The main challenge with the classic ORB Study for Amibroker is that it generates too many signals on the intraday charts and backtesting is not possible with such a study. This problem has been overcome by Mr Dinesh Tarte by fine tuning ORB study makes the code backtestable

Dinesh is software Engineer by profession and a trader in equity and commodity markets. He does research with various technical analysis and loves to develop strategies in amibroker. Remarkably he is a student of Marketcalls.

ORB Trading rules

1)Buy after 11.15a.m if the market crosses above ORBH ( ORB-High) and exit logs at 150pts profit in case of banknifty or exit around 3.30p.m or if the stoploss ORBL ( ORB-Low) hits.

2)Short after 11:15a.m if the market crosses below ORBL ( ORB-Low) and exit shorts at 150pts profit in case of banknifty or exit around 3.30p.m or if the stoploss ORBH ( ORB- High) hits

What does this code do?

Sample ORB strategy is shown above over Bank Nifty April Futures Charts. Where the Green and Red arrows indicates Buy and Sell Signals Respectively. And the Green and Red Star indicates Buy Exit and Sell Exit Respectively.

The ORB Study calculates the high (ORBH) and low (ORBL) between the first two hours i.e. from 9.15a.m to 11.15a.m .It takes the signal descision when the market cross the range on or either side after 11:15a.m. The below parameter in the code mentions the market open, close time and signal breakout time. Here signal breakout will occur only if the ORBH and ORBL break out after 11:15a.m.

Market_Start_Time=091500;

Market_Open_Brakeout=111500;

Market_end_time=151500;

The code has been optimized for Bank Nifty and it also exits at profit (say 150 points in case of Bank Nifty). However you can change the values according to your favorite stock/index. The following code decide the target point

target_point=Optimize(“target_point”,150,20,200,1);

Stop Loss Hits in Case of Two Conditions

1) If the 1st signal is active and market breaches the stoploss i.e ORBL is the stop loss in case of active buy signal

and ORBH is the stoploss in case of active sell signal

2)The position will be closed at the end of the day .

This system is purely optimized for bank nifty and consider the lot size of 50 (2 lots) in case of Bank Nifty. This code can be used with high beta stocks like SBI and others and fine tuned with the break out time like first 1 hr or ½ hr depending upon your analysis and experience with ORB study.

Amibroker Settings

The following settings is mandatory for this code to work properly.

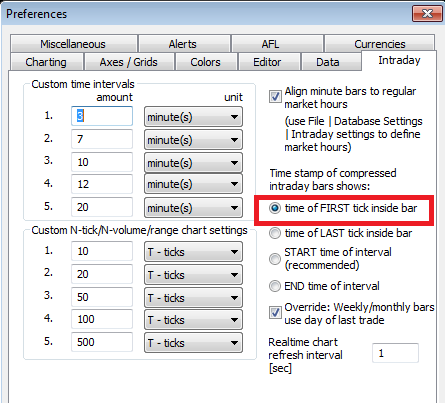

Goto->Tools->Preferences->Intraday and Set time of first inside tick bar as shown below

Download Backtestable ORB code for AmibrokerBackTestable ORB

Amibroker Code

// Developed by Dinesh R Tarte

_SECTION_BEGIN("Backtestable ORB");

SetBarsRequired(100000,0);

GraphXSpace = 15;

SetChartOptions(0,chartShowArrows|chartShowDates);

SetChartBkColor(ParamColor("bkcolor",ColorRGB(0,0, 0)));

GfxSetBkMode(0);

GfxSetOverlayMode(1);

SetBarFillColor(IIf(C>O,ParamColor("Candle UP Color", colorGreen),IIf(C<=O,ParamColor("Candle Down Color", colorRed),colorLightGrey)));

Plot(C,"\nPrice",IIf(C>O,ParamColor("Wick UP Color", colorDarkGreen),IIf(C<=O,ParamColor("Wick Down Color", colorDarkRed),colorLightGrey)),64,0,0,0,0);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Market_Start_Time=091500;

Market_Open_Brakeout=111500;

Market_end_time=151500;

//need to consider 60 min insted of 100 //Market_Signal_time=Market_end_time - Market_Open_Brakeout;

Market_Signal_time=033000;

Min_in_signal_time=2190;

Bars_in_Signal=210/5;

Total_No_Of_Every_Day_Bar=72;

target_point=Optimize("target_point",150,20,200,1);

SetPositionSize(1,spsShares);

//Total_No_Of_Every_Day_Bar=(Market_end_time-Market_Start_Time)/5(Time in Min)

printf("\n Bars in the signal is =>" + Bars_in_Signal);

//(for 5 Min Chart divide by 5 AND for 15 Min Charts divide by 15 (Min))

printf("\n market singal Time=>"+Market_Signal_time);

SetTradeDelays(1,1,1,1);

ST=MArket_start_time=091500;

BT=brake_out_time=111500;

Currtime =TimeNum();

Currentdate=DateNum();

afterbreakout0 = Cross(TimeNum(),BT);

printf("\n Todays date is +" +NumToStr((Currentdate),formatDateTime ));

Curren_Dae=Day();

SetPositionSize(1,spsShares);

//--New Day & Time. End Day & Time . End Day & Time is null till end of day 1

//IT will check the condition of the each bar .

