Introduction

During the post-independence period until the early 1990s, the financial system in India was characterized by a heavily regulated framework such as interest rate controls, a directed credit programme and strict entry rules to the financial markets.

In addition, money and capital markets were underdeveloped, and the budget deficit of the central government was automatically monetised by the Reserve Bank of India (RBI). Against this background, a macroeconomic crisis arose in the early 1990s. Due to a deficiency in the tax system and a significant proportion of unplanned expenditure in the fiscal sector, the budget deficit became persistent.

Furthermore, India had to rely on foreign debt in order to fill the saving-investment gap in the faceof a declining trend of external assistance flows in the 1970s.

The accelerating fiscal deficits led to a higher rate of inflation and a balance of payments crisis occurred in 1991. Since then, the government has launched a gradual financial reform programme as an integral part of its stabilization policies.

We starts with a brief overview of the current main regulations imposed on commercial banks. Then, the development of the financial markets in the pre and post-financial reform periods will be discussed, including the government securities market, the credit market, the money market, the stock market and the foreign exchange market. The impact of the liberalisation in the financial sector on the conduct and effectiveness of monetary policy will then be investigated.

Concluding remarks summarize the major effects of the financial reforms on the real and financial sectors.

Main regulations in the banking sector

All banks have been subject to a range of regulations and controls administered by the RBI. These include the following (RBI 2000b):

Cash Reserve Ratio (CRR): Each bank must keep a certain proportion of its deposit liabilities as cash reserves with the RBI. The CRR has been actively used as a policy instrument and has varied between 3% and 15% over the period 1951–94.

http://www.rbi.org.in/scripts/WSSViewDetail.aspx?TYPE=Section&PARAM1=4%0A

Statutory Liquidity Ratio (SLR): Banks are required to invest a certain proportion of their deposit liabilities in government securities or government-approved securities of public sector financial institutions. The SLR was set at 20% until 1963. Since then it has been varied within a range of 20% to 38.5%.

http://www.rbi.org.in/scripts/BS_ViewMasCirculardetails.aspx?id=6508

Priority Sector Lending Requirements: Following the1969 nationalisations, the government stipulated a group of priority sectors for bank lending, including agriculture, small industry and business and small transport operations. A mandatory minimum proportion of assets to be allocated to priority sectors was not specified, but in practice, about 40% of bank funds (net of cash and liquid assets) has been allocated to these sectors.

http://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/73748.pdf

Capital to Risk-weighted Assets Ratio (CRAR): In 1992 the CRAR was fixed at 8% to comply with international standards on bank capital adequacy under the Basel agreement. Prior to this, banks were often grossly undercapitalised because of the constraints on their balance sheets and on profitability which were imposed by the various controls.

http://rbidocs.rbi.org.in/rdocs/notification/PDFs/62CB300611FL.pdf

Government securities market

There has been a structural weakness in central government finance, in that revenue generation has been lower than expenditure required. This led to a significant volume of government debt during the 1980s. The RBI automatically monetised the component of the deficit which was financed by the ad-hoc issue of 91-dayTreasury Bills, increasing the amount of reserve money. In order partially to neutralise the effect of deficit financing on the level of the money supply, CRR was frequently raised (it gradually reached11%in 1988, from6%in 1979), and also to facilitate the expanding government debt, an involuntary credit ratio by commercial banks under the provision of SLR was increased. Further, in order to keep the cost of borrowing from the market low, interest rates on government securities were suppressed: the Indian government manipulated government securities yields down by quoting the security prices below face value, besides captive market in credit allocation and the tax concession on the return of government securities supported the low level of theyie lds.

Fiscal reforms have taken place following the recommendation of the Chakravarty Committee 1985: the government was to finance its deficit directly from the market at market-related rates rather than through automatic monetization by the RBI. See the main reforms in the government securities market as follows:

1991 The maximum coupon rate on central government securities was raised to near-market rates.

1992–93 The system of selling 91-days Treasury Bills through weekly auctions was introduced.

The new instruments of 364-day Treasury Bills and dated government securities2 emerged at market-determined rates on an auction basis.

