![CPI Inflation]()

[Image Source : CapitalMind]

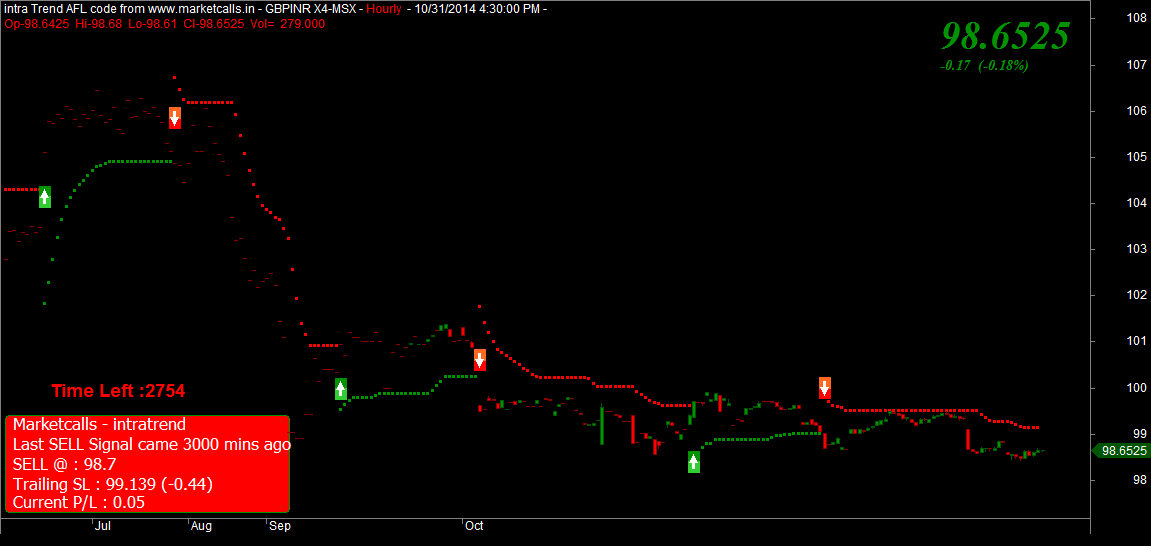

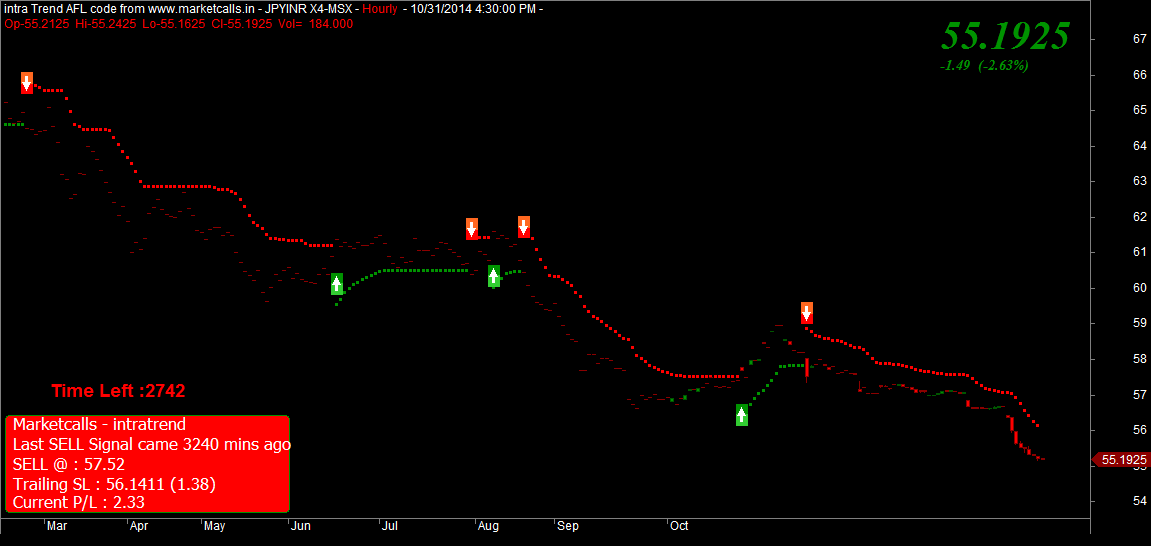

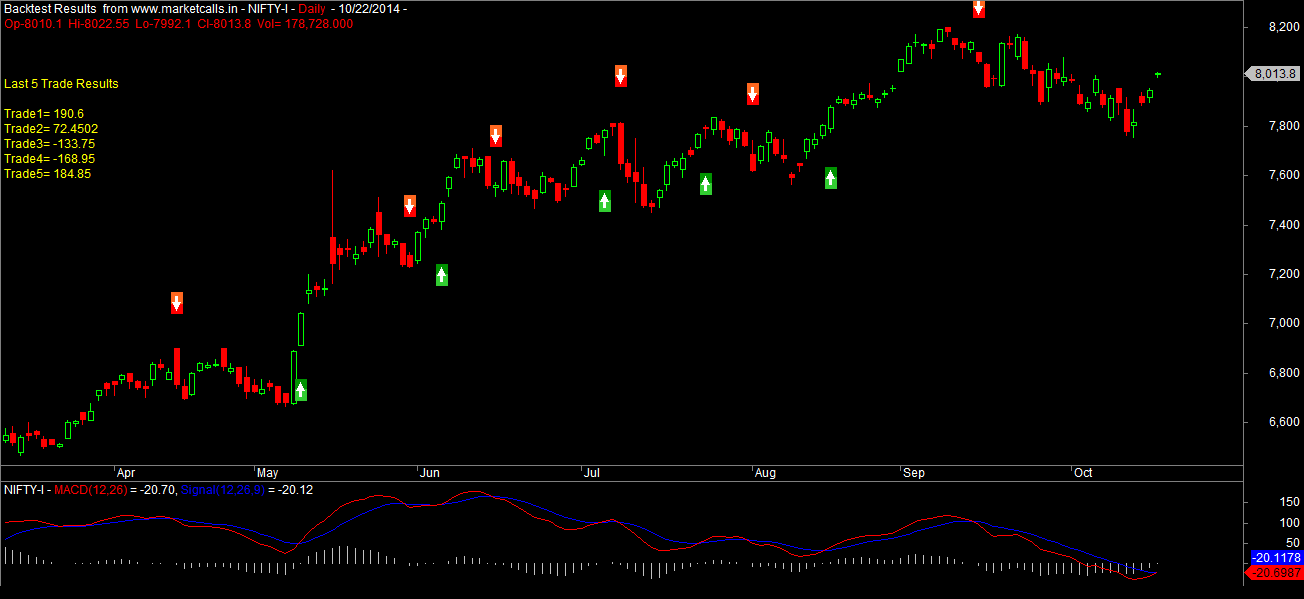

Trading Inflation CPI number is very big fundamental economics indicator for trading NSE.But according to our complete analysis it shows. Trading on CPI number depends upon various factors i.e expectation of market CPI Number & Its future projection for Year by Top Investing companies & Stable Govt. & their policies.

