OptionAction is a Option Analysis tool which lets you to build and analyze option strategies for Indian Stock Markets. It provides most of the analytics required for a option trader to practice and implement their option strategies. Though it is a simple tool with cool UI interface you can build any complex option strategies with the available pre built option templates.

OptionAction comes with features like Option Chain, Option Greeks, Option Strategy Builder, Option Greeks Calculator, Option Pain, Put-Call Ratio (OI & Volume), Open Interest look up, Volatility Smile, Volatility Cone and much more features.

Step to Download OptionAction

1)Download OptionAction Setup and Install it

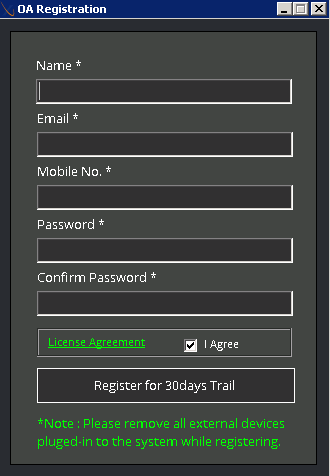

2)Open OptionAction. It opens the registration page. Give your registration details and register. This will send you the activation key details to the registered email id.

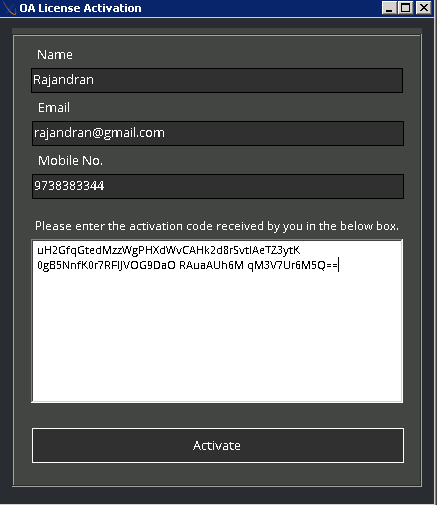

3)Copy the activation key you received in your registered mail and paste it in the activation code box as shown below and press Activate

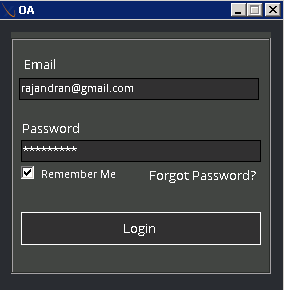

4)After successful license activation. It ask for user credentials. Enter the login credentials which you created during registration and press Login button.