1994 The automatic monetisation of the Central government budget deficit through ad-hoc Treasury Bills came to an end. In 1997, the government’s temporary shortfalls in finance were replaced byways and Means Advances (WMA).

Although the reform started with the objectives of activating an internal debt management policy and for more effective monetary policy, it brought unintended results. The market-determined interest rates have led to an increase in interest payments, adding to the debt accumulation process during the last decade.Furthermore, the market-related interest rates of the risk-free government securities attracted banks to invest in them, reducing other financial investments. It appears that the unbalanced budget position in the Central government and the corresponding

policies form a vicious cycle and have adversely affected the credit market in India.

Credit market and banking sector

Credit in the banking sector was characterized as being a captive market in the sense that banks were forced to provide credits to the government sector or the government-owned financial institutions under SLR and the priority sector lending requirements. Combined with a high ratio of CRR, the usage of bank deposit resources at their own discretion was extremely restricted. For example, during the fiscal crisis in early 1990s with CRR and SLR being raised to the statutory maxima of 15% and 38.5% respectively, they had only about 45% of the resources and even out of this, 40% was allocated as loans to the priority sectors. Only the residual was allocated to the industrial sectors, despite the fact that bank financing was a prime external source of funds for the commercial sector due to a less-developed capital market.

Another disturbing feature was the structure of interest rates, which was complicated with about 50 lending categories and a large number of stipulated interest rates depending on the loan size, usage and types of borrowers. There was, therefore, a significant cross-subsidy between sectors: pre-emption5 of resources was at concessionary rates of interest; on the other hand much higher lending rates were imposed on medium and large industries. Interest rate differentials between assets and deposit liabilities in the banking sector may give an insight into the scale of the cross-subsidy. The mean annual interest rate differential between the government securities’ yields and deposit rates over the period 1951 to 1993 is 0.45%, whereas that between lending rates and deposit rates over the same period is 4.31%; (the 4.31% amounts to about a third of the mean lending rates). There is a relatively larges pre ad in the case of lending rates in comparison with the case of government securities’ yields. Yet, in general, there were ceilings on bank lending rates and credit flows were quantitatively restricted. Because of the low level of government securities’yields coupled with the ceiling rate system, the cost of funds (i.e. deposit rate) was repressed.

The nature of pre-emption coupled with administered interest rates, represented financial repression in the credit market and prevented sound banking practice; (i) banks were unable to satisfy the credit requirements of the productive economic sectors, (ii) the restrictions on banks’use of funds affected their profitability, (iii) the reduced role of the interest rate as an equilibrium mechanism led to inefficient allocation of credit. In addition, restrictions on entry norms and the dominance of PSBs (public sector banks) constrained market forces in the banking sector.

The major financial sector reforms were undertaken with a view to encouraging competitive efficiency in the banking sector following the recommendation of the Narasimham Committee 1991. Themajor reforms involved: i) there duction of statutory pre-emption levels, ii) dismantling the complex administered interest rate structure, iii) laying down of capital adequacy requirements and iv) liberalization of entry norms for domestic and foreign banks. See the salient reforms in the credit market and banking sector set out below:

1992–93 The structure of lending rates for the commercial banks was simplified; the six categories of interest rates were reduced to four in 1992 and to three in 1993.

1994 Banks were allowed total freedom to set their own lending rates on bank advance over Rs. 2 lakhs in 1994 (1 lakh = 100,000).The interest rates on loans up to Rs.2 lakh were deregulated later in

1998 subject to small-scale borrowers being charged at not exceeding prime lending rate (PLR).

1997 The SLR gradually decreased to 25% from its peak of 38.5% of Net Demand and Time Liabilities in 1990–92 and concessional rates were replaced by market-related rates.

1999 TheCRR gradually falls to 9.0% from a peak of 15% in 1989–93.

1999–2000 TheBank ratew as lowered to 8.0% gradually from 12.0% in 1997, leading PLR to fall.

The financial sector reforms have had a significant impact on the banking sector.