So what we see there is not major impact on Indian market as per Inflation number trading is concern.i.e from last 2012 now on 13 oct 2014 inflation no comes down But shows not good sign of recover in market & close by 20 points down.

INFLATION

Inflation tells us the changing (increasing) price of a range of goods or services; basically how much of something we can get for our money. The rate of change of prices – the speed at which the price of goods and services that are bought by households or businesses alter – is called inflation. But prices can also fall, in a process called deflation, sometimes termed negative inflation.

Inflation is more common than deflation, or at least it has been in the last 50 years or so, and so it has become associated with changes in the price of goods and services. Historically, however, price falls were as common as price rises, as we will see later.

Both inflation and deflation have advantages and disadvantages.

CAUSES OF INFLATION

Price inflation is caused when there is an excessive increase in money supply relative to the demand for it in the economy. In effect, too much money chasing too few goods. As a result of views like these, the INDIA had a monetary target for 2013 – 14 because it was thought that the best way to control price inflation (the 2008 – 13 was a period of particularly high inflation) was to control the increase in the quantity of money.

However, although there is a relationship in the long run, and at times the INDIA has seen close short-term links as well, the lags can be ‘long and variable’ and so targeting money supply eventually fell out of vogue in favor of targeting inflation itself.

Over the last few years, for instance, the INDIA has seen consumer price inflation well above the 3 – 4 per cent inflation target (10 – 12%), and yet money supply growth has been excessively slow. There are good reasons for this, but what it shows is that money supply itself is not that good a target for controlling inflation.

In fact, the detail of what is causing which components of money supply to change and why, is crucial in working out cause and effect. Of course, it could be argued that the economy was so weak that raising interest rates to control inflation would have just caused more damage to the economy. And in this sense, it is correct, as policymakers (RBI) did not raise interest rates because consumer inflation was above target, but cut them instead, because the economy was so weak, as suggested by the weak growth of money supply. So it would be true perhaps to argue that money supply has been correct, but the point is that it is not a good variable to use to target inflation, because it can send misleading signals.

Inflation can be thought of as being derived from the costs of producing domestic goods and services and the imported prices of goods and services. In fact the RPI is split into goods prices and services prices, and includes estimates of imported goods. Domestic costs can be measured through the GDP deflator, which does not include imported goods prices. It can be broken down into broad categories such as profits and rents (40 per cent) and wages (about 60 per cent). Import prices are paid on the basis of the currency that the goods originate from and so the value of the Rupees will vary between these currencies and so will impact the price of those inputs.

These goods can rise or fall in price for other reasons (such as crop failure or a rise in demand or costs), of course, but the change in the Rupees value against Dollar will also influence domestic price changes. A rise in the Rupees could push down imported prices; a fall will push prices up.

Consumer price inflation was so low between 2008 and 2013. It seems it was not about monetary policy, but the effect of global economic competition stemming from the inclusion of China and India, which drove down internal goods prices.

Oil prices played a role, as did services goods prices and a strong sterling exchange rate. The latter, in particular, would have pushed down imported price inflation. But this means that to understand INDIA inflation you do have to look at the detail of the inflation data, particularly goods price inflation. In terms of domestic prices, the main focus should be on services prices, which do appear to be remarkably stable, and high, at 5–6 percent a year, almost irrespective of what is happening to the wider economy. This implies that domestic INDIA prices are sticky downwards.

If we focus on just goods prices and compare those with INDIA import price inflation, we see that there is a very good fit. In other words, one of the key drivers of INDIA import prices inflation, and hence consumer price inflation, was goods prices. The period between 2007 and 2013 shows a negative inflation influence from goods prices. The fit between goods prices in the CPI and imports is strong over time, and their volatile trends tend to track each other well. Recently, INDIA goods price inflation has been rising gain, perhaps due to the influence of the weaker currency. For inflation watchers, particularly those looking at fixed income investments; these are critical trends to explore when analyzing the inflation data, for investors in those types of assets lose out when inflation accelerates.

What we see by analyzing complete data – Inflation rises when the Rupees falls and vice versa. The period between 1998 and 2013 is one where the relationship held but in a rising trend for inflation and the Rupees. One underlying reason why inflation may have risen is the length of the Indian economic boom (16 years), which gathered particular pace during that period, driven by consumer borrowing. Price inflation would probably have been even higher, had the exchange rate not appreciated.

Indian producer prices tend to move with CPI and RPI and the foreign exchange rate. As the name implies, it the measures firms’ prices, both their input prices and their output prices. The gap between the two is sometimes referred to as an implied profit margin, but of course a firm’s costs are much more than just raw material costs, which are what producer prices are trying to take into account.

Another way of thinking about the causes of inflation is in the following terms:

Cost-push inflation – inflation derived from a sharp rise in a key cost of firms.

Demand-pull inflation – occurs when demand in the economy exceeds its ability to supply that demand (too much money chasing too few goods).

Built-in inflation – due to the effects of past inflation persisting into the present.

Cost-Push Inflation

Cost-push inflation is derived from a sharp rise in a key cost of firms. This produces a ‘supply side’ shock that results in an expectation of inflation that helps create a wage-price spiral, producing a long-lasting effect. The example most often quoted is the oil price shock of the August 2013 Syria’s Oil Crisis , because of that it creating widespread inflation in all oil-associated sectors and products. By that their is a rise in the price level, which then results in a real output decline.

Not everyone agrees with this analysis, however.

Monetarists argue that inflation became a problem because central banks ‘accommodated’ it by allowing money supply to rise in response.

Where as some experts argument centers on the fact that increases in the cost of goods and services do not lead to inflation unless the government and its central bank cooperate in increasing the money supply. The argument is that, if the money supply is constant, increases in the cost of a good or service will reduce the money available for other goods

and services, and therefore the price of some of those goods will fall and offset the rise in price of those goods whose prices have increased. One consequence of this is that Monetarist economists do not believe that the rise in the cost of oil was a direct cause of the inflation of the 2013. They argue that, when the price of oil went back down in the 2014 there was no corresponding deflation, so, therefore, they state, how can you argue that an increase in the price of oil causes inflation?

