![Jay Nifty Wizard]() Trading World is filled with lots of exciting stories and not everyone in this world are successful. There is a saying that “95% of the traders loose money“. And everyone of us want to be a part of the remaining 5% and every trader takes necessary steps to ensure that he moves towards that remaining 5%. A common man learns from his own experiences while the sharper and wise men learn from the front runners.

Trading World is filled with lots of exciting stories and not everyone in this world are successful. There is a saying that “95% of the traders loose money“. And everyone of us want to be a part of the remaining 5% and every trader takes necessary steps to ensure that he moves towards that remaining 5%. A common man learns from his own experiences while the sharper and wise men learn from the front runners.

So to help my very enthusiastic followers take a step ahead of others, I plan to interview successful traders across the globe so that we get to know the path they have traveled to reach that successful trader position. In this interview series, you can be assured to get an insight of their trading styles, discipline and models. I hope that this question answer session with successful traders will benefit my readers.

This time I am going to interview Mr.Jay Chandran (aka niftywizard) one of the top successful Market Profile trader from South India. He is a pure intraday trader and a very active person in social networking sites like Facebook and Twitter and people love him because of his information sharing nature.

Here is the question and answer series with him.

Jay Chandran, first of all I would like to say warm welcome on Marketcalls.

Rajandran, Its my pleasure to get interviewed on Marketcalls.

What makes you to get into the trading career. I know you are from engineering Background

Yes I did Btech Bioinformatics in Satyabama University and Iam a 2006 Passed out. I worked in Verizon as a test Engineer and later by 2008 I left my job to start trading as my full time career.

During my college days I used to stay in my cousins home here in Chennai where I met couple of my cousins friend who talks about stocks and stock markets which rose / fall that day.

I was little eager in understanding how to trade/invest in stock market. My cousins friend given me the profit/loss statements and he explained a little brief about how the stock market functions. So I was following him for couple of days to understand things better.

Did you started your trading during college days? When was your first trade?

During my college days I was just watching my cousin friend trading. Once he left the room I didn’t had a chance to see markets so left that time !!

After my college I was recruited by verizon as a test engineer . That time everyone in office used to trade. so I thought to put old learning now. During 2007 End I started my first trading.

For every trader their first trade set the tone for their career for me same thing happened. It was a CE option (I didn’t remembered which strike price) where my colleague asked me to buy . Without doing any analysis I bought that option for 10000 rs premium. During that time I even even dont know where to keep a stoploss or where to book the profits.

My Colleague told to buy I just bought . Later two days the total Rs10000 premium gone down to Rs900. Then I asked him “what to do now” as the value of my account gone to 900. he said “it not worked book your losses”. I booked @ loss with Rs900 left in account.

Then my brother told me to buy a Put option for that remaining Rs900 which was trading around Rs15. After taking the trade my trading account reached Rs8000. That was the sparking moment in my trading career this is where I thought to leave my job and start digging markets little more deeper. Its started all here after this trade.

And I had taken a payout of Rs8000 and left 500 in account which I bought a stock named Visu international around 9 rs and left it.

What make you to turn as a professional trader?

Passion first , then the profitable factor in trading ! Everyday market puts you in test only a trader with good mindset and continuous learning can overcome day to day test. I feel my passion towards trading and Learning new stuff every day put me at this place.