A general scaling down of pre-emption by lowering the level of CRR and SLR has encouraged banks to manage their asset portfolio in a more market-oriented fashion. The deregulation of lending rates contributed to the banks’ profitability and so deposit rates were raised to attract investors. This also initiated interest rates as an equilibrium mechanism allocating resources in a more efficient manner in the credit market.

Along with the liberalisation, there was a movement towards a regulatory mechanism that would ensure the safety and solvency of the banking sector. In the last decade, an increased perception of risk was prevalent in the banking sector, especially after the South-East Asian and the Barings Bank crises. This was reflected in a shift of funds in favour of zero-risk investments; investments in government securities voluntarily exceeded the SLR during the 1990s, whereas the share of loans and advances in total assets showed a consistent decline over the same period.

The banks’ behaviour is consistent with prudent measures. By the end of March 1996, all public sector banks attained a CRAR of 8%.

Other financial markets

The main reforms in other financial markets are listed below followed by commentary:

May 1989 Call money rates were effectively freed from the regulated rate and the grant of entry was given to all participants in the bills re-discounting market as lenders, also in 1993, the other financial institutions (OFIs) are permitted to join in the call market as borrowers.

June 1989 Certificate of Deposits (CDs) was introduced and it became a market-determined instrument in October 1993.

Jan. 1990 Commercial Paper (CP) was introduced at freely determined discount to face value.

1992 Beginning of relaxation of foreign exchange controls.

1992 The CCI (controller of capital issues) which had regulatory control over all capital issues was abolished.

SEBI (Securities and Exchange Board of India) was given statutory powers for regulating the security markets.

Issuers of securities were allowed to raise capital from the market without any consent from any authority either for floating the issueor for pricing it.

Sept. 1992 Foreign institutional investors (FIIs) were allowed unrestricted entry in terms of volumes of investment in the security market.

Dec. 1992 Reserve Bank’s Repurchase Agreements (Repos) was introduced.

March 1993 Exchange rate transitioned from a basket-linked managed float to market-based system via a transitional phase of dual exchange rate regime.

Until the late 1980s, the Indian money market was characterised by a limited number of participants, regulation of entry, limited availability of instruments and tightly regulated interest rates. The reform involved a phased decontrol and development of money markets with a view to the gradual integration among these markets.

The inter-bank call money market, which was the core of the money market until the late 1980s in India, was very active due to the high cash reserve requirement in India. After reforms, with the widening of the market through the participation of non-banking financial sectors and the introduction of CDs, scope for short term funds in the banking sector has expanded. This was reflected in the declining trend of the commercial banks to hold excess reserves. However, the deregulation of the interest rate led the call money rate to vary in a highly volatile manner; during the South-East Asian crisis when the Reserve Bank undertook a series of tight monetary policy measures to control liquidity conditions, the average call rates reached the high level of 50% in January 1998. The Repos were introduced so as to stabilise money market rates by influencing short-term liquidity. The Reserve Bank switched over from auction-based repos to daily fixed-rate Repos in November 1997 to provide signals to money market rates and to set a floor to call rates to impart stability to short-term interest rates. The introduction of Commercial Paper has widened the availability of short-term finance in the corporate sector, which can obtain funds at a lower cost than the cost of borrowing from banks.

During the pre-reform period, the stock market continued to suffer from serious deficiencies: (i) the prevalence of many unhealthy practices, (ii) the regulation of pricing and the high cost of issuing new shares,8 (iii) eligibility of interest payment of debt as an item of expenses vis-à-vis dividend payment. These factors discouraged corporations from raising funds by issuing new shares and thus a relatively high debt-equity ratio for Indian companies was the consequence.

In the post-reform period, issuers of securities have been allowed to raise capital from the market without any consent from any authority either for floating the issue or for pricing it. Deregulation of the primary issues market led to a substantial decrease in the cost of raising funds in the capital market, and resulted in a significant shift in capital structure for the corporate sector; in 1992–93 the equity share constituted over 20% of the total sources of funds from 7.8% in 1991–92, and during this time an unprecedented upsurge of activity was experienced in the stock market; the BSE (Bombay Stock Exchange) Sensex increased by 266.9%. A further step was taken to strengthen the entry norms and disclosure standards to ensure the quality of the issues in the rapidly growing market, for which SEBI (Securities and Exchange Board of India) guidelines were set up.