What the central bank (RBI ) should have done was not to accommodate the increase in price pressure and raise interest rates, tightening monetary policy.

In that case some expert argue that in a modern industrial economy, many prices are sticky downwards or downwardly inflexible, so that instead of prices for non-oil-related goods falling in this story, a supply shock would cause a recession, i.e. rising unemployment and a drop in gross domestic product (GDP). It is the costs of such a recession that most likely cause governments and central banks to allow a supply shock to result in inflation. Otherwise, in order to control the inflation being generated they would have to reduce GDP by even more and so make the recession even worse. In addition, although prices did not fall outright, the rate of price inflation eased back. If the fact that inflation is driven by a number of factors – not just supply – is taken into account, the picture changes.

Demand falls back in a recession and so inflation eases; alongside that, as prices fall, so wage expectations ease as well, creating a virtuous cycle of expectations adapting to the reality of falling prices, i.e. a negative price/wage spiral.

Demand-Pull Inflation

Demand-pull inflation occurs when demand in the economy exceeds its ability to supply that demand.

Demand-pull inflation is considered to arise when aggregate demand in an economy outpaces aggregate supply. It involves inflation rising as real GDP rises and unemployment falls. This is commonly described as ‘too much money chasing too few goods’. This assumes that all available resources in the economy are fully utilized,including employment and investment and raw materials.

According to Expert theory, the more firms that are prepared to employ people, the more people will be employed. The aggregate demand (AD) will become greater and will make firms employ more people in order to produce more output. Due to capacity constraints, this increase in output will eventually become so small that the price of the good will rise. At first, once this occurs, unemployment will go down, shifting AD1 to AD2, which increases demand (Y) by (Y2 – Y1). This increase in demand means more workers are needed, and thus AD will be shifted from AD2 to AD3. However, this time, much less is produced than in the previous shift, but the price level has risen from P2 to P3, a much higher increase in price than in the previous move. This increase in price is called inflation.

Demand-pull inflation is in contrast to cost-push inflation, when price and wage increases are being transmitted from one sector to another. However, these can be considered as different aspects of an overall inflationary process: demand-pull inflation explains how price inflation starts, and cost-push inflation demonstrates why inflation, once begun, is so difficult to stop.

Built-In Inflation

Built-in inflation is due to the effects of past inflation persisting into the present. Experts believes that built-in inflation originates from either persistent demand-pull or large cost-push (supply-shock) inflation in the past. It then becomes a ‘normal’ aspect of the economy, via inflationary expectations and the price/wage spiral.

Inflationary expectations play a role because, if workers and employers expect inflation to persist in the future, they will attempt to increase their (nominal) wages and prices now. This means that if people expect inflation to be high, it is high, because they behave in a way that confirms it. For instance, they will accept higher prices being charged for goods rather than shun them, which would force firms to lower prices. Part of the reason why they will accept a higher price is because they will push for and get higher wages to compensate them. This then creates an inflationary cycle that is difficult to stop.

Expectations and behavior are therefore capable of being inflation drivers in the way described. So inflation happens now simply because of subjective views about what may happen in the future. Of course, following the generally accepted theory of adaptive expectations, such inflationary expectations arise because of persistent past experience with inflation.

The price/wage spiral refers to the adversarial nature of the wage bargain in modern capitalism. (It is part of the conflict theory of inflation, referring to the objective side of the inflationary process.) Workers and employers usually do not get together to agree on the value of real wages. Instead, workers attempt to protect their real wages (or to attain a target real wage) by pushing for higher money (or nominal) wages. Thus, if they expect price inflation – or have experienced price inflation in the past – they push for higher money wages. If they are successful, this raises the costs faced by their employers.

To protect the real value of their profits (or to attain a target profit rate or rate of return on investment), employers then pass the higher costs on to consumers in the form of higher prices. This encourages workers to push for even higher money wages to meet the rising prices, and so begins the cycle of inflation.

In the end, built-in inflation involves a vicious circle of both subjective and objective elements, so that inflation encourages inflation to persist. It means that the standard methods of fighting inflation, using monetary policy or fiscal policy to induce a recession, are extremely expensive, i.e. they can cause large rises in unemployment and large falls in real GDP. This suggests that alternative methods such as wage and price controls (incomes policies) may also be needed in the fight against inflation.

EARNINGS/WAGE INFLATION

Inflation can be broadly split into two categories – price inflation and earnings inflation. Earnings inflation is important in terms of its impact on the labour market and company profitability.

Lower earnings growth has been recorded across many sectors in Year 2012 – 13. The consequences for this are reductions in disposable income, expenditure and economic growth.

Earnings inflation is also relevant as a labour cost for businesses. It has an impact on firms’ profitability and thus on the equity and bond markets.

PRICE BASKET

Price changes, inflation or deflation, are measured from a basket of goods and services that are based on what is typically bought by the average consumer, either household or business. An index is created that is based on a summary of the total price changes in this basket of goods and services. The change in this index is then taken as the inflation or the deflation rate, depending on whether it is going up or down. This is based on an estimate of the index over time.

HOW IS PRICE INFLATION MEASURED?

At the last count there were about 5 major different measures of consumer price inflation in the India (Food, beverages and tobacco , Fuel and light , Housing , Clothing, bedding and footwear & Miscellaneous )

In addition to publishing the Consumer Price Indices (CPI) in the Indian on a monthly basis, the Govt. Of India Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation publishes a number of other indices.

(www.mospi.gov.in).

All India Weights of different Sub-groups within Consumer Food Price Index Sub-groups

| |

Description |

Rural |

Urban |

Combined |

|

Cereals and products |

36.71 |

28.51 |

34.16 |

|

Pulses and products |

6.25 |

6.11 |

6.20 |

|

Oils and fats |

8.98 |

9.44 |

9.13 |

|

Egg, fish and meat |

6.50 |

7.38 |

6.77 |

|

Milk and products |

16.53 |

21.59 |

18.10 |

|

Condiments and spices |

4.10 |

3.79 |

4.00 |

|

Vegetables |

12.64 |

12.93 |

12.74 |

|

Fruits |

3.65 |

6.14 |

4.43 |

|

Sugar etc. |

4.64 |

4.11 |

4.47 |

| Total Weights |

100.00 |

100.00 |

100.00 |

WHY IS INFLATION IMPORTANT?

As a target for official monetary policy setters, inflation is a key statistic for traders and investors. Inflation can have a detrimental impact on living standards if the prices of goods and services are rising beyond those of incomes.

