The Market is big and confusing.With Multiple stocks and sectors it can be overwhelming for an average retail Investor But by understanding how the different financial markets interact with each other, the bigger picture can become much clearer. Observing the relationship between stock market as whole comparing with bonds, commodities and currencies gives an absolute advantage for a Market player which will lead to a much smarter trade opportunities compared to single market/Asset analysis .One of the main reason why an average Indian investor loses is because a lack of understanding on what’s behind the market movements. Majority of the time as I noticed, Indian retail player is engaged with single asset analysis or failing to grasp what is the main mover behind the major trends, what’s worse in some cases are blindly sticking to their bias even when the market turns around it back

What is Inter-market analysis ?

There is a general order in which markets are linked together due to various factors like global economic policies,Interest rate cycles etc. By watching the country’s financial market as a whole (means currency,commodity,stock market and bond prices), we are better able to assess the direction in which a market is shifting. All four markets work together. Sometimes move with each other, and sometimes against.The reason to look the market in this way is to understand or grasp which is the major theme causing the market prices fluctuate with or against each other. By absorbing the main theme,we can make good trading decisions and capture better profits

Application- simple and easy

Oh! I got it – reading my former two paragraphs some might have already confused or thinking this is tough and complex rather some of you might be saying “this guy is creating a complicated way to analyse the market” No worries- Applying Inter-market analysis is very simple and easy.Once you start looking the markets this way, You really gonna love it and understand major reasons behind the price movements. The only requirement you should have is some basic knowledge of how to look at the price chart

Let’s begin by looking at how commodities, bonds, stocks and currencies interact. As commodity prices rise, the cost of goods is pushed up. This increasing price action is inflationary and interest rates also rise to reflect the inflation. Since the relationship between interest rates and bond prices is inverse, bond prices fall as interest rates rise.Bond prices and stocks are generally correlated. When bond prices begin to fall, stocks will eventually follow suit and head down as well. As borrowing becomes more expensive and the cost of doing business rises due to inflation, it is reasonable to assume that companies (stocks) will not do as well Once again, we will see a lag between bond prices falling and the resulting stock market decline

Take a Look at US stock Dividend yields and Bond Yields How the correlation is unfolding(1954-2008)

The currency markets have an impact on all markets, but the main one to focus on is commodity prices Commodity prices affect bonds and, subsequently, stocks. The USD and commodity prices generally trend in opposite directions. As the dollar declines relative to other currencies, the reaction can be seen in commodity prices

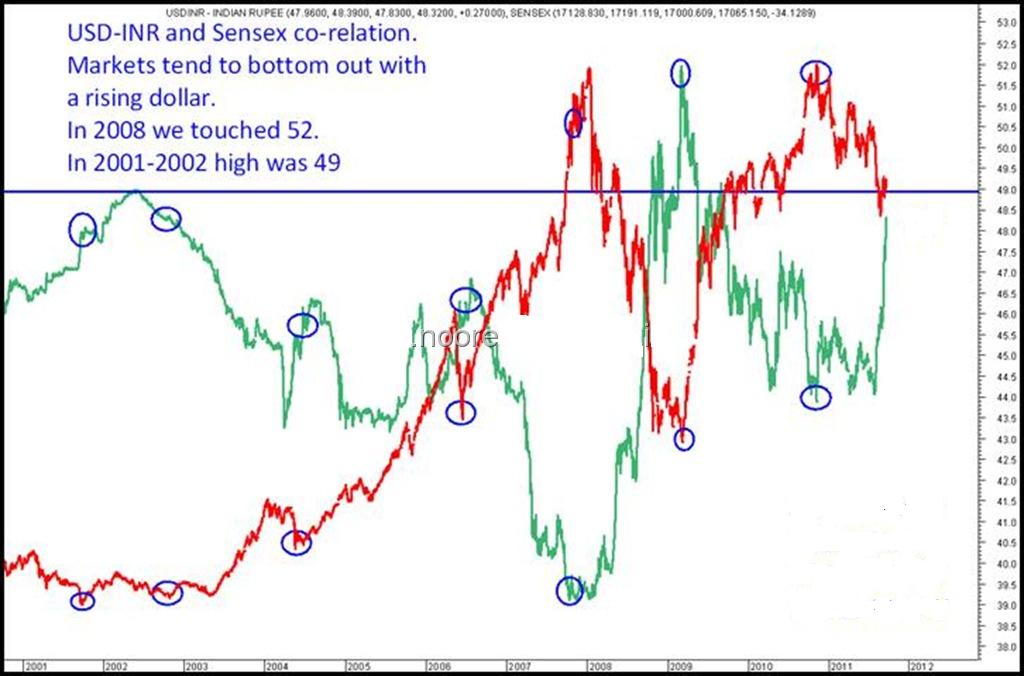

Indian stock market have different tendency to the fluctuation in USD/INR which is visible in the following chart (Till 2008)

Inter-market analysis is not a method that will give you specific buy or sell signals. However, it does provide an excellent confirmation tool for trends, and will warn of potential profit opportunities

Inter-market analysis is a valuable tool when investors understand how to use it. However, we must be aware of the type of economic environment we are in over the long term, and adjust the relationships we will see accordingly. Inter-market analysis should be used as a tool to judge when a certain market is likely to reverse, or whether a trend is likely to continue Just go ahead pop the different market charts together and see how the relationship holds and let me know in comments what do you guys think about the recent market situations from an Inter-market view

Still not a profitable trader? Take up our professional course and turn around your performance, Learn ultimate and profitable trading strategies from an Institutional perspective, To know more contact arulbalaji184@yahoo.com

Related Readings and Observations

The post Capture Profits by Fixing the Puzzle of Inter-market relationships appeared first on Marketcalls.