They are strongly motivated by fundamental data or technical analysis and some even do techno-fundamental analysis. Their trading behavior is aggressive when they start dominating the market. However they are very less dominant compared to the shorter timeframe traders. When they are dominating the market they are very aggressive in moving the price to the extreme. During this phase the shorter timeframe traders who are trading against these intermediate traders will incur significant damage to their portfolio. They have the potential to breakout of the daily consolidation trading ranges.

Longer Timeframe Investors/Traders

Their holding period is typically ranging from more than 6 months to even couple of years. They are strongly motivated by fundamental data and market valuations. Their focus is on finding an outstanding company at a sensible price. When they started dominating the market every other timeframe joins along with them. They have the potential to breakout of the weekly or monthly trading ranges.

The post Understanding Market Participants and their Behavior appeared first on Marketcalls.

![]()