Higher inflation can also erode the income to be gained from fixed assets, which creates issues for those dependent on fixed assets, i.e. pensioners. On the flip side, inflation means that firms can earn higher profits from their goods or services without actually doing anything further. This, of course, has a knock-on effect on the equity markets.

However, too much inflation can be a bad thing as it can make investments increasingly unpredictable and erode confidence in the markets, making investors less likely to invest, which is ultimately bad for economic growth.

Essentially, it makes calculating the rate of return on an investment uncertain because of the effect that inflation can have on eroding real returns. This unpredictability of future inflation is what can be so damaging for investment, and one of the reasons that policymakers are keen on keeping inflation low and stable, i.e. predictable, is because it makes for stronger investment and so economic growth.

Advantages of Inflation

Increased profitability for firms.

Strengthening of the equity markets.

It can be argued that targeting a higher inflation rate could boost growth, particularly in a prolonged recession.

Disadvantages of Inflation

Detrimental impact on fixed incomes.

Can cause standard of living to decline.

Can be destabilizing as it creates uncertainty.

Inflation can lead to a boom-and-bust scenario.

Discourages investment and long-term growth.

Can make exports uncompetitive although this depends on one country’s inflation rate compared with others.

It may devalue the exchange rate, creating further uncertainty.

Changes ‘real interest rates’ and so impacts on real returns for investors such as pension funds and insurance companies.

This, in turn, has an impact on the real economy.

DEFLATION

As we’ve mentioned, when prices are rising it erodes real income. Similarly, when prices are falling, in a deflationary environment, it erodes real value. The common perception is that this discourages people from spending. Although this is certainly the case for items of large capital expenditure and short-term hold, if prices are falling then real incomes are increasing and so households and businesses might actually be encouraged to spend.

The Japanese economy, for example, has faced a persistent deflationary environment. Despite this, real per-capita income is holding up, although growth has slowed as people delay purchases.

Deflation also means that companies earn less profit, so they in effect have to run faster just to stay still. Over the long term this is not tenable.

Advantages of Deflation

Can encourage spending as people have more money in their pocket as prices fall.

Lower prices.

Real wages may rise as workers resist employers’ attempts to reduce wages (an advantage for employees).

Disadvantages of Deflation

Firms’ profits impacted.

Value of assets eroded.

Discourages spend on non-essential or large-ticket items.

Increases the value of debt, making it more difficult to pay down.

Can erode the value of monetary policy as interest rates cannot fall below 0 per cent.

Real wages may rise as workers resist employers’ attempts to reduce wages (a disadvantage for employers and investors).

OTHER MEASURES OF INFLATION TARGETING

Inflation targeting is an economic policy in which a central bank estimates and makes public a projected, or ‘target’, inflation rate and then attempts to steer actual inflation towards the target through the use of interest rate changes and other monetary tools.

The RBI, for example, has an inflation target of 6 per cent but it has not hit that target since 2014.Does this mean that it has given up on inflation? That would be the easy reading. But in fact, with the economy having been in and out of recession since then, arguing that it should have raised rates to hit an inflation target with the effect of damaging an already weak economy is not one anyone accepts would have been the correct response.

Pulling all of the Indian main indices of inflation together, whether wages, prices CPI or CFPI, shows the same sort of trend, up or down, over any length of time. This means that they are closely linked and that to understand what the inflation pressures are in the economy, one must analyse all of them when they are released, in a broad way. Doing that means that maximum benefit will be derived.

Because interest rates and the inflation rate tend to be inversely related, the likely moves of the RBI to raise or lower interest rates become more transparent under the policy of inflation targeting.

For example:

If inflation appears to be above the target, the Bank is likely to raise interest rates. This usually (but not always) has the effect over time of cooling the economy and bringing down inflation.

If inflation appears to be below the target, the Bank is likely to lower interest rates. This usually (again, not always) has the effect over time of accelerating the economy and raising inflation.

Under the policy, investors know what the Bank considers the target inflation rate to be and therefore may more easily factor in likely interest rate changes in their investment choices. This is viewed by policymakers who target inflation directly as leading to increased economic stability.

HOW CAN WE EXTRACT VALUE FROM THIS?

Trends in inflation tell us about the direction of interest rates and policy. But they also tell us about the stresses and strains in the economy between demand and supply and between relative bargaining power and the different agents and sectors that make up the complex system that is a modern economy. Rising inflation matters because it means the official interest rate (cost of money) may go up or that fiscal policy might be toughened. It erodes the real value of wealth, so it informs people to push into products that protect them from its corrosive effects on wealth. The opposite is also true, of course: it could herald boom time as inflation falls if it also means a fall in interest rates. So it clearly matters that we get the analysis of the direction of inflation right.

Trading CPI Figure.

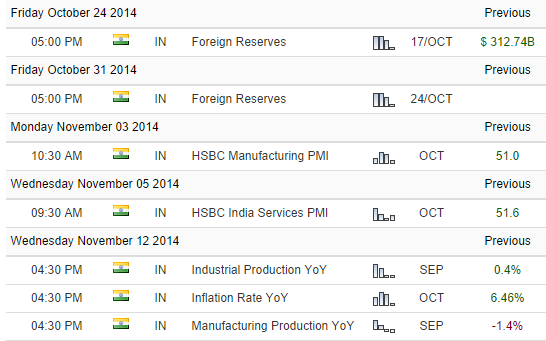

Release date of CPI data (5:30 PM evening so effect of next day) & their effects on NSE Index.

| SNo. |

Subject |

Press Release Date |

| 1 |

Press Release on New CPI for September, 2014 |

13/10/2014 |

| 2 |

Press Release on New CPI for august 2014 |

12/09/2014 |

| 3 |

Press Release on New CPI for July 2014 |

12/08/2014 |

| 4 |

Press Release on New CPI for June 2014 |

14/07/2014 |

| 5 |

Press Release on New CPI for May 2014 |

12/06/2014 |

NSE

12 June 2014 Data release Next day effect

May Data :

Provisional annual inflation rate based on all India general CPI (Combined) for the month of May, 2014 on point to point basis (May 2014 over May 2013) is 8.28% as compared to 8.59% (final) for previous month of April 2014 (Annex II). The corresponding provisional inflation rates for rural and urban areas for May 2014 are 8.86% and 7.55%.Inflation rates (final) for rural and urban areas for April 2014 are 9.17% and 7.69% respectively.

