Infosys Q2 2014 Result – Key Highlights

- Post Results Infosys up 6%. Watch the live Infosys future charts here to track price movements.

- Infosys Q2 standalone net profit comes in at Rs 3365 crore against Rs 2326 cr in the same period last year

- Infosys Board approves a bonus issue of 1:1 Bonus applicable to ADR shareholders also

- Declares interim divided of Rs 30/share

- Continue to hold guidance of 7-9% $ revenue growth in FY15

- Gross addition of 14,255 employees during the quarter. 165,411 employees as on September 30, 2014 for Infosys & its subsidiaries.

- Earnings: Q2 North America growth at 3.1%, Europe growth at 4.2% Earnings: Q2 attrition at 20.1%

- Earnings: Revenues from India – which account for less than 3% of the company’s total revenues – declined 5.1%

- has pledged Rs 254 crore for FY15 towards CSR through the Infosys Foundation.

- attrition rate crosses 20% in second quarter

- added 49 new clients during the period as against 61 clients in April-June period, taking the total number of active clients to 912

- margin improved by 100 basis points to 26.1% as against 25.1% at the end of first quarter

- Vishal Sikka : Signed 6 large deals with a cumulative value of $600 mn

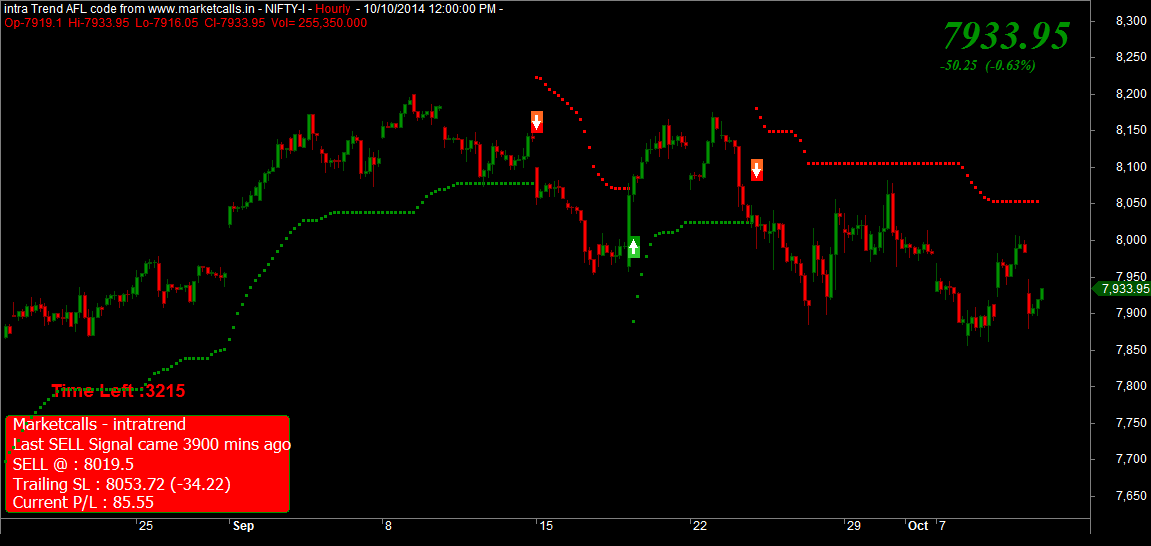