NewDay = Day()!= Ref(Day(), -1);

printf("\n Day+starttime : " + Day() );

EndDay = (Day()!= Ref(Day(), 1));

printf("\n newday Value is=>"+NewDay);

printf("\n End day value is =>"+EndDay);

printf("\n EndDay : " + EndDay );

starttime = Cross(TimeNum(),ST);

TimeNum()>ST;

//it will caluclate the highest and lowest array from the start time

//.its go on calculating entire array till next Day

Exit_Time = TimeNum() > Market_end_time;

Highest_science = HighestSince(starttime,H,1);

Lowest_science =LowestSince(starttime,L,1);

WriteIf (IsNan(Highest_science) , "higest_scinece value is =

"+Highest_science+" ","")+"\n"+

//it will calculate the high and low value of the BT time

ORBH = ValueWhen(afterbreakout0,Highest_science,1);

ORBL = ValueWhen(afterbreakout0,Lowest_science,1);

//Plots ORB High and Low Line

Plot(ORBH,"",colorGreen,styleDots);

Plot(ORBL,"",colorBlue,styleDots);

Buy=IIf(Cross(C,ORBH) AND (Currtime>BT) ,True,Null);

Short =IIf((Cross(ORBL,C) AND (Currtime>BT)) ,True,Null);

Shortflag=-99;

BarsToday = 1 + BarsSince( Day() != Ref(Day(), -1));

Buy_Bar_count=ValueWhen(Buy,BarsToday,1);

Short_bar_Count=ValueWhen(Short,BarsToday,1);

printf("\n Buy signal coming at the bar => "+Buy_Bar_count);

printf ("\n Today's date is =>"+ Date());

printf ("Bar is =>"+BarsToday);

ReminingBarinDay=ReminingBarinDay_short=60;

Buy=ExRemSpan(Buy,ReminingBarinDay);

Short=ExRemSpan(Short,ReminingBarinDay_short) ;

//this is for when buy is active and short signal is coming

sellflag_short=IIf(Short==1, True,0);

//Shortflag=Buyflag=IIf(NewDay == 1 ,2,Null);

//this is for when short is active and Buy signal is coming

Coverflag_buy=IIf(Buy==1,True,0);

// to set the flag when buy condition is true

IIf(Buy==1,Buyflag=1,0);

BuyPrice1=ValueWhen(Buy,C,1);

SellPrice1=BuyPrice1+target_point;

printf("\n before sell signal coming SellPrice:-" +SellPrice1);

Sell_Cond=Cross(H,SellPrice1);

//Sell_Cond=IIf(H >=SellPrice1,True,False);

printf("\n DD->Sell Cond Value is =>"+Sell_Cond);

//short flag is used to close the condition when buy condition is active at the same time short is also active (in short when the buy signal is active short signal is coming so closing the position of buy @short price);

printf("\n Buy flag value is =>"+BuyFlag);

printf("\n Sell_flag_short value is =>"+Sellflag_short);

//Shortflag=Close the existing position when Short Signal arrived

//End Day:-close the open position at the end of the day

Sell=IIf(((BuyFlag==1) AND ((Sell_Cond==1) OR (EndDay==1))),True ,Null);

//this is for when buy is active and short signal is coming

Sell=IIf(((BuyFlag==1) AND (Sellflag_short==1 ) ),True ,Sell);

Shortflag=Buyflag=IIf(NewDay == 1 ,2,Null);

Sell=ExRem(Sell,Buy);

printf("\n Buy Verible value is =>"+Buy);

printf("\n Sell Verible value is =>"+Sell);

SellPrice=ValueWhen(Sell,H,1);

printf("\n sellsell price is :-" +SellPrice);

ShortPrice=ValueWhen(Short,C,1);

//Setting the flag when short condition is active

IIf(Short==1,Shortflag=1,0);

printf("Short flag value is =>"+Shortflag);

printf("\n short sell flag value is =>" +Sellflag_short);

ShortPrice1=ValueWhen(Short,C,1);

//Cover the Condition Of the Lower point

CoverPrice1=ShortPrice1-target_point;

printf ("Short price is for price1 is =>"+ ShortPrice1);

printf ("CoverPrice is for price1 is =>"+ CoverPrice1);

Cover_cond= IIf(L<=CoverPrice1,True,False);

printf("\n Cover Cond Value is =>"+Cover_Cond);

//Cover the position when Short is active AND Current price(L) is Less then Condition price OR Close the position end Of the Day

Cover=IIf((ShortFlag==1) AND (Cover_Cond==1 OR EndDay==1),True,Null) ;

//this is for covering the position when buy signal is appering when short signal is active .clsoing the existing short position

Cover=IIf((ShortFlag==1) AND (Coverflag_buy==1),True,Cover);

printf("\n Cover value is =>"+Cover);

CoverPrice=ValueWhen(Cover,C,1);

printf("\n Cover price is ->"+CoverPrice);

Cover=ExRem(Cover,Short);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Sell, shapeStar, shapeNone),colorGreen, 0, H, Offset=-70);

PlotShapes(IIf(Cover, shapeStar, shapeNone),colorBlue , 0, L, Offset=-70);

Note : Code tested with Amibroker 5.60 version

Related Readings and Observations

The post Backtestable Open Range Breakout ( ORB ) Study for Amibroker appeared first on Marketcalls.