Market Profile Workshop (MP 2016) is a rigorous training program for traders, providing you with the clarity of thought for your trading journey through live lectures, case studies, assignments, guidance, feedback and insights.

![Market Profile Workshop]()

Why this Course

Markets are complex to understand. We teach how to understand markets in a better way, will bring thinking ability in you to trade independently in dynamic complex trading environments. The Program will provide the right framework and concepts to equip you with clarity for your trading journey

Venue : Premier Inn, ,ITPL Main Road Seetharampalya,Whitefield, Bengaluru, Karnataka, India

Date : 24th and 25th, Sep 2016

Contact : 09738383344 (Mon – Sat 9a.m -6p.m)

About the Mentor

Rajandran is a Full time trader and founder of Marketcalls, hugely interested in building timing models, algos , discretionary trading concepts and Trading Sentimental analysis. He now instructs users all over the world, from experienced traders ,professional traders to individual traders.

Rajandran attended college in the Chennai where he earned a BE in Electronics and Communications. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst(Optuma), Metatrader, Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies.

About the Mentor

Agenda

click here to view the agenda

Topics Covered

Day 1 – Morning Session

Why to trade using Market Profile.

Introduction to Auction Market Theory.

Understanding two way auction process.

Basic Building Blocks of Market Profile.

Understanding Market Participants.

Measuring Trading Participants confidence level.

Understanding Who is in control.

Trading Price Vs Trading Value

Market Profile and Market Internals.