The experience of the external payments difficulties of the early 1990s highlighted the weakness of the debt-dominated capital account financing in India. This has brought out a policy of fully fledged liberalisation of the foreign investment regime since 1991. In particular, foreign direct investment flows have been encouraged with full repatriation benefits to foreign investors. Portfolio Investment in listed companies can be made by foreign institutional investors (FIIs) without any lock-in period for there mittance of the funds. At the same time , a market determined exchange rate and a relaxation of exchange controls were pursued in the post-reform period, aimed at the integration of domestic foreign exchange markets with foreign markets and more operational freedom for dealing banks. Also, significant measures have been taken in the direction of removing restrictions on imports and exports.

The evolution of the liberalisation in the foreign sector led to a considerable growth in the current and capital account transactions and has contributed to the overall balance of payments surplus since 1993–94. However, these external reforms were at the expense of an increase in domestic money supply. As is often the case in emerging markets, after the liberalisation there was a massive inflow of foreign funds into India generating excess liquidity. Against this, the RBI had to purchase foreign currency for domestic currency in order to avoid an appreciation of the exchange rate. This led to sharp increases in narrow money, consequently leading to a higher rate of inflation in the post-reform, for example, from 6% in 1989 to 14% in 1991 (CPI).

Monetary policy in India

The RBI pursues its monetary policy using the instruments of the Bank rate, OMOs (open market operations), CRR, SLR and Selective and Direct credit control.Before the financial liberalisation, open market operations as a method of monetary control were a useless weapon, plagued by the underdeveloped securities’ and money markets and administered interest rates. The effect of the Bank rate on other interest rates was also limited by regulated interest rates. Yet, the Bank rate may have influenced the level of money supply in a manner peculiar to developing economies. Due to the lack of substitutes for the short-term liquidity in the banking sector (for which re-discounting bills of exchange was a main source of short-term funds), the impact of the change in the Bank rate on the amount of credit might not have been trivial. The CRR, SLR and a selective direct control on credit were probably the main effective policy instruments. Since1973, the RBI raised or reduced the CRR a number of times to influence the volume of cash within the commercial banking system and thus influence their volume of credit. An effect of a higher liquidity ratio, SLR, for the part of government securities,9 is to reduce banks’ ability to grant loans and advances to business and industry, and is, hence, anti-inflationary.To the extent that there were few substitutes of credit, direct credit control also performed effectively during the pre-reform period. These features are probably common in other developing economies.

As a corollary to the financial reforms, the impact of the policy instruments on the financial markets has altered significantly. The liberalisation has initiated the transition from a direct monetary policy (i.e. CRR, SLR and credit control) to the use of indirect instruments (i.e. OMOs and the Bank rate) as the dominant tool of monetary policy. First, as other financial institutions and financial innovations develop, the CRR is seen as a tax on the banking system and its

effectiveness is eroded as there is a loophole to avoid the CRR, for example, an increase in the CRR leads banks to bid for more wholesale deposits. There is also pressure on RBI to reduce CRR to international levels and not to use it as an instrument of credit control (Datt and Sundharam 2000). Second, the initiators of the financial reform envisaged that open market operations were to be the principal instrument of liquidity management in India. OMOs are attractive among others in that the base money is adjusted within short periods of time without

incurring confusion in the financial markets and administrative problems in banks (Cargill 1979). The evolution of the auction system of government securities at market-related interest rates is an important step. Third, the liberalisation of the administered interest rates will vitalise the role of the Bank rate. Interest rates have been emerging as instruments of resource allocation and there would potentially be an interest rate channel of monetary transmission. Then, it is possible

that the Bank rate works as a signalling instrument of monetary policy by indicating the interest rate stance to all economic agents, as is the case in developed economies. For example, when India found itself in a severe liquidity position, the RBI reduced the Bank rate in 1999 and this prompted the banks to reduce the Prime Lending Rate.