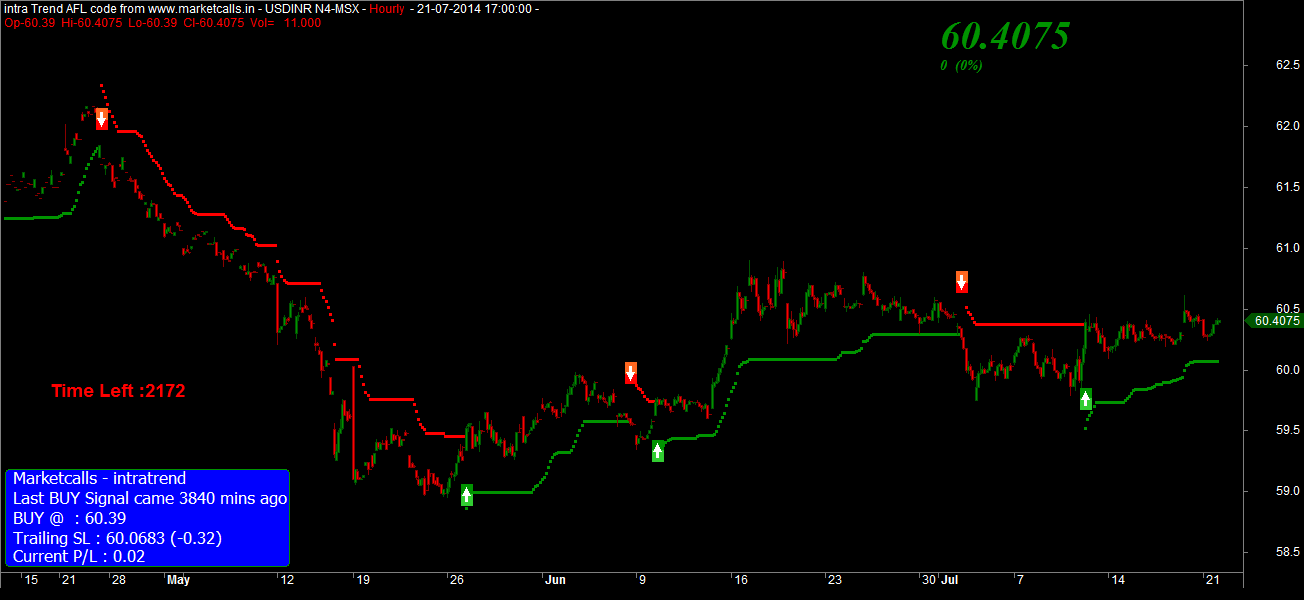

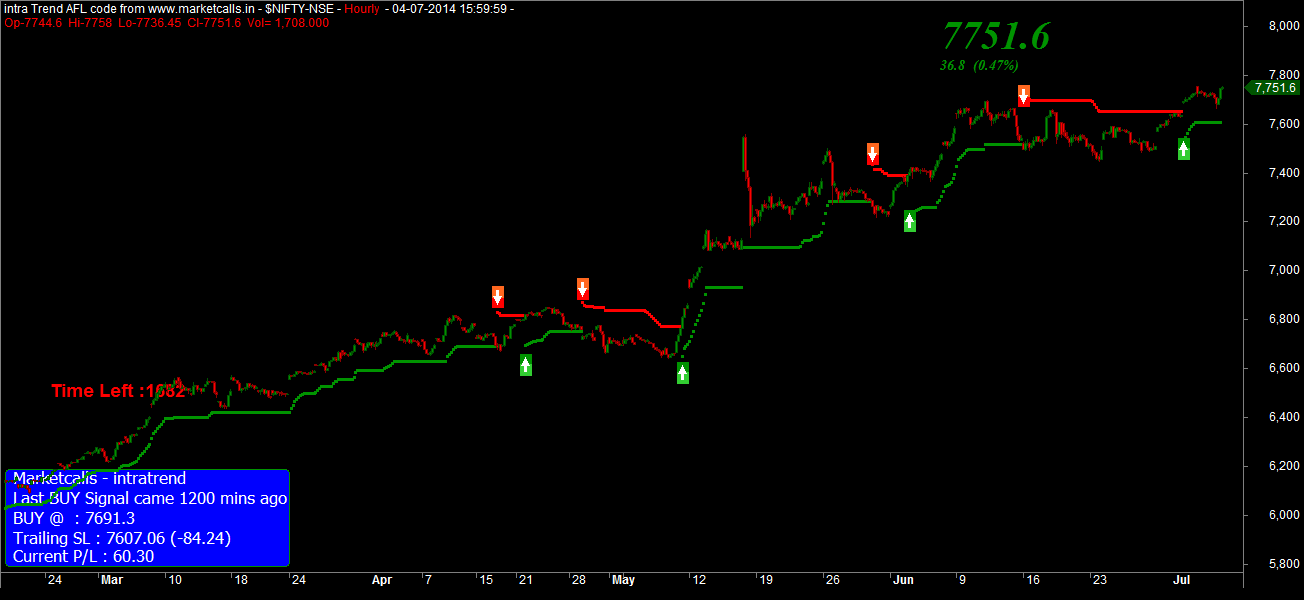

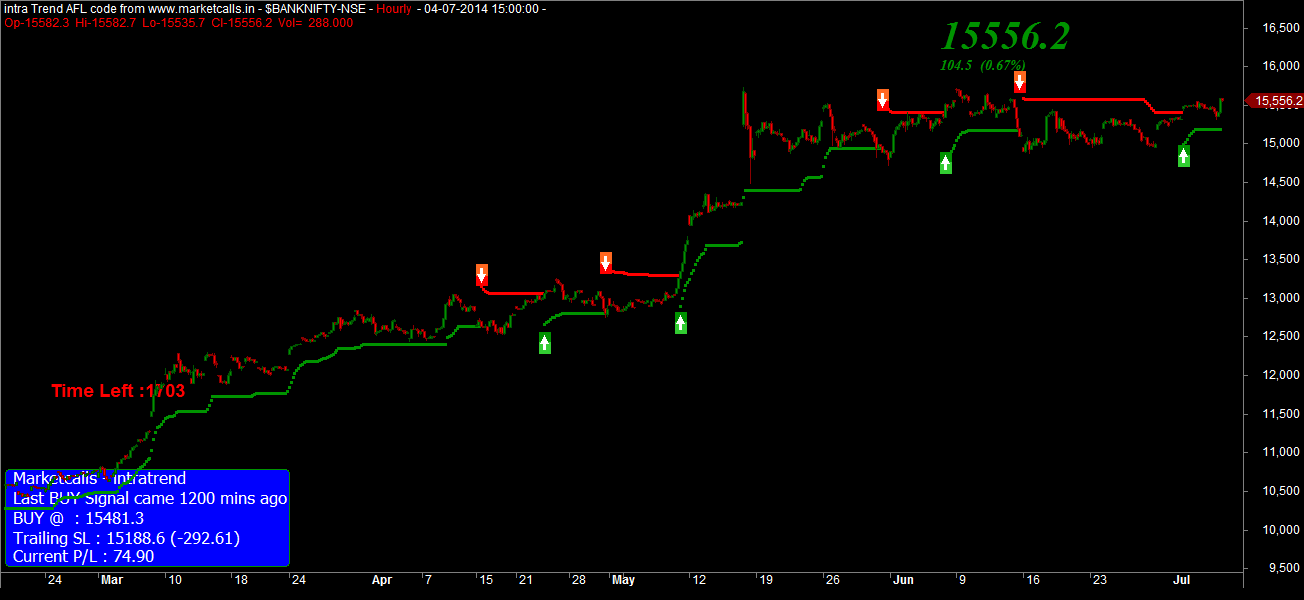

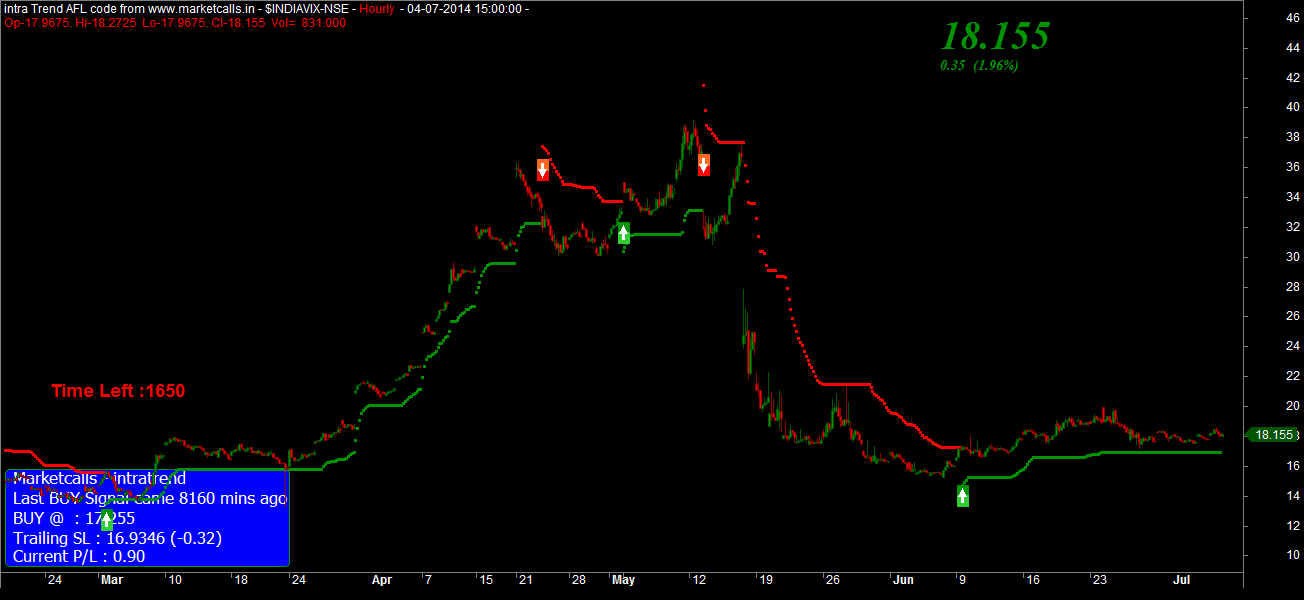

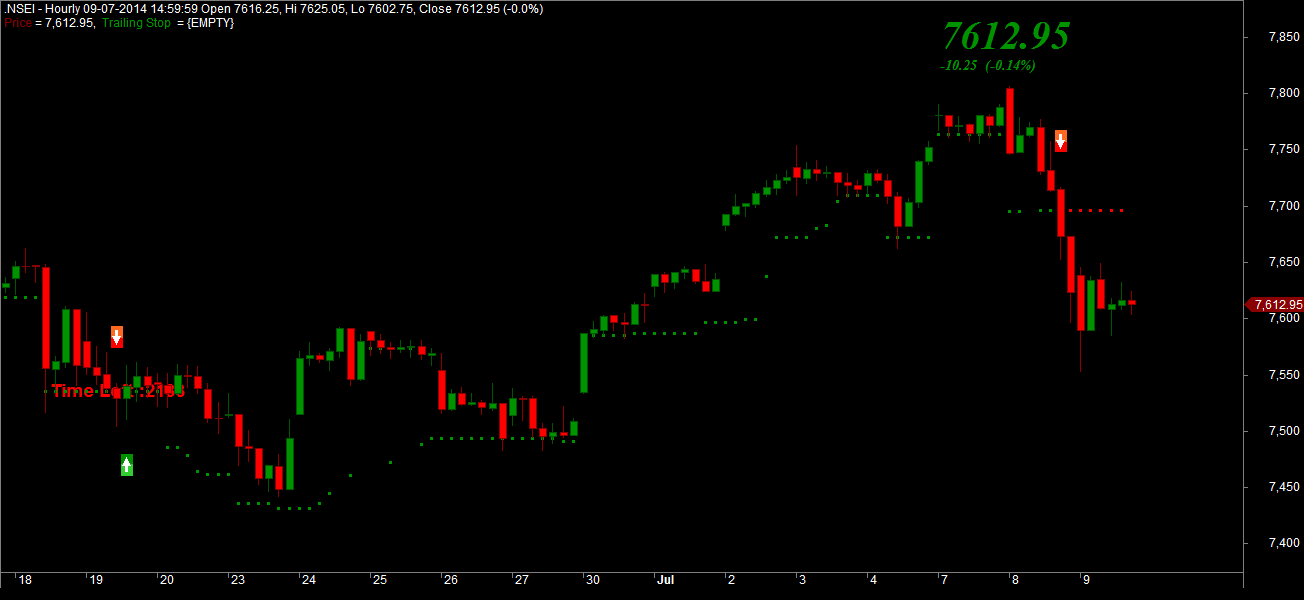

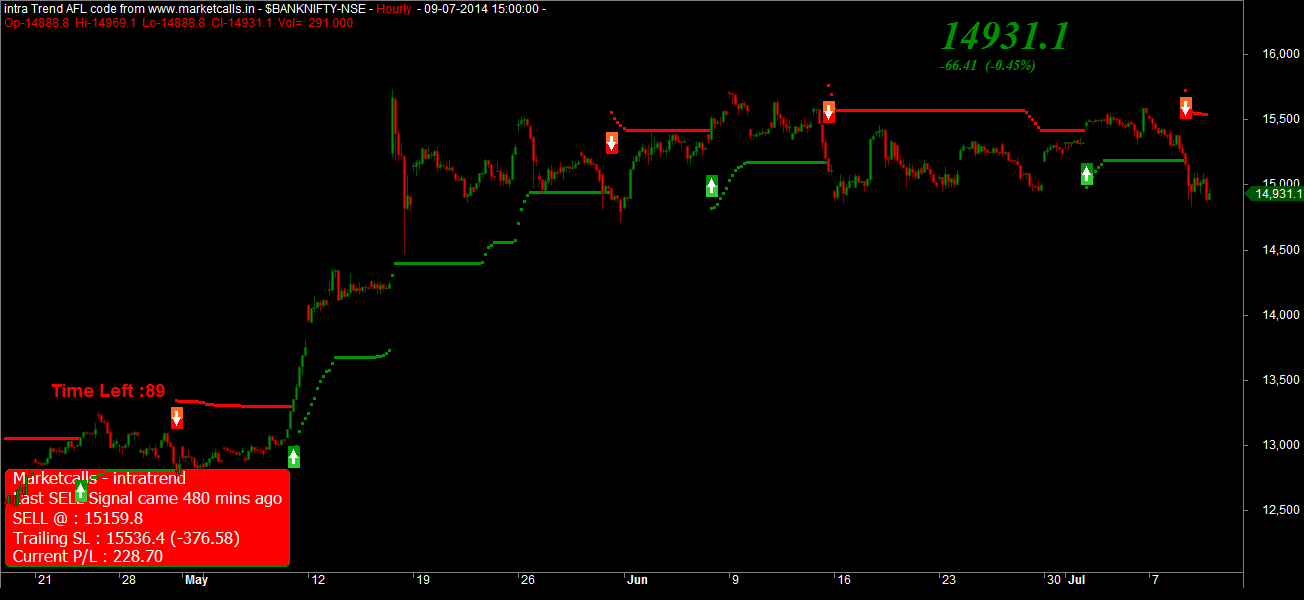

And What are the Tools/Studies you are using currently? How much you are spending on your trading infrastructure

I am currently using Market delta & Amibroker right now for my Market profile studies and Esignal for Datafeeds. Every month i use to spend merely around Rs20,000 rupees (includes Software, Datafeed, Internet) as i feel right tools are the key to run your trading as a business. Currently most of the Software, Datafeeed cost is paid in USD. And the pricing is highly volatile due to USD-INR movement. And there is not good datafeed provider in India with eSignal quailty. It would be great boon for traders like me if people in India are coming up with such solutions.