Features

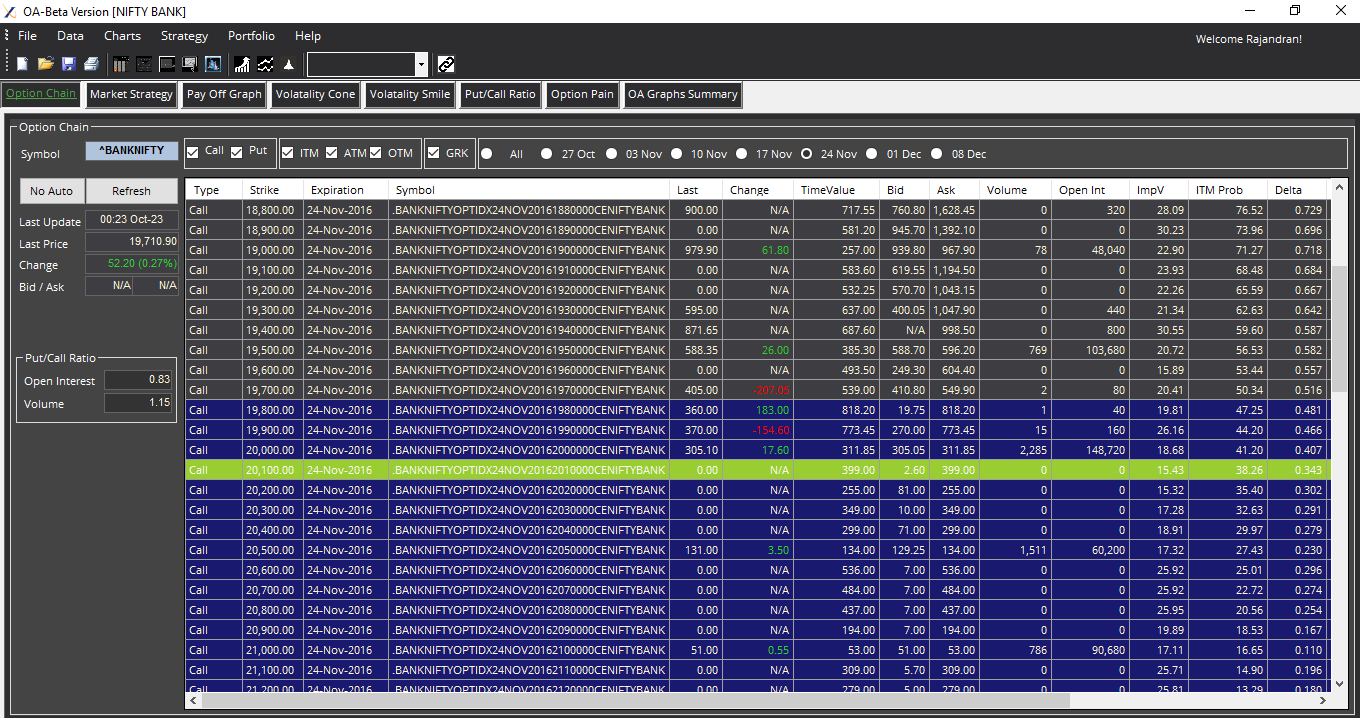

1)Neat and Cool Option Chain tool with Option Greeks, Implied Volatility, PCR Ratio (OI & Volume), Type and Search Symbols. It also computes total PCR ratio for the entire option expiry contracts or individual expiry contracts. By default it computes Total Put-Call Ratio for the entire expiry contracts.