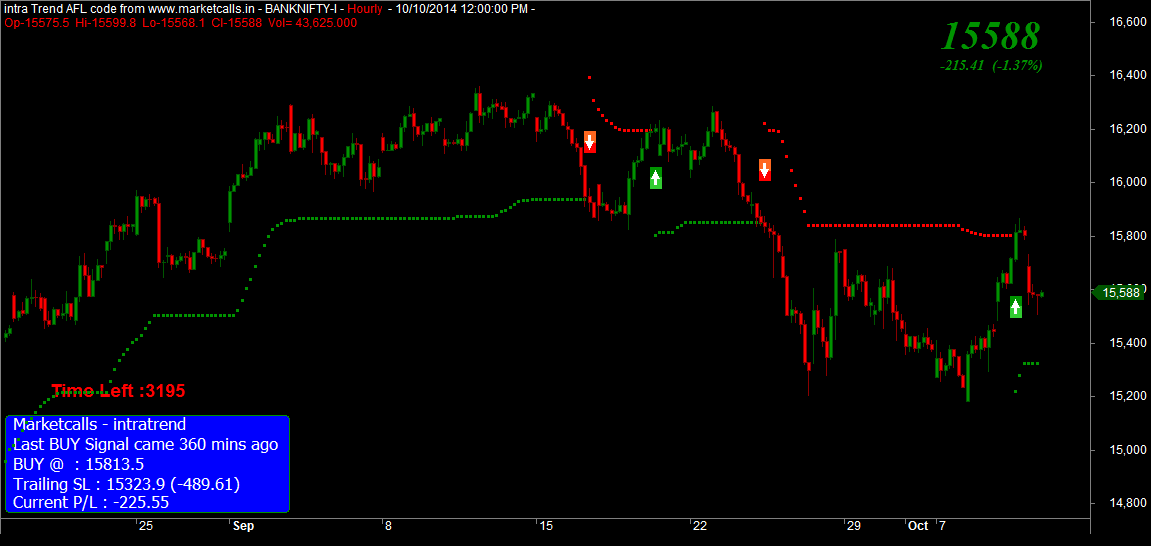

Nifty futures turned to positional sell mode on 23rd of September and currently the resistance zone comes around 8053 reverse your position to positional buy mode if the resistance zone breaks on the hourly charts. On Contrary Bank Nifty futures turned to positional buy mode yesterday during the second half of the trading session and currently the support zone comes around 15323. Reverse your position to positional sell mode if the support zone breaks on the hourly charts.

India VIX Hourly Charts

After a prolong sell mode in India VIX finally there is some volatility on cards and turned to positional buy mode and currently the support zone for India VIX comes around 12.67 and we can expect a little descent increase in volatility in the upcoming sessions.

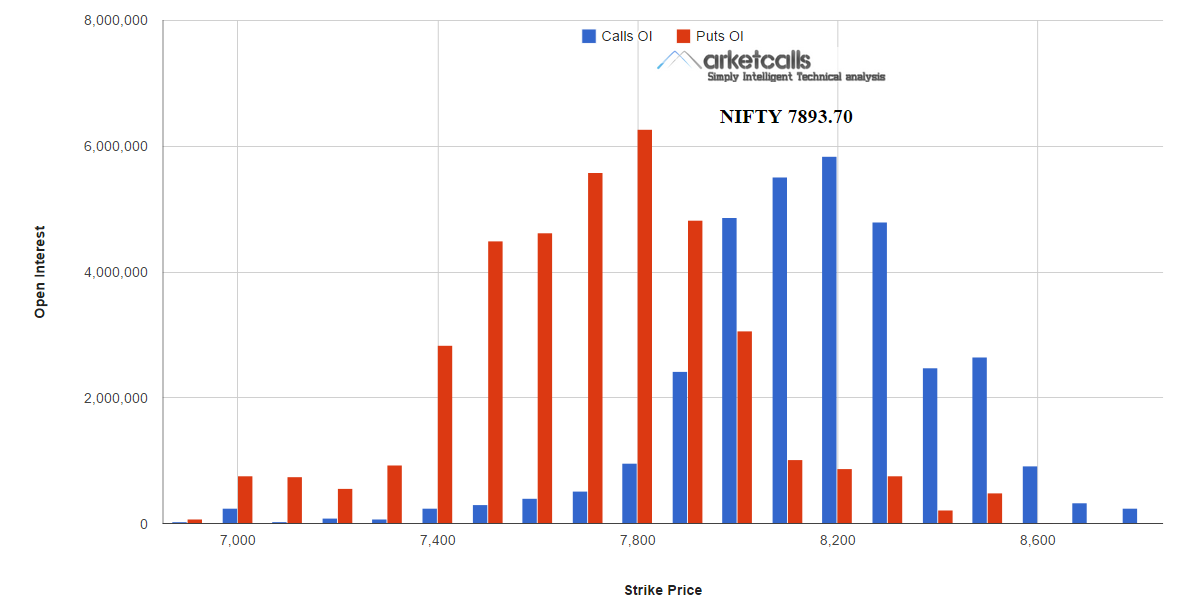

Open Interest

The Higher open interest build up is seen in 7800PE. unwinding of open interest in 7800PE could be a sign of further downtrend on contrary maintaining the open interest built up could take 7800 as EOD support for current month expiry.

Related Readings and Observations

The post Nifty and Bank Nifty Hourly Charts Overview and Infosys Result appeared first on Marketcalls.