Day 1 – Afternoon Session

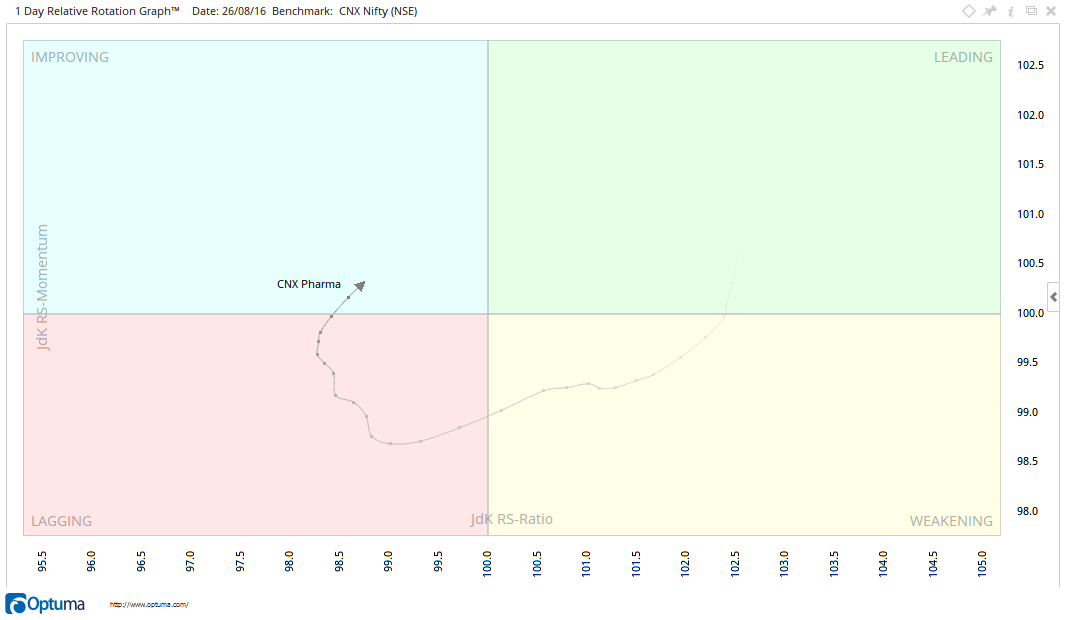

Setting up Market Profile Charts for various instruments

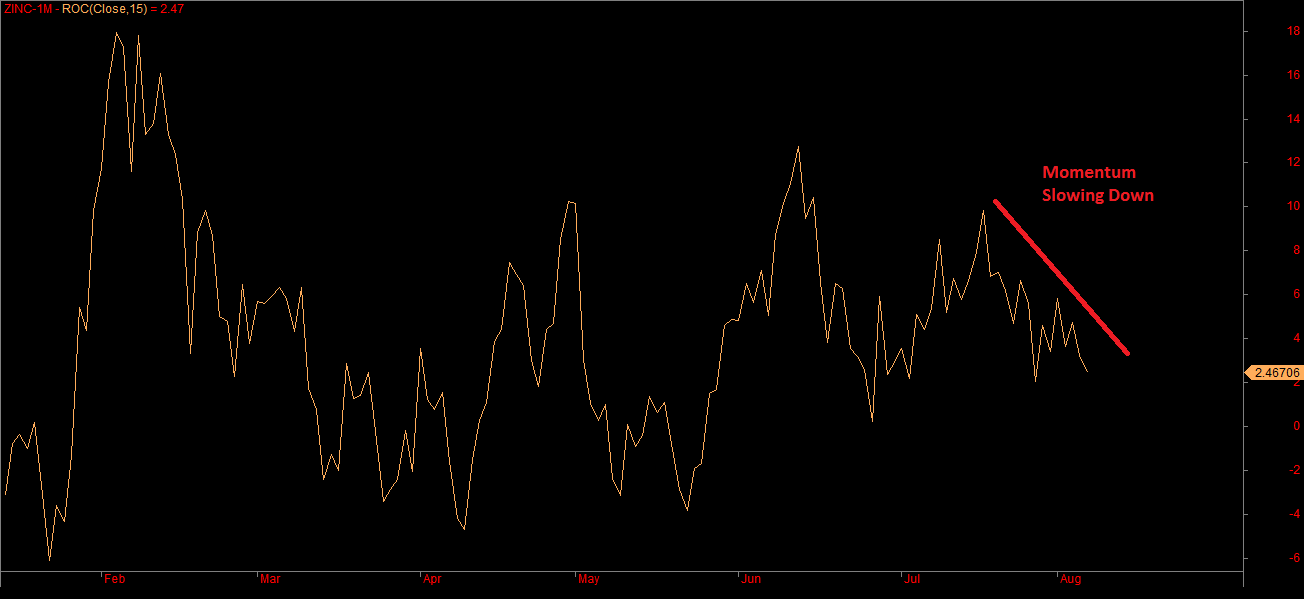

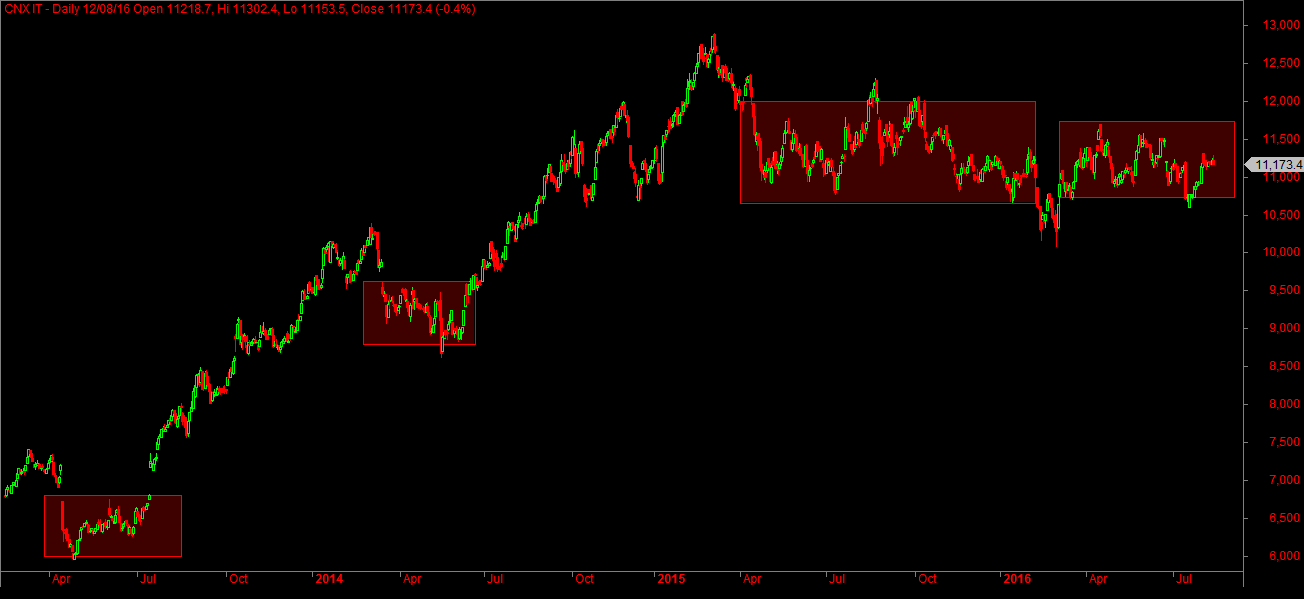

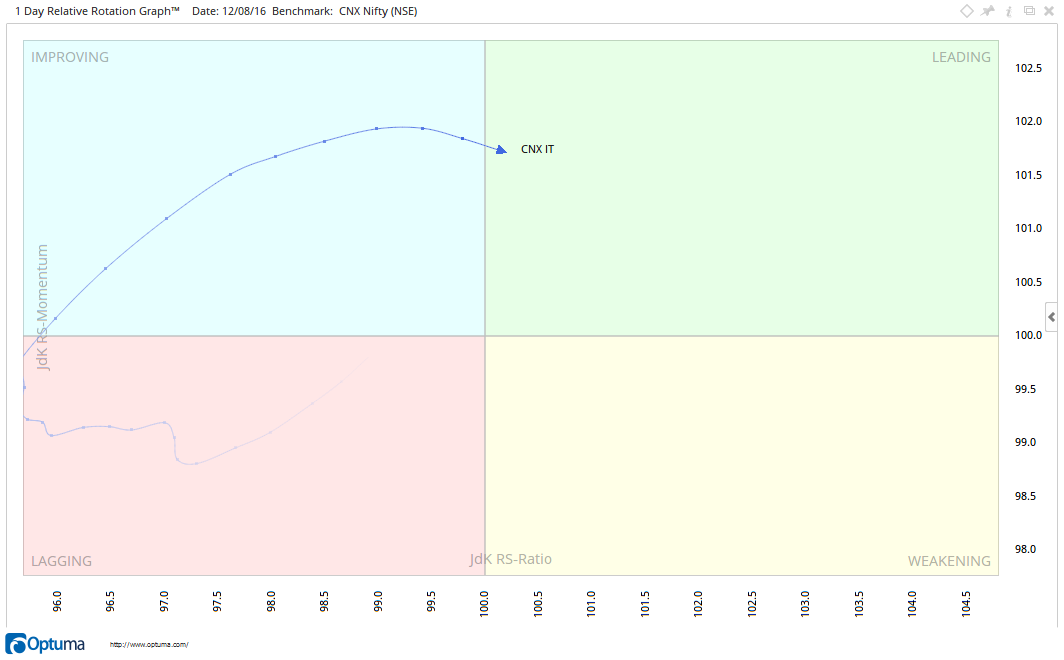

Learn to do analyze stocks using Top Down Approach

How to Measure the Age of the Trend

Understanding Excess and Balance

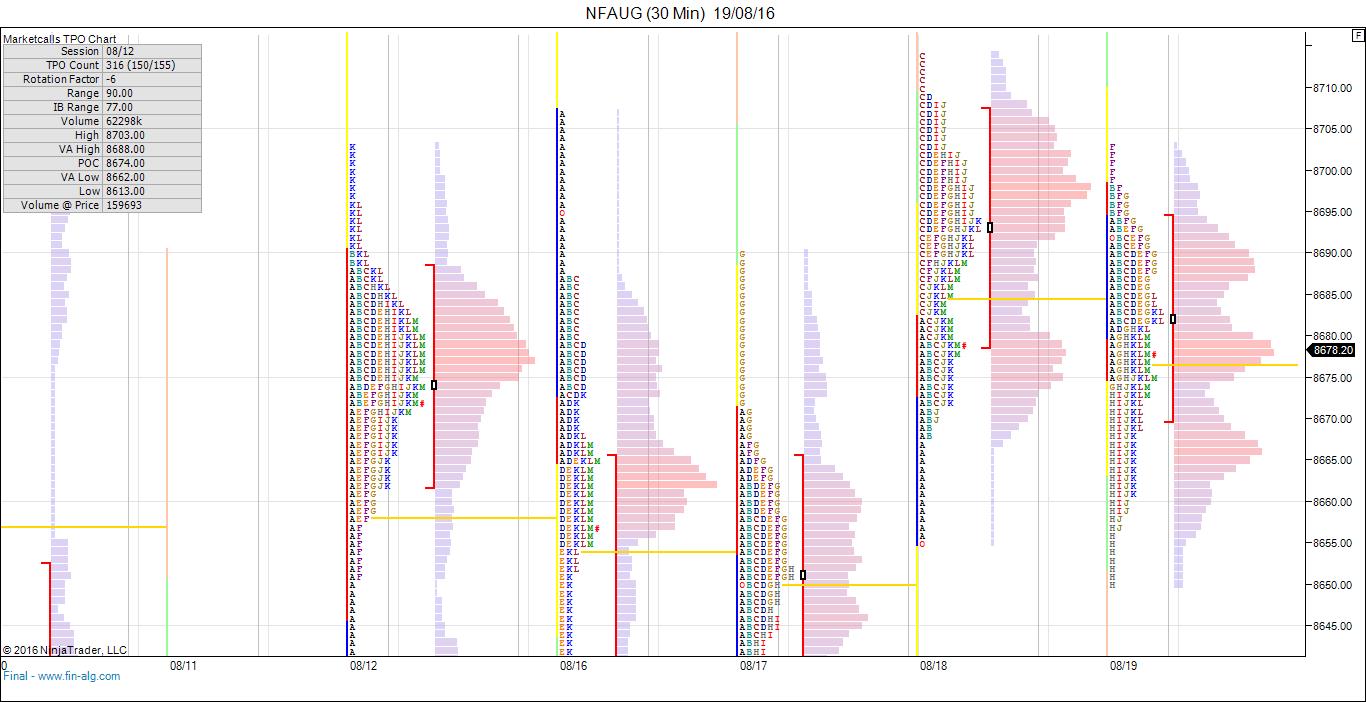

Understanding POC and Value area concepts