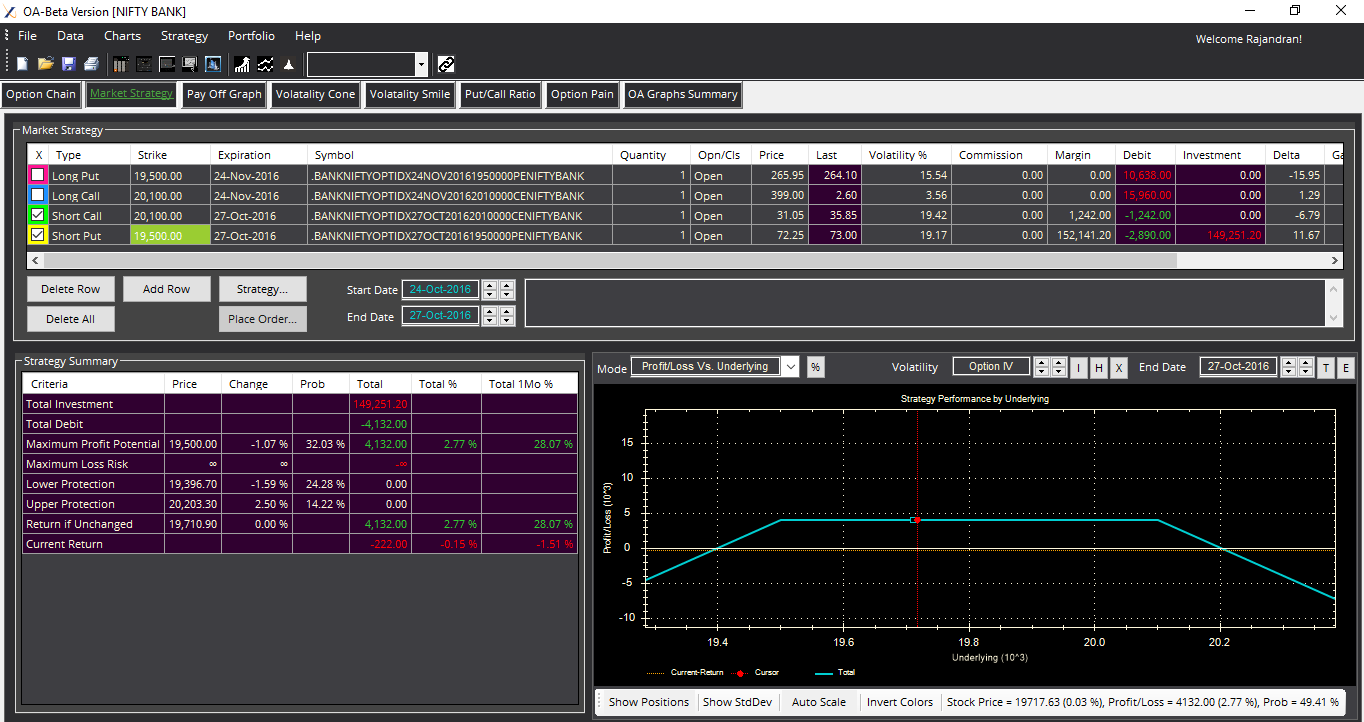

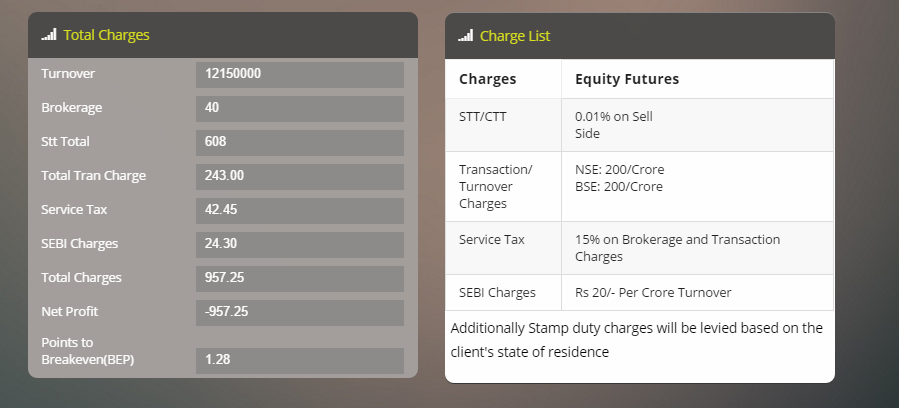

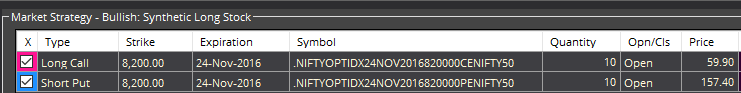

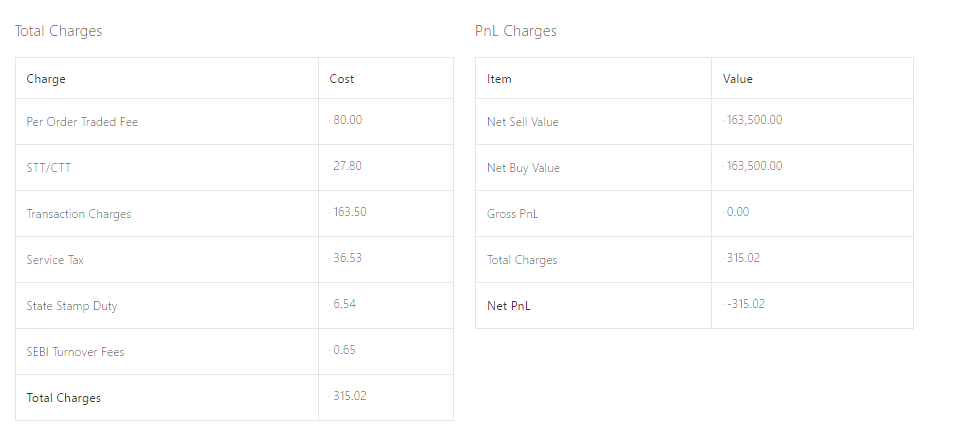

2)Market Strategy is where one can build their option strategy either manually or with custom prebuilt templates (click on strategy button to get pre built templates). Once the strategy is built you can immediately analyze using strategy summary and payoff graph analyzer as shown below.