Provisional annual inflation rate based on all India CFPI (Combined) for the month of May, 2014 on point to point basis (May 2014 over May 2013) is 9.56% as compared to 9.83% (final) for previous month of April 2014. The corresponding provisional inflation rates for rural and urban areas for May 2014 are 10.27%and 7.98%respectively. Inflation rates (final) for rural and urban areas for April 2014 are 10.53% and 8.35% respectively.

| Date |

Open |

High |

Low |

Close |

Shares Traded |

Turnover (Rs. Cr) |

| 12-Jun-14 |

7641.3 |

7658 |

7593.8 |

7649.9 |

148207144 |

8187.49 |

| 13-Jun-14 |

7668.2 |

7678.5 |

7525.35 |

7542.1 |

174522339 |

11254.75 |

14 July

June Data :

| Inflation rates based on CPI (General) and CFPI Indices |

June 2014 |

May 2014 |

June 2013 |

| Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

| CPI (General) |

7.72 |

6.82 |

7.31 |

8.86 |

7.55 |

8.28 |

9.63 |

10.13 |

9.87 |

| CFPI |

8.68 |

6.57 |

7.97 |

10.27 |

7.98 |

9.56 |

11.52 |

12.74 |

11.93 |

| Date |

Open |

High |

Low |

Close |

Shares Traded |

Turnover (Rs. Cr) |

| 14-Jul-14 |

7469 |

7478.45 |

7422.15 |

7454.15 |

135231220 |

6659.48 |

| 15-Jul-14 |

7491.3 |

7534.9 |

7459.15 |

7526.65 |

122068670 |

6124.15 |

12 August

July Data

| Inflation rates based on CPI (General) and CFPI Indices |

July 2014 |

June 2014 |

July 2013 |

| Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

| CPI (General) |

8.45 |

7.42 |

7.96 |

7.87 |

6.82 |

7.46 |

9.14 |

10.18 |

9.64 |

| CFPI |

9.85 |

8.45 |

9.36 |

8.83 |

6.57 |

8.05 |

10.66 |

12.52 |

11.22 |

| Date |

Open |

High |

Low |

Close |

Shares Traded |

Turnover (Rs. Cr) |

| 12-Aug-14 |

7688.8 |

7735.75 |

7654.8 |

7727.05 |

120611660 |

6181.17 |

| 13-Aug-14 |

7717.3 |

7757.1 |

7695.7 |

7739.55 |

154083920 |

8030.41 |

12 Sep

| Inflation rates based on CPI (General) and CFPI Indices |

August 2014 |

July 2014 |

August 2013 |

| Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

| CPI (General) |

8.35 |

7.04 |

7.80 |

8.37 |

7.42 |

7.96 |

8.93 |

10.32 |

9.52 |

| CFPI |

9.83 |

8.40 |

9.42 |

9.78 |

8.45 |

9.36 |

10.54 |

12.58 |

11.11 |

| Date |

Open |

High |

Low |

Close |

Shares Traded |

Turnover (Rs. Cr) |

| 12-Sep-14 |

8087.05 |

8114.3 |

8071.6 |

8105.5 |

111444349 |

6156.73 |

| 15-Sep-14 |

8070.35 |

8077.3 |

8030 |

8042 |

96502556 |

5387.06 |

13 Oct

| Inflation rates based on CPI (General) and CFPI Indices |

September 2014 (Prov.) |

August 2014 |

September 2013 |

| Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

| CPI (General) |

6.68 |

6.34 |

6.46 |

8.27 |

7.04 |

7.73 |

9.71 |

9.93 |

9.84 |

| CFPI |

7.78 |

7.45 |

7.67 |

9.75 |

8.40 |

9.35 |

11.79 |

11.50 |

11.75 |

HISTORCAL CPI INDIAN DATA.

Table – 2014 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2014 – december 2013 |

-0.84 % |

|

january 2014 – january 2013 |

7.24 % |

| february 2014 – january 2014 |

0.42 % |

|

february 2014 – february 2013 |

6.73 % |

| march 2014 – february 2014 |

0.42 % |

|

march 2014 – march 2013 |

6.70 % |

| april 2014 – march 2014 |

1.26 % |

|

april 2014 – april 2013 |

7.08 % |

| may 2014 – april 2014 |

0.83 % |

|

may 2014 – may 2013 |

7.02 % |

| june 2014 – may 2014 |

0.82 % |

|

june 2014 – june 2013 |

6.49 % |

| july 2014 – june 2014 |

2.44 % |

|

july 2014 – july 2013 |

7.23 % |

| august 2014 – july 2014 |

0.40 % |

|

august 2014 – august 2013 |

6.75 % |

| september 2014 – august 2014 |

- |

|

september 2014 – september 2013 |

- |

| october 2014 – september 2014 |

- |

|

october 2014 – october 2013 |

- |

| november 2014 – october 2014 |

- |

|

november 2014 – november 2013 |

- |

| december 2014 – november 2014 |

- |

|

december 2014 – december 2013 |

|

|

Table – 2013 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2013 – december 2012 |

0.91 % |

|

january 2013 – january 2012 |

11.62 % |

| february 2013 – january 2013 |

0.90 % |

|

february 2013 – february 2012 |

12.06 % |

| march 2013 – february 2013 |

0.45 % |

|

march 2013 – march 2012 |

11.44 % |

| april 2013 – march 2013 |

0.89 % |

|

april 2013 – april 2012 |

10.24 % |

| may 2013 – april 2013 |

0.88 % |

|

may 2013 – may 2012 |

10.68 % |

| june 2013 – may 2013 |

1.32 % |

|

june 2013 – june 2012 |

11.06 % |

| july 2013 – june 2013 |

1.73 % |

|

july 2013 – july 2012 |

10.85 % |

| august 2013 – july 2013 |

0.85 % |

|

august 2013 – august 2012 |

10.75 % |

| september 2013 – august 2013 |

0.42 % |

|

september 2013 – september 2012 |

10.70 % |

| october 2013 – september 2013 |

1.26 % |

|

october 2013 – october 2012 |

11.06 % |

| november 2013 – october 2013 |

0.83 % |

|

november 2013 – november 2012 |

11.47 % |

| december 2013 – november 2013 |

-1.65 % |

|

december 2013 – december 2012 |

9.13 % |

|

Table – 2012 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2012 – december 2011 |