What are the tools you initially adopted in Trading and Why you shifted your studies to Market Profile?

As every trader at initial stage of my career I ran for so called readymade Afl Trading systems and day by day used to jump from one system to system. Then I thought by this way I am not going to make anything in trading. only it can lead to collection of fancy afl’s ![:)]() There are tons of ready made trading systems which have simple concepts but sold for higher price.

There are tons of ready made trading systems which have simple concepts but sold for higher price.

Those days I used to register in every trading forum. Int the Trading Laboratory forum I found a thread named market profile where everyone giving their interest. there was a stmt ” Market profile is been used by institutions “ which pulled my interest towards it. Then I started digging deeper into market profile. Thats how my professional career in trading starts.

Apart from Market Profile do you use any other studies for your Buy or Sell Decision?

I generally stick to price action studies as my secondary confirmation for any trigger which Market profile throws.

Did you tried fundamental analysis in your trading career?

yep I traded one fundamental call with my own self analysis. Don’t laugh it was just too fundamental when I picked it. The stock was Jublilant foodworks and it was trading around Rs400. By that time lot of pizzas where consumed and lot pizza shops where setting up all over the country. Then I thought this stock will hit 1000 plus in next 2 years due to their sales. I bought it around 430. but luckily it went to Rs1000 in just few months and where i sold the stock. I should say, I am lucky as move happened very quick.

As a Professional Intraday trader how do you manage risk in your trades?

I give more weightage to index trades on my trading. Always I go for intra trades which have 1:1 Risk reward. what I do usually is I always book partial profits i.e 50% on my intial quantity for 1:1 reward. Then ride the rest with moving trailing stoploss to cost. By that way ensure that I am not gonna give anything back to markets as well as to my broker.

What is the worst case scenario you face so far in your trading career?

The worst case was the first trade that gave me all the lesson what I should not do being a trader. Its rather good to focus on your studies and take a decision rather than depending on someone else.

When I started trading full time few years ago there was sudden dip during intraday where I was just freeze & not able to take decision to cut down my position or not. I could be a severe loss if i booked it out but luckily market bounced back from the lows. Then I noted in my trading diary take positions till it doesn’t hurt your trading capital even in a worst case scenario.

Also from that day I started book partial profits.

What are your future plans?

To trade for an institution and help newbie traders what not to do in this markets.

What is the general mindset of today’s newbie traders?

They want very quick money. They want a black box system which they think it should be an ATM for them . Worst thing is they go broke in their mindset when they saw some loss.

What advice would you give to non-professionals who would like to start trading?

If you dont have a family business don’t leave your job . Just start learning trading after office hrs . Try to start trading higher time frame signals initially then you can learn to trade lower timeframe signals. Learn how not to make losses rather than how to make profit.

Before finishing this interview i would like to add a quote “If you cannot make money with $100 what in the world makes you think you can with $100,000. it will only be 1000 times worse.”

Thanks Jay for your Brief interview. My Best wishes for your future plans and Would like to do a deep interview in the future.

Related Readings and Observations

The post Little Market Wizards : Jay Chandran – Market Profile Trader appeared first on Marketcalls.

![]()

Trading World is filled with lots of exciting stories and not everyone in this world are successful. There is a saying that “95% of the traders loose money“. And everyone of us want to be a part of the remaining 5% and every trader takes necessary steps to ensure that he moves towards that remaining 5%. A common man learns from his own experiences while the sharper and wise men learn from the front runners.

Trading World is filled with lots of exciting stories and not everyone in this world are successful. There is a saying that “95% of the traders loose money“. And everyone of us want to be a part of the remaining 5% and every trader takes necessary steps to ensure that he moves towards that remaining 5%. A common man learns from his own experiences while the sharper and wise men learn from the front runners.