One Timeframing is a simple, powerful and popular concept when comes to a market profile trader. One Timeframing generally refers to a market that is trending in one direction. In simpler terms candlesticks constantly making higher high and higher lows lows and the consecutive candles should not breach the lows of previous candle by not more than 2-ticks in the up trending move then it is called One Timeframing Up. IF the candles/bars are constantly making lower high and lower lows lows and the consecutive candles should not breach the high of previous candle by not more than 2-ticks in the down trending move then it is called One Timeframing Down.

One timeframing happens across all the timeframes but from a intraday trading perspective 30min daily profile charts provides meaningful indication for mean reversion trading. Either one can practice mean reversion trading, partial profit booking or tighten/trail his stops when one timeframe occur on 30min charts.

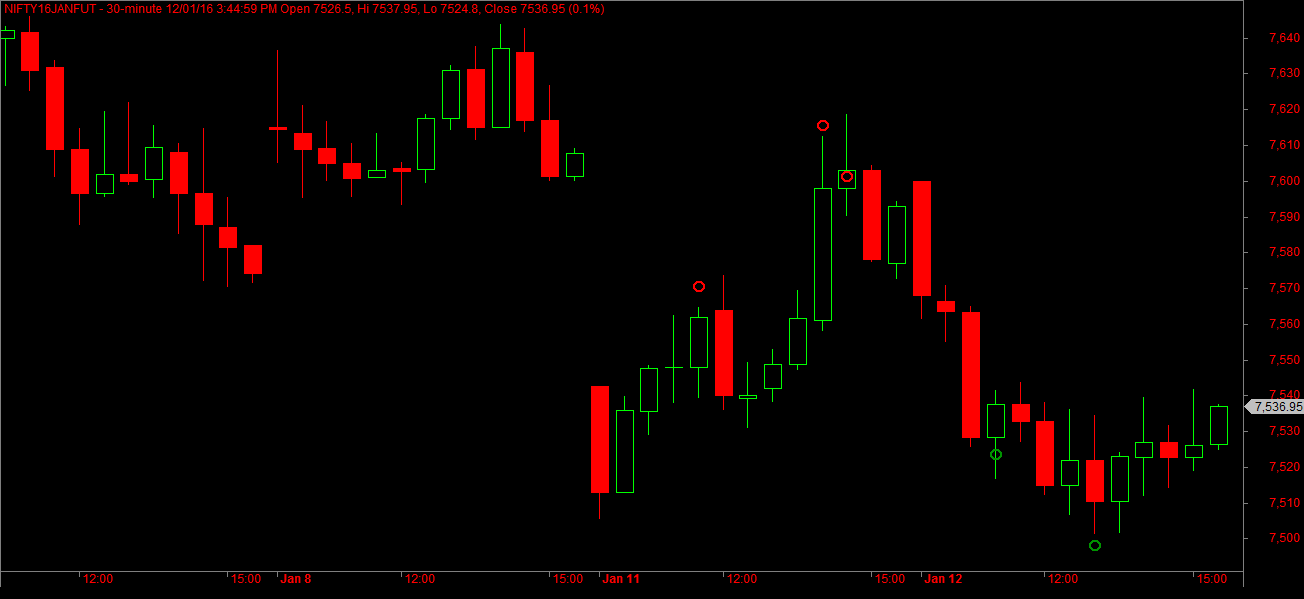

Post One Timeframing occurrence either the market can balance(move side ways) near the Onetimeframe zone or mean revert. One Timeframing is a very good visual concept for a day timefram traders perspective. The following One Timeframing Indicator and Amibroker Exploration provides onetimeframing indication with red and green circles and indicate the presence of one timeframing visually. The afl code looks for a minimum of 4 consecutive candles for the occurance of onetimeframe activity.

One Timeframing Amibroker Exploration Code

Download One Timeframing Amibroker Exploration

Note : we are interested only in consecutive candles whereas the text books and the internet reference might differ as many consider inside bar which still not breaking the previous bar high/low and making higher high or lower low also as a part of One Timeframing.

The post One Timeframing and Amibroker Exploration Code appeared first on Marketcalls.