Understanding Profile Structure, Subtle and Nuances

Understanding Key Reference Levels and its Significance

Day 2 – Morning Session

Composite Profile and Profile Settings

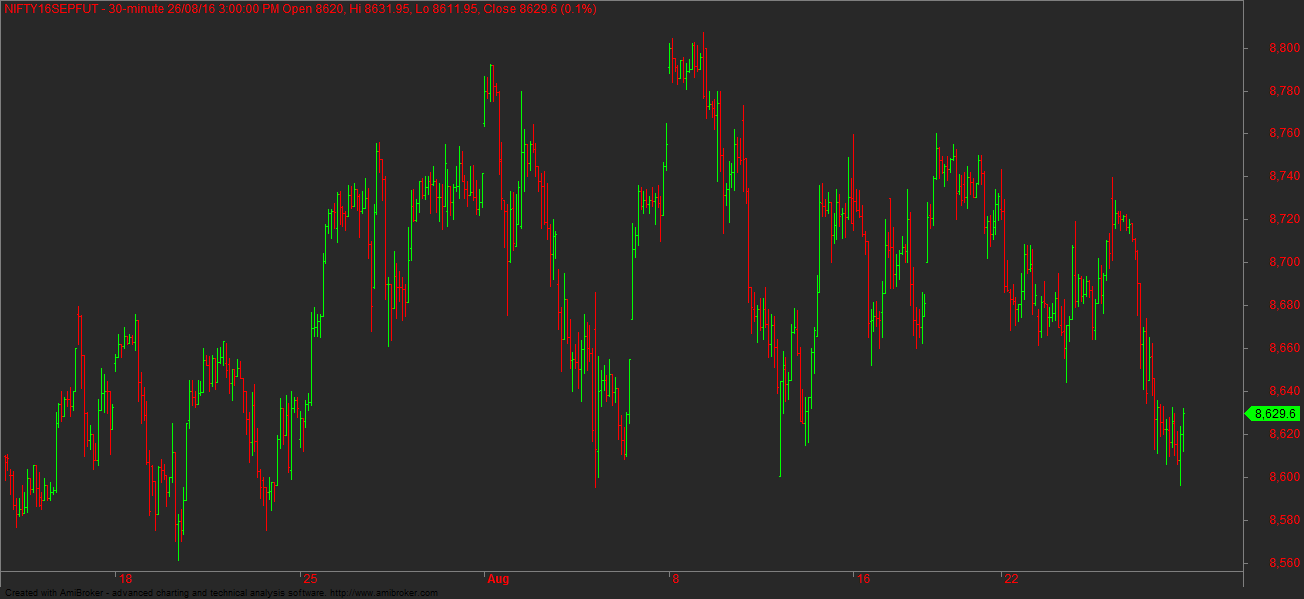

How to Identify intraday and positional trading setups

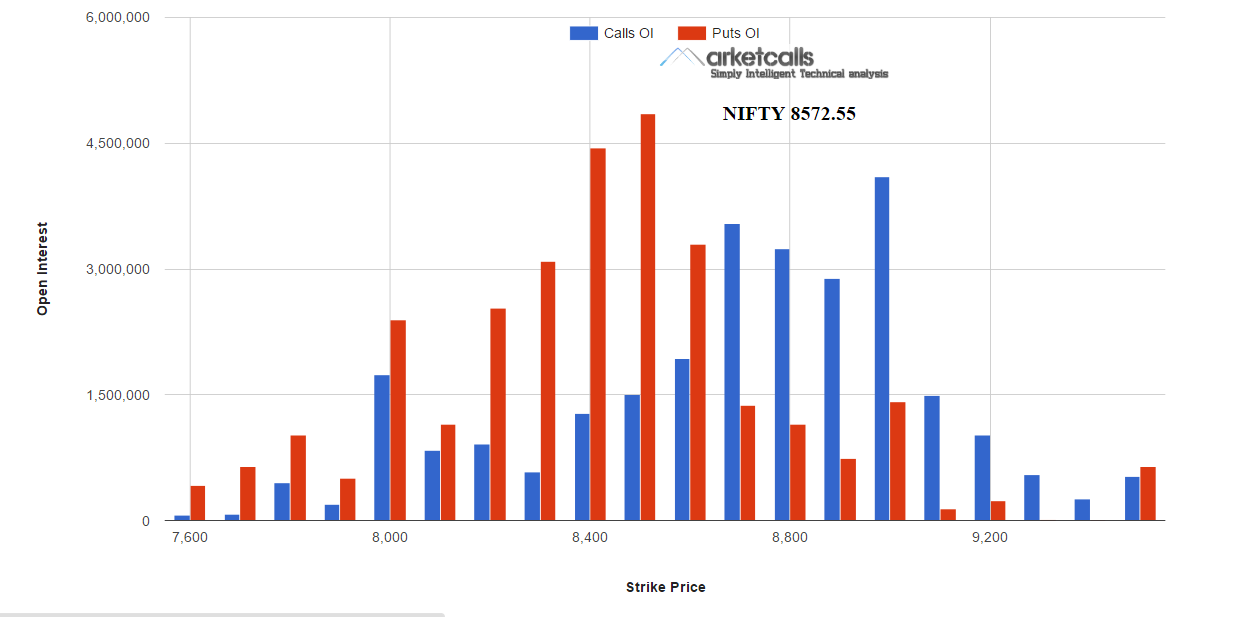

Trading Options using Market Profile

Market Profile Case studies

Introduction to Order flow Analysis

Day 2 – Afternoon Session

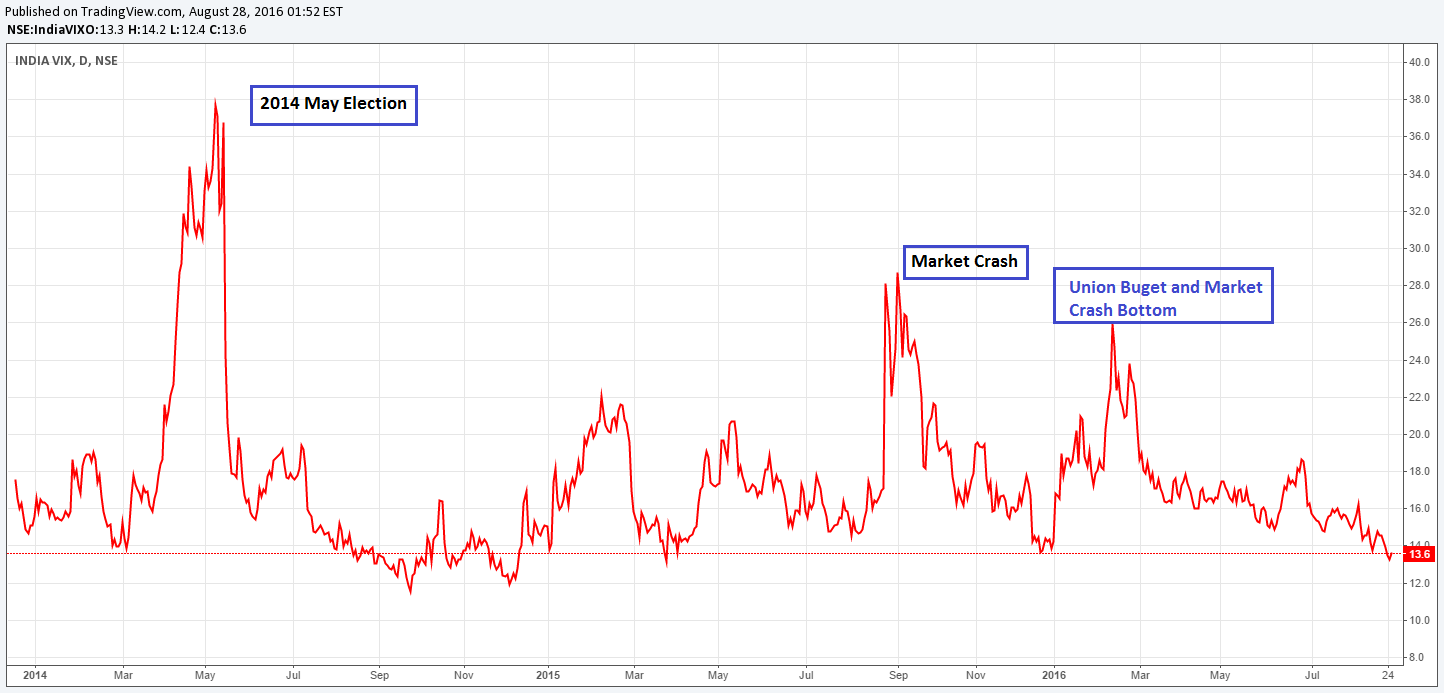

