Last friday nifty lost close to 118 points intraday due to fears of a decline in global money flows if the United States, increases interest rates and due to Argentina’s second default in 13 years. The RBI’s monetary policy review on Tuesday could guide us the further direction and could give us clear cut view on the market direction. It should be noted that FIIs infuse over $26-billion so far in 2014; $6-billion in July alone but still USDINR trading below 4 month low.

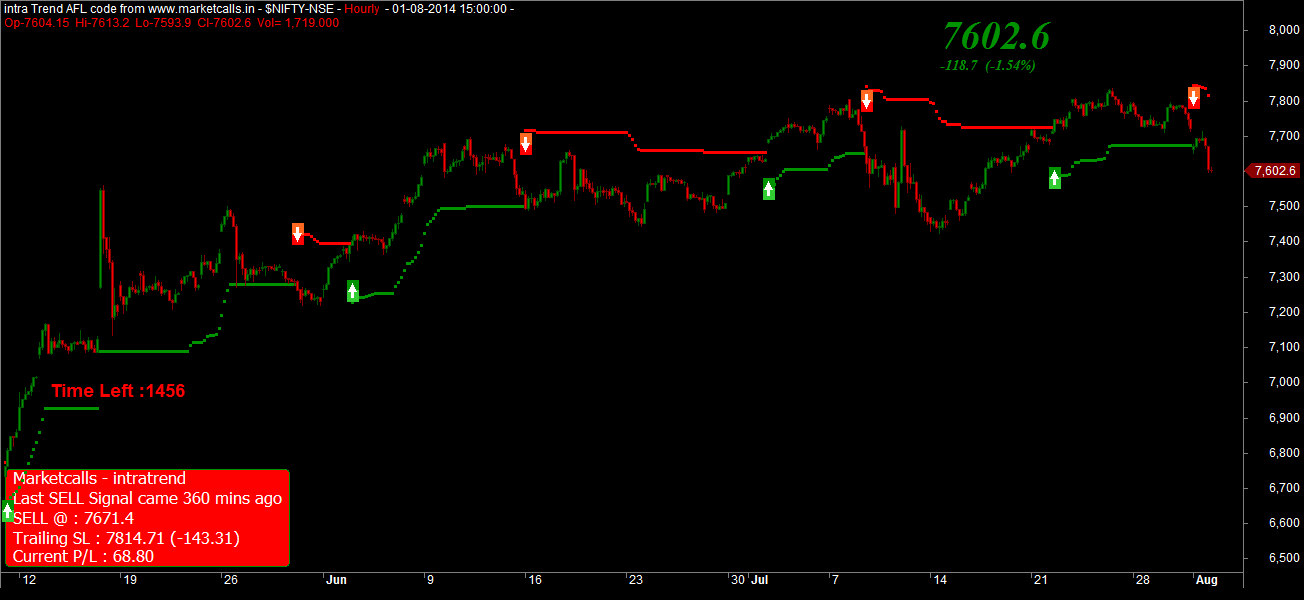

Nifty Spot Hourly Charts

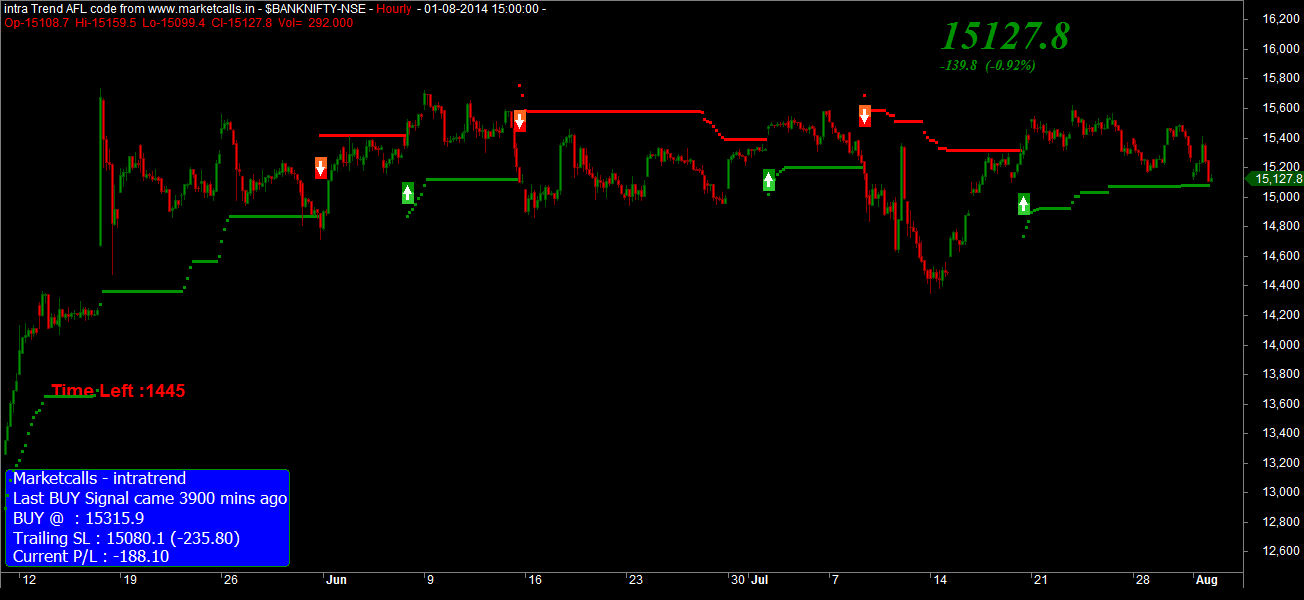

Nifty on the hourly charts turned to Positional Sell mode with resistance zone around 7814 on contrast Bank Nifty maintains the Positional Buy mode and trading very close to the support zone near 15080. Any breakdown below 15080 on hourly close could turn bank nifty into positional sell mode.

India VIX Hourly Charts

India VIX still maintains the positional sell mode since mid of july 2014 and currently the resistance zone comes under 15.73. Any breakout would like to show increased volatility in the market.

Nifty Options Open Interst Lookup

Currently 7300PE holds the highest open interest amoung the strike price. Its quite early to point of that 7300 could act as a support zone as the August Option series just started.

Related Readings and Observations

The post Nifty and Bank Nifty August Overview appeared first on Marketcalls.