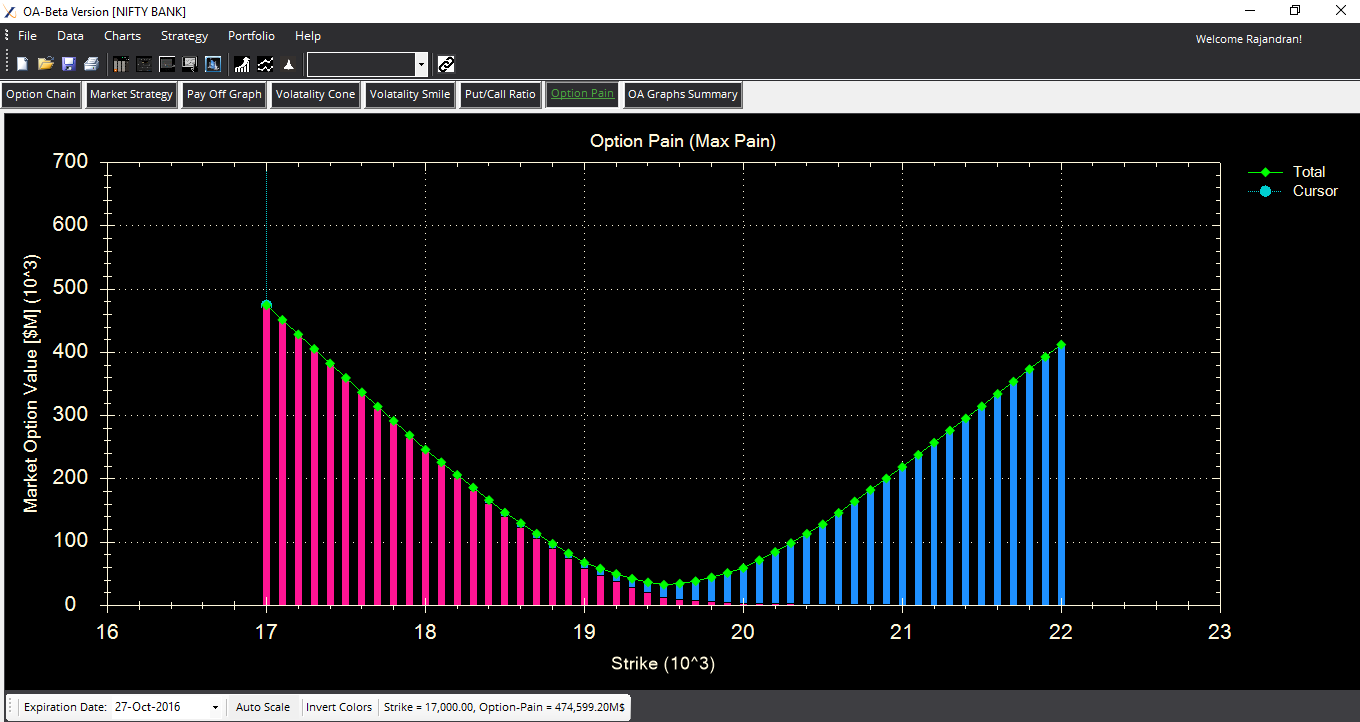

3)OptionAction provides provision to compute and plot Option Pain. Option Pain, also known as Max Option Pain or Max Pain, is based on the theory that since most options buyers lose in options trading, the price of the underlying stock must be manipulated somehow to close during options expiration at a price that results in the most options contracts expiring out of the money