Why Sentimental Analysis in Trading.

Gathering and Evaluating the Crowd Sentiment.

How to trade Extreme Sentimental Factors.

Understand the Mindset of Emotional traders

How and When to Trade Against crowd sentiment

Best Trading Practices and Market Profile Trading Principles

Trading Room and Daily Market Commentary

Daily Market Commentary (Online – Gotowebinar)

Date : Oct 3rd – Oct 28th,2016 (All Market Days)

Timings : 8.30a.m – 9.00a.m

Market Profile Trading Room (Online – Gotowebinar)

Date : Oct 3rd – Oct 28th,2016 (All Market Days)

Timings : 9.15a.m – 4p.m

Key Takeaways

6 months access to Recorded Webinars (Marketcalls Portal)

1 month access to Live Trading Journal (Slack Chat group)

1 month access to Live Trading Room Setup (gotowebinar)

1 month access to Live Daily Market Commentary on market days 8.30a.m-9.00a.m (gotowebinar)

Access to our previous mentorship video archives. (100+ hours)

Live Case Studies, Personalized feedback

Network with like minded traders

Who Should Attend

-Anyone who is passionate to learn and trade in complex market environments.

-Aspiring full time traders/active investors

-Willing to have a flexible trading mindset.

Requirements

-Laptop with 3G/4G dongle

-Ninjatrader 7 installed

-Understanding about Futures and Options Concepts

-Min 1 Year of Trading Experience in Futures and Option Markets

The post Market Profile Bangalore Workshop appeared first on Marketcalls.

![]()