There are, however, some fundamental weaknesses remaining in the effectiveness of monetary policies. First, the Indian financial market is disturbed by the existence of two markets, one organised and the other unorganised with the divergence in the structure of interest rates. There are borrowers who are entirely dependent on the unorganised market, especially in rural areas of India.A uniform implementation of monetary policy is difficult in the segmented financial market

(Agarwal 1978). Second, it is a cause of inflationary pressure. To the extent that the pressure is the result of the growth in bank financing, the RBI’ s general controls will have a positive effect, however, if it comes from the government’s deficit financing (or the shortage of goods due to supply shocks), the RBI’ s control has little effect. It seems that the latter has been the case in India (Datt and Sundharam 2000). Third, the overall effect of monetary policy via credit may be weak in India due to the relatively high currency-deposit ratio: the credit creating capacity is

limited. Fourth, India was often confronted with a dilemma of conflicting objectives; the need to restrict money supply, but at the same time the need to provide funds to certain sectors for the economic growth of the country. Accordingly, the conflicting policy measures of direct credit control (i.e. contractionary policy) and the reduction of lending rates (i.e. expansionary policy) were often implemented.

http://www.rbi.org.in/scripts/PublicationsView.aspx?id=14228

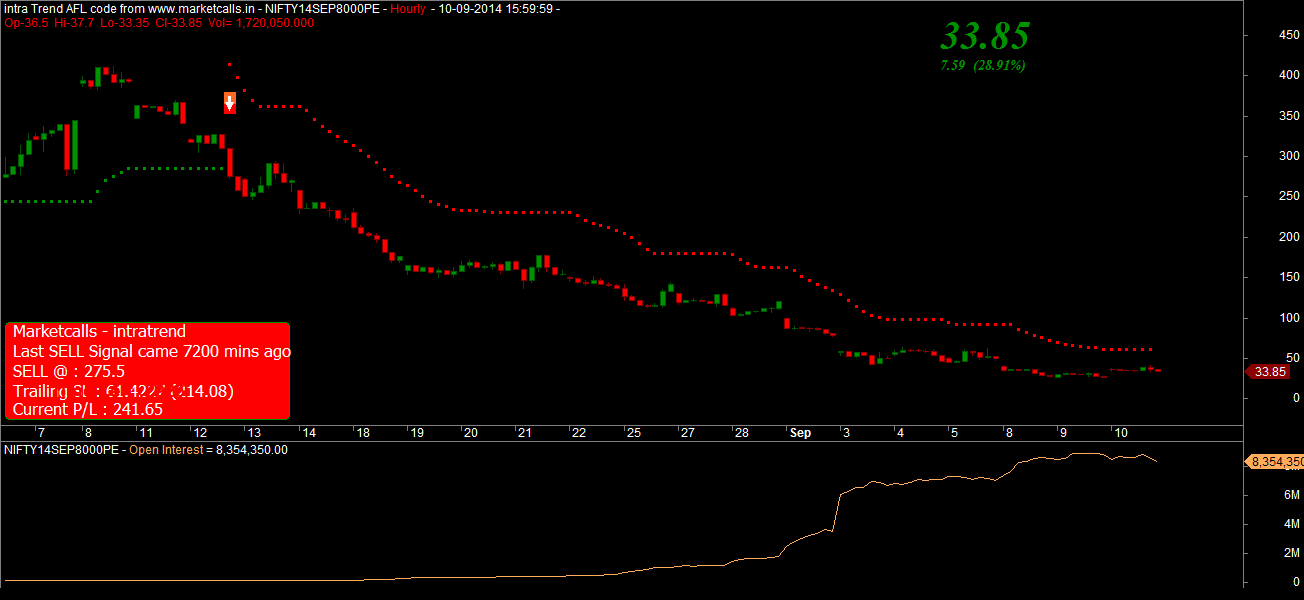

Lokesh madan

http://algotradingindia.blogspot.in

Related Readings and Observations

The post Flow of Funds in Indian Financial markets appeared first on Marketcalls.