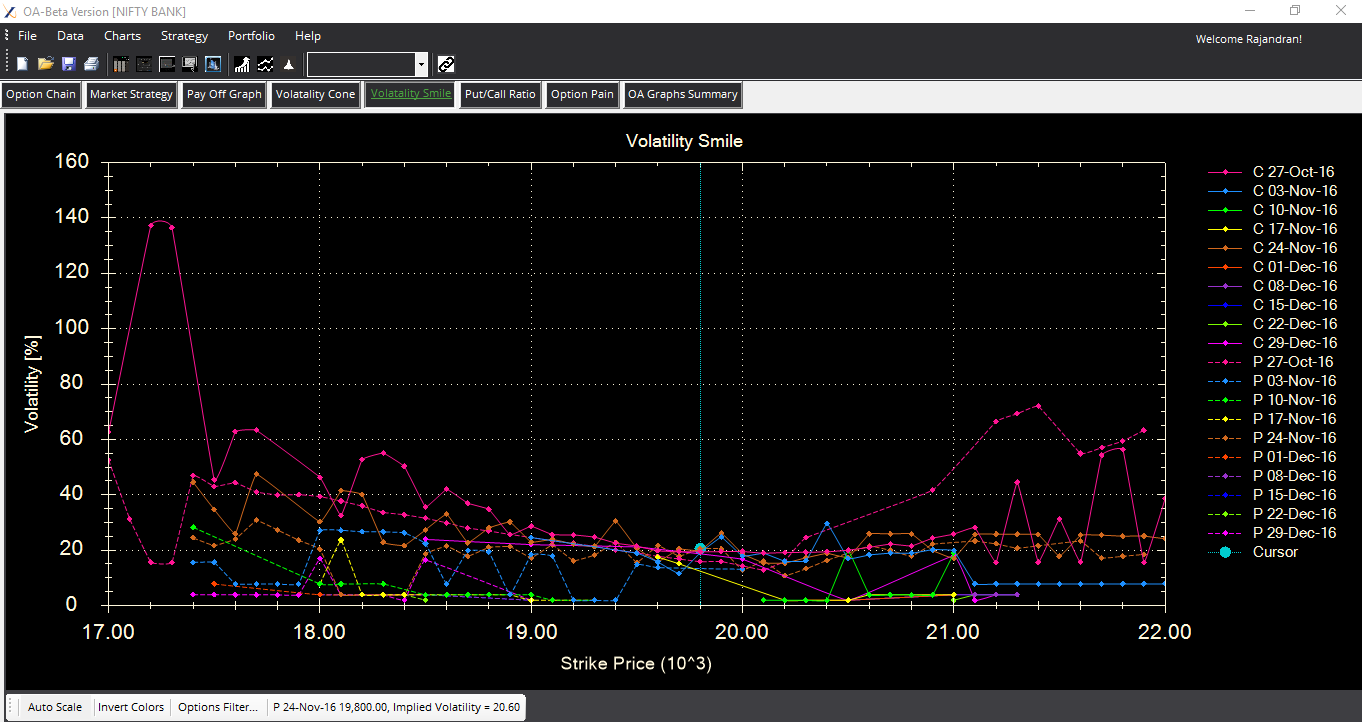

4)OptionAction comes with features like volatility cone, Volatility smile to understand which option strikes are cheaper/expensive when compared to the historical volatility