0.51 % |

|

january 2012 – january 2011 |

5.32 % |

| february 2012 – january 2012 |

0.51 % |

|

february 2012 – february 2011 |

7.57 % |

| march 2012 – february 2012 |

1.01 % |

|

march 2012 – march 2011 |

8.65 % |

| april 2012 – march 2012 |

1.99 % |

|

april 2012 – april 2011 |

10.21 % |

| may 2012 – april 2012 |

0.49 % |

|

may 2012 – may 2011 |

10.16 % |

| june 2012 – may 2012 |

0.97 % |

|

june 2012 – june 2011 |

10.05 % |

| july 2012 – june 2012 |

1.92 % |

|

july 2012 – july 2011 |

9.84 % |

| august 2012 – july 2012 |

0.94 % |

|

august 2012 – august 2011 |

10.31 % |

| september 2012 – august 2012 |

0.47 % |

|

september 2012 – september 2011 |

9.14 % |

| october 2012 – september 2012 |

0.93 % |

|

october 2012 – october 2011 |

9.60 % |

| november 2012 – october 2012 |

0.46 % |

|

november 2012 – november 2011 |

9.55 % |

| december 2012 – november 2012 |

0.46 % |

|

december 2012 – december 2011 |

11.17 % |

|

Table – 2011 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2011 – december 2010 |

1.62 % |

|

january 2011 – january 2010 |

9.30 % |

| february 2011 – january 2011 |

-1.60 % |

|

february 2011 – february 2010 |

8.82 % |

| march 2011 – february 2011 |

0.00 % |

|

march 2011 – march 2010 |

8.82 % |

| april 2011 – march 2011 |

0.54 % |

|

april 2011 – april 2010 |

9.41 % |

| may 2011 – april 2011 |

0.54 % |

|

may 2011 – may 2010 |

8.72 % |

| june 2011 – may 2011 |

1.07 % |

|

june 2011 – june 2010 |

8.62 % |

| july 2011 – june 2011 |

2.12 % |

|

july 2011 – july 2010 |

8.43 % |

| august 2011 – july 2011 |

0.52 % |

|

august 2011 – august 2010 |

8.99 % |

| september 2011 – august 2011 |

1.55 % |

|

september 2011 – september 2010 |

10.06 % |

| october 2011 – september 2011 |

0.51 % |

|

october 2011 – october 2010 |

9.39 % |

| november 2011 – october 2011 |

0.51 % |

|

november 2011 – november 2010 |

9.34 % |

| december 2011 – november 2011 |

-1.01 % |

|

december 2011 – december 2010 |

6.49 % |

|

Table – 2010 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2010 – december 2009 |

1.78 % |

|

january 2010 – january 2009 |

16.22 % |

| february 2010 – january 2010 |

-1.16 % |

|

february 2010 – february 2009 |

14.86 % |

| march 2010 – february 2010 |

0.00 % |

|

march 2010 – march 2009 |

14.86 % |

| april 2010 – march 2010 |

0.00 % |

|

april 2010 – april 2009 |

13.33 % |

| may 2010 – april 2010 |

1.18 % |

|

may 2010 – may 2009 |

13.91 % |

| june 2010 – may 2010 |

1.16 % |

|

june 2010 – june 2009 |

13.73 % |

| july 2010 – june 2010 |

2.30 % |

|

july 2010 – july 2009 |

11.25 % |

| august 2010 – july 2010 |

0.00 % |

|

august 2010 – august 2009 |

9.88 % |

| september 2010 – august 2010 |

0.56 % |

|

september 2010 – september 2009 |

9.82 % |

| october 2010 – september 2010 |

1.12 % |

|

october 2010 – october 2009 |

9.70 % |

| november 2010 – october 2010 |

0.55 % |

|

november 2010 – november 2009 |

8.33 % |

| december 2010 – november 2010 |

1.65 % |

|

december 2010 – december 2009 |

9.47 % |

|

Table – 2009 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2009 – december 2008 |

0.68 % |

|

january 2009 – january 2008 |

10.45 % |

| february 2009 – january 2009 |

0.00 % |

|

february 2009 – february 2008 |

9.63 % |

| march 2009 – february 2009 |

0.00 % |

|

march 2009 – march 2008 |

8.03 % |

| april 2009 – march 2009 |

1.35 % |

|

april 2009 – april 2008 |

8.70 % |

| may 2009 – april 2009 |

0.67 % |

|

may 2009 – may 2008 |

8.63 % |

| june 2009 – may 2009 |

1.32 % |

|

june 2009 – june 2008 |

9.29 % |

| july 2009 – june 2009 |

4.58 % |

|

july 2009 – july 2008 |

11.89 % |

| august 2009 – july 2009 |

1.25 % |

|

august 2009 – august 2008 |

11.72 % |

| september 2009 – august 2009 |

0.62 % |

|

september 2009 – september 2008 |

11.64 % |

| october 2009 – september 2009 |

1.23 % |

|

october 2009 – october 2008 |

11.49 % |

| november 2009 – october 2009 |

1.82 % |

|

november 2009 – november 2008 |

13.51 % |

| december 2009 – november 2009 |

0.60 % |

|

december 2009 – december 2008 |

14.97 % |

|

Table – 2008 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2008 – december 2007 |

0.00 % |

|

january 2008 – january 2007 |

5.51 % |

| february 2008 – january 2008 |

0.75 % |

|

february 2008 – february 2007 |

5.47 % |

| march 2008 – february 2008 |

1.48 % |

|

march 2008 – march 2007 |

7.87 % |

| april 2008 – march 2008 |

0.73 % |

|

april 2008 – april 2007 |

7.81 % |

| may 2008 – april 2008 |

0.72 % |

|

may 2008 – may 2007 |

7.75 % |

| june 2008 – may 2008 |

0.72 % |

|

june 2008 – june 2007 |

7.69 % |

| july 2008 – june 2008 |

2.14 % |

|

july 2008 – july 2007 |

8.33 % |

| august 2008 – july 2008 |

1.40 % |

|

august 2008 – august 2007 |

9.02 % |

| september 2008 – august 2008 |

0.69 % |

|

september 2008 – september 2007 |

9.77 % |

| october 2008 – september 2008 |

1.37 % |

|

october 2008 – october 2007 |

10.45 % |

| november 2008 – october 2008 |

0.00 % |

|

november 2008 – november 2007 |

10.45 % |

| december 2008 – november 2008 |

-0.68 % |

|

december 2008 – december 2007 |

9.70 % |

|

Table – 2007 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2007 – december 2006 |

