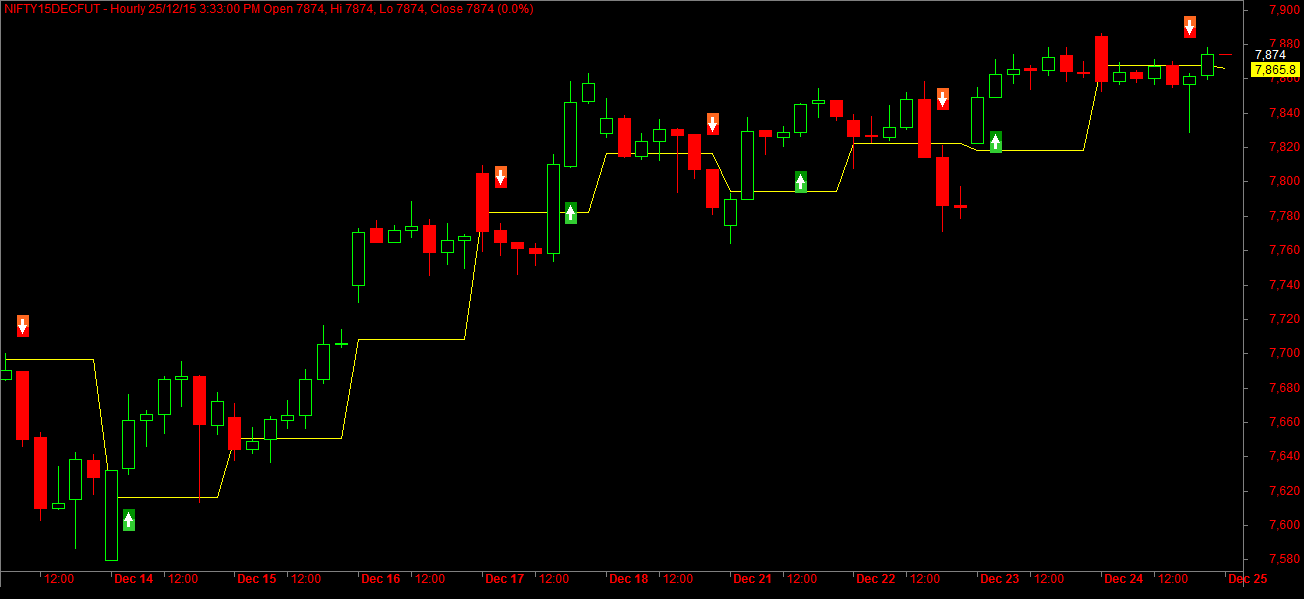

Here is an interesting trading system i would like to share. Generally people use Camarilla as Pivot Point levels for their intraday trading. How about using Camarilla Pivot as Trailing Stop for positional trading. We build this interesting trading system (Prototype) using the concept limit order backtesting. It is a simple long/short breakout trading system with no optimization variables.

The Buy/Sell rules are shown below

1)Measure Reference High for Buy Signal – i.e High when the Candle Closes above Camarilla Pivot.

2)Buy on Intraday any time if the price crosses Reference High on Intraday basis

1)Measure Reference Low for Short Signal – i.e Low when the Candle Closes below Camarilla Pivot.

2)Short on Intraday any time if the price crosses Reference low on Intraday basis

So if any sharp spike is coming in and that reference high/low are not taken out then the system will remove such unwanted signals.

Following Video tutorial explains how the Camarilla as Pivot Point Strategy Functions

Camarilla Pivot as Trailing Stop Loss – Amibroker AFL Code

Download Camarilla Pivot as Trailing Stops

Preferred Timeframe : 15min/Hourly

Strategy is backtestable!

The post Camarilla Pivot as Trailing Stop Loss – Amibroker AFL Code appeared first on Marketcalls.