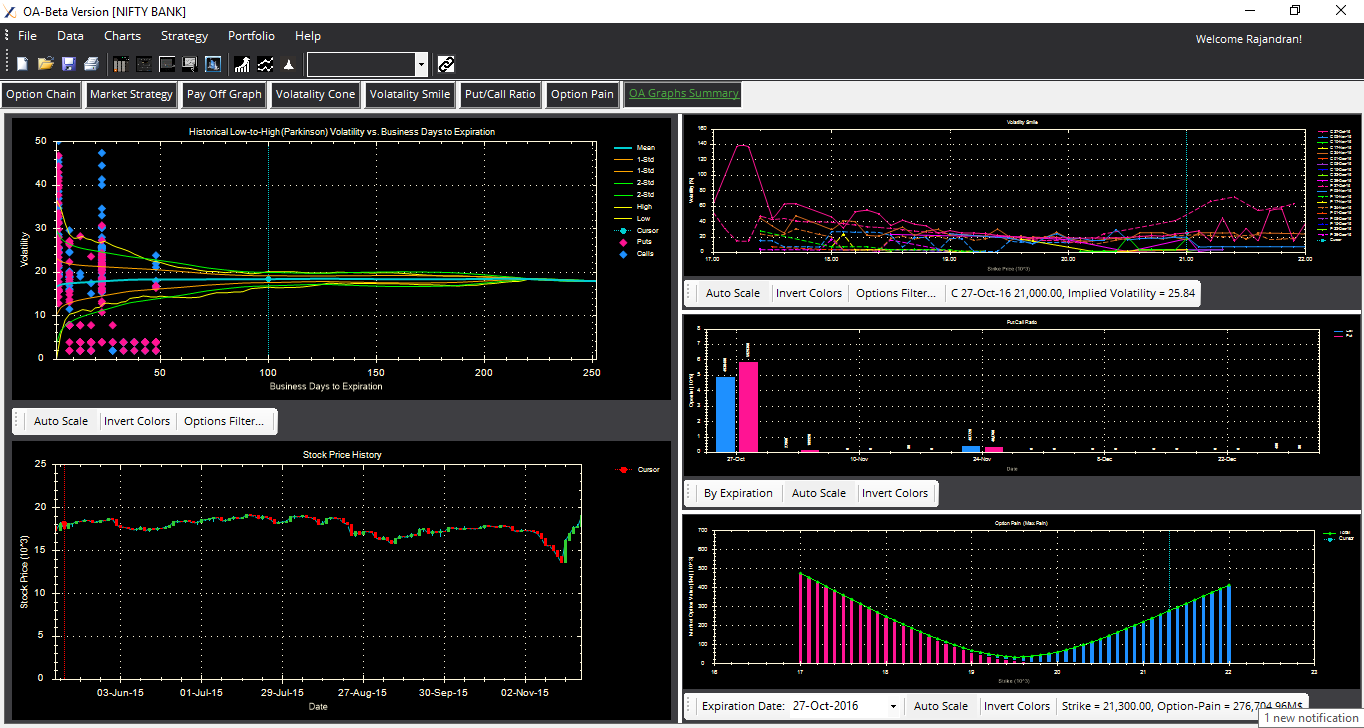

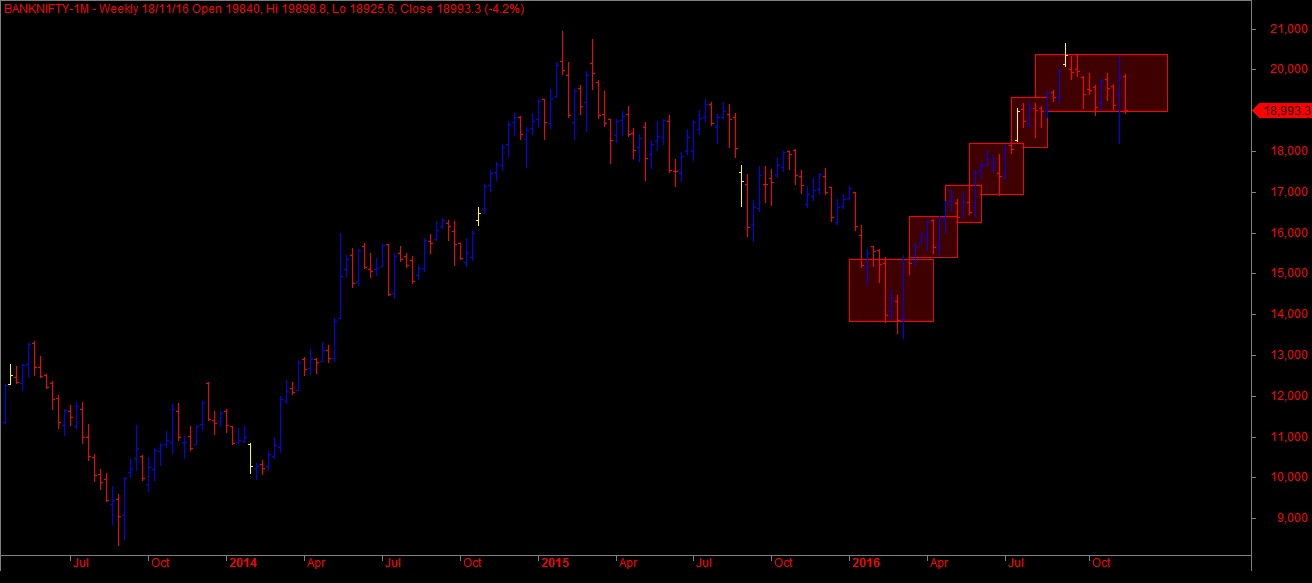

5)It also summarize the overall strategy with All in One Dashboard which gives you the bird eye view to the market condition and strategy overview.

For support or resolving bugs one can raise their queries at OA Desk forum.

Overall a good tool to try with. Hope the developers who engaged with OptionAction comes with lot more interesting features and analytical dataset.

The post Option Action – Options Analysis Tool for Indian Markets appeared first on Marketcalls.