0.00 % |

|

january 2007 – january 2006 |

6.72 % |

| february 2007 – january 2007 |

0.79 % |

|

february 2007 – february 2006 |

7.56 % |

| march 2007 – february 2007 |

-0.78 % |

|

march 2007 – march 2006 |

6.72 % |

| april 2007 – march 2007 |

0.79 % |

|

april 2007 – april 2006 |

6.67 % |

| may 2007 – april 2007 |

0.78 % |

|

may 2007 – may 2006 |

6.61 % |

| june 2007 – may 2007 |

0.78 % |

|

june 2007 – june 2006 |

5.69 % |

| july 2007 – june 2007 |

1.54 % |

|

july 2007 – july 2006 |

6.45 % |

| august 2007 – july 2007 |

0.76 % |

|

august 2007 – august 2006 |

7.26 % |

| september 2007 – august 2007 |

0.00 % |

|

september 2007 – september 2006 |

6.40 % |

| october 2007 – september 2007 |

0.75 % |

|

october 2007 – october 2006 |

5.51 % |

| november 2007 – october 2007 |

0.00 % |

|

november 2007 – november 2006 |

5.51 % |

| december 2007 – november 2007 |

0.00 % |

|

december 2007 – december 2006 |

5.51 % |

|

Table – 2006 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2006 – december 2005 |

-0.18 % |

|

january 2006 – january 2005 |

4.37 % |

| february 2006 – january 2006 |

0.00 % |

|

february 2006 – february 2005 |

4.57 % |

| march 2006 – february 2006 |

0.00 % |

|

march 2006 – march 2005 |

4.57 % |

| april 2006 – march 2006 |

0.84 % |

|

april 2006 – april 2005 |

4.65 % |

| may 2006 – april 2006 |

0.83 % |

|

may 2006 – may 2005 |

5.93 % |

| june 2006 – may 2006 |

1.65 % |

|

june 2006 – june 2005 |

7.27 % |

| july 2006 – june 2006 |

0.81 % |

|

july 2006 – july 2005 |

6.33 % |

| august 2006 – july 2006 |

0.00 % |

|

august 2006 – august 2005 |

5.94 % |

| september 2006 – august 2006 |

0.81 % |

|

september 2006 – september 2005 |

6.40 % |

| october 2006 – september 2006 |

1.60 % |

|

october 2006 – october 2005 |

6.92 % |

| november 2006 – october 2006 |

0.00 % |

|

november 2006 – november 2005 |

5.95 % |

| december 2006 – november 2006 |

0.00 % |

|

december 2006 – december 2005 |

6.53 % |

|

Table – 2005 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2005 – december 2004 |

0.96 % |

|

january 2005 – january 2004 |

4.37 % |

| february 2005 – january 2005 |

-0.19 % |

|

february 2005 – february 2004 |

4.17 % |

| march 2005 – february 2005 |

0.00 % |

|

march 2005 – march 2004 |

4.17 % |

| april 2005 – march 2005 |

0.76 % |

|

april 2005 – april 2004 |

4.96 % |

| may 2005 – april 2005 |

-0.38 % |

|

may 2005 – may 2004 |

3.74 % |

| june 2005 – may 2005 |

0.38 % |

|

june 2005 – june 2004 |

3.32 % |

| july 2005 – june 2005 |

1.70 % |

|

july 2005 – july 2004 |

4.06 % |

| august 2005 – july 2005 |

0.37 % |

|

august 2005 – august 2004 |

3.45 % |

| september 2005 – august 2005 |

0.37 % |

|

september 2005 – september 2004 |

3.63 % |

| october 2005 – september 2005 |

1.11 % |

|

october 2005 – october 2004 |

4.18 % |

| november 2005 – october 2005 |

0.91 % |

|

november 2005 – november 2004 |

5.33 % |

| december 2005 – november 2005 |

-0.54 % |

|

december 2005 – december 2004 |

5.57 % |

|

Table – 2004 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2004 – december 2003 |

0.40 % |

|

january 2004 – january 2003 |

4.35 % |

| february 2004 – january 2004 |

0.00 % |

|

february 2004 – february 2003 |

4.13 % |

| march 2004 – february 2004 |

0.00 % |

|

march 2004 – march 2003 |

3.49 % |

| april 2004 – march 2004 |

0.00 % |

|

april 2004 – april 2003 |

2.23 % |

| may 2004 – april 2004 |

0.79 % |

|

may 2004 – may 2003 |

2.83 % |

| june 2004 – may 2004 |

0.79 % |

|

june 2004 – june 2003 |

3.02 % |

| july 2004 – june 2004 |

0.98 % |

|

july 2004 – july 2003 |

3.19 % |

| august 2004 – july 2004 |

0.97 % |

|

august 2004 – august 2003 |

4.61 % |

| september 2004 – august 2004 |

0.19 % |

|

september 2004 – september 2003 |

4.81 % |

| october 2004 – september 2004 |

0.57 % |

|

october 2004 – october 2003 |

4.57 % |

| november 2004 – october 2004 |

-0.19 % |

|

november 2004 – november 2003 |

4.17 % |

| december 2004 – november 2004 |

-0.76 % |

|

december 2004 – december 2003 |

3.78 % |

|

Table – 2003 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2003 – december 2002 |

-0.21 % |

|

january 2003 – january 2002 |

3.43 % |

| february 2003 – january 2003 |

0.21 % |

|

february 2003 – february 2002 |

3.86 % |

| march 2003 – february 2003 |

0.62 % |

|

march 2003 – march 2002 |

4.06 % |

| april 2003 – march 2003 |

1.23 % |

|

april 2003 – april 2002 |

5.12 % |

| may 2003 – april 2003 |

0.20 % |

|

may 2003 – may 2002 |

4.66 % |

| june 2003 – may 2003 |

0.61 % |

|

june 2003 – june 2002 |

4.41 % |

| july 2003 – june 2003 |

0.80 % |

|

july 2003 – july 2002 |

4.16 % |

| august 2003 – july 2003 |

-0.40 % |

|

august 2003 – august 2002 |

3.10 % |

| september 2003 – august 2003 |

0.00 % |

|

september 2003 – september 2002 |

2.89 % |

| october 2003 – september 2003 |

0.80 % |

|

october 2003 – october 2002 |

3.29 % |

| november 2003 – october 2003 |

0.20 % |

|

november 2003 – november 2002 |

3.07 % |

| december 2003 – november 2003 |

-0.40 % |

|

december 2003 – december 2002 |

3.72 % |

|

Table – 2002 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2002 – december 2001 |

-0.43 % |

|

january 2002 – january 2001 |

4.94 % |

| february 2002 – january 2002 |

-0.21 % |

|

february 2002 – february 2001 |

5.19 % |

| march 2002 – february 2002 |

0.43 % |

|

march 2002 – march 2001 |

5.17 % |

| april 2002 – march 2002 |

0.21 % |

|

april 2002 – april 2001 |

4.69 % |

| may 2002 – april 2002 |

0.64 % |

|

may 2002 – may 2001 |

4.66 % |

| june 2002 – may 2002 |

0.85 % |

|

june 2002 – june 2001 |

4.16 % |

| july 2002 – june 2002 |

1.05 % |

|

july 2002 – july 2001 |

3.89 % |

| august 2002 – july 2002 |

0.62 % |

|

august 2002 – august 2001 |

3.86 % |

| september 2002 – august 2002 |

0.21 % |

|

september 2002 – september 2001 |

4.30 % |

| october 2002 – september 2002 |

0.41 % |

|

october 2002 – october 2001 |

4.06 % |

| november 2002 – october 2002 |

0.41 % |

|

november 2002 – november 2001 |

3.60 % |

| december 2002 – november 2002 |

-1.02 % |

|

december 2002 – december 2001 |

3.20 % |

|

Table – 2001 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2001 – december 2000 |

-0.22 % |

|

january 2001 – january 2000 |

3.25 % |

| february 2001 – january 2001 |

-0.45 % |

|

february 2001 – february 2000 |

3.02 % |

| march 2001 – february 2001 |

0.45 % |

|

march 2001 – march 2000 |

2.53 % |

| april 2001 – march 2001 |

0.67 % |

|

april 2001 – april 2000 |

2.28 % |

| may 2001 – april 2001 |

0.67 % |

|

may 2001 – may 2000 |

2.50 % |

| june 2001 – may 2001 |

1.33 % |

|

june 2001 – june 2000 |

3.39 % |

| july 2001 – june 2001 |

1.31 % |

|

july 2001 – july 2000 |

4.04 % |

| august 2001 – july 2001 |

0.65 % |

|

august 2001 – august 2000 |

5.19 % |

| september 2001 – august 2001 |

-0.21 % |

|

september 2001 – september 2000 |

4.73 % |

| october 2001 – september 2001 |

0.65 % |

|

october 2001 – october 2000 |

4.23 % |

| november 2001 – october 2001 |

0.85 % |

|

november 2001 – november 2000 |

4.89 % |

| december 2001 – november 2001 |

-0.64 % |

|

december 2001 – december 2000 |

5.16 % |

|

Table – 2000 inflation India (CPI)

| inflation (monthly basis) |

inflation |

|

inflation (yearly basis) |

inflation |

| january 2000 – december 1999 |

0.00 % |

|

january 2000 – january 1999 |

2.62 % |

| february 2000 – january 2000 |

-0.23 % |

|

february 2000 – february 1999 |

3.61 % |

| march 2000 – february 2000 |

0.93 % |

|

march 2000 – march 1999 |

4.83 % |

| april 2000 – march 2000 |

0.92 % |

|

april 2000 – april 1999 |

5.54 % |

| may 2000 – april 2000 |

0.46 % |

|

may 2000 – may 1999 |

5.01 % |

| june 2000 – may 2000 |

0.45 % |

|

june 2000 – june 1999 |

5.24 % |

| july 2000 – june 2000 |

0.68 % |

|

july 2000 – july 1999 |

4.95 % |

| august 2000 – july 2000 |

-0.45 % |

|

august 2000 – august 1999 |

3.99 % |

| september 2000 – august 2000 |

0.23 % |

|

september 2000 – september 1999 |

3.50 % |

| october 2000 – september 2000 |

1.13 % |

|

october 2000 – october 1999 |

2.75 % |

| november 2000 – october 2000 |

0.22 % |

|

november 2000 – november 1999 |

2.74 % |

| december 2000 – november 2000 |

-0.89 % |

|

december 2000 – december 1999 |

3.48 % |

|

– See more at: http://www.inflation.eu/inflation-rates/india/historic-inflation/cpi-inflation-india-2000.aspx#sthash.SwcvuHbL.dpuf

http://mospi.nic.in/Mospi_New/site/PressRelease.aspx

| SNo. |

Subject |

Press Release Date |

| 1 |

Press Release on New CPI for September, 2014 |

13/10/2014 |

| 2 |

Press Release on New CPI for august 2014 |

12/09/2014 |

| 3 |

Press Release on New CPI for July 2014 |

12/08/2014 |

| 4 |

Press Release on New CPI for June 2014 |

14/07/2014 |

| 5 |

Press Release on New CPI for May 2014 |

12/06/2014 |

|

|

http://dbie.rbi.org.in/DBIE/doc/Release_Calender.pdf

SAMPLE OF INFLATION REPORT GENERATED BY GOVT OF INDIA

This Press Release is embargoed against publication, telecast or circulation on internet till 5.30 pm today i.e. 13th October 2014. Page 1 of 4

GOVERNMENT OF INDIA

MINISTRY OF STATISTICS AND PROGRAMME IMPLEMENTATION

CENTRAL STATISTICS OFFICE

Dated the 13th October2014

21, Asvina, 1936 Saka

PRESS RELEASE

CONSUMER PRICE INDEX NUMBERS ON BASE 2010=100 FOR RURAL,

URBAN AND COMBINED FOR THE MONTH OF SEPTEMBER 2014

The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation releases Consumer Price Indices (CPI) on base 2010=100 for all-India and States/UTs separately for rural, urban and combined every month with effect from January, 2011. In addition to this, Consumer Food Price Indices (CFPI) for all India for rural, urban and combined separately are also released w.e.f May, 2014. Inflation rates (on point to point basis i.e. September, 2014 over September, 2013), based on General Indices and CFPIs, are given as follows:

| Inflation rates based on CPI (General) and CFPI Indices |

September 2014 (Prov.) |

August 2014 |

September 2013 |

| Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

Rural |

Urban |

Combd. |

| CPI (General) |

6.68 |

6.34 |

6.46 |

8.27 |

7.04 |

7.73 |

9.71 |

9.93 |

9.84 |

| CFPI |

7.78 |

7.45 |

7.67 |

9.75 |

8.40 |

9.35 |

11.79 |

11.50 |

11.75 |

Complete Details : http://mospi.nic.in/Mospi_New/site/PressRelease.aspx

Lokesh Madan

Algo Trading India

Related Readings and Observations

The post Trading Economic Indicators : CPI Inflation appeared first on Marketcalls.

![]()

The Double Tax Avoidance Agreements (DTAA) is essentially bilateral agreements entered into between two countries, in our case, between India and another foreign state. The basic objective is to avoid, taxation of income in both the countries (i.e. Double taxation of same income) and to promote and foster economic trade and investment between the two countries. The advantages of DTAA are as under.

The Double Tax Avoidance Agreements (DTAA) is essentially bilateral agreements entered into between two countries, in our case, between India and another foreign state. The basic objective is to avoid, taxation of income in both the countries (i.e. Double taxation of same income) and to promote and foster economic trade and investment between the two countries. The advantages of DTAA are as under.