Here are the collection of tutorials which help you to kickstart, understand the basic building blocks, improves your understanding about Market Profile and helps you to organize the market generated information in a better way than any other trader.

How to Read a Market Profile Chart?

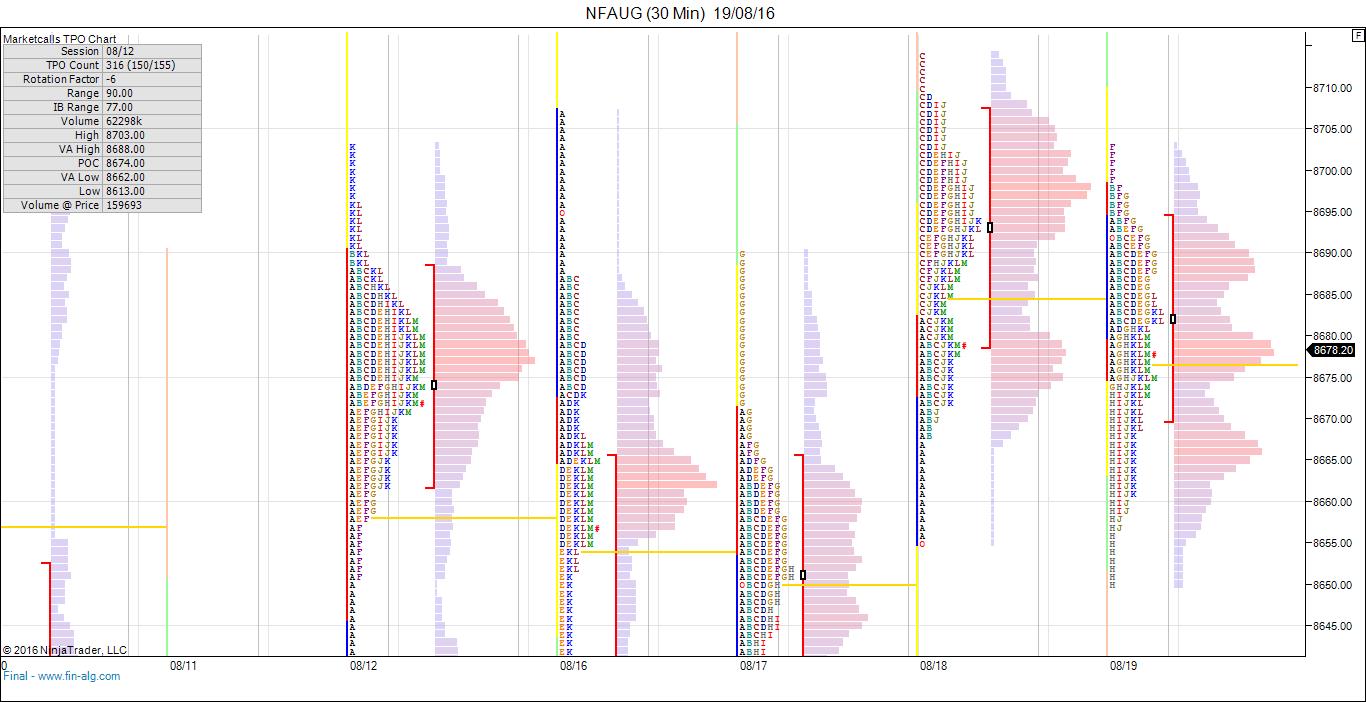

Market Profile is not a trading system but a market generated information and a decision supportive system along with your existing trading systems. It provides you knowledge about who is in control in the market (Long Term Players, Short Term Players, Day Traders), directional conviction. Market Profile gives an idea to a day trader about where to take a trade and which trend to play for the day based on trend conviction

Market Profile : Balanced and Imbalanced Markets

In this section we will cover different types of markets (Balanced Markets and Imbalanced Markets) and provide a fair idea when such days occur and who is in control for the day.

Market Profile : Different Types of Profile Days

In this tutorial we will be discussing about the different types of Market Profile Days. By analyzing the shape of profile one can easily identify who is in control in the market and the conviction among market participant.

How to Play 80 Percentage Rule

Market Profile – 80% rule which was first mentioned in The Profile Reports (Dalton Capital Management 1987 – 1991). It says if the market opens either above or below the value area and test the value area high/low within 2 consecutive 30 minutes

Market Profile Open Type and Confidence

Reading the profile right from the market day open gives more confidence to a day trader towards trade conviction. The confidence level of the Other timeframe trader (Long Term or Positonal trader) can be analysed through market opening.

Market Profile – Spike and Spike Rules

By observing Spike action in market and the next days follow through price action one can determine whether the previous days spike action is false move to confuse the traders or it is going to create a sustainable trend towards the spike direction.

Market Profile – Failed Auction

Failed Auction is a Market Profile Pattern brought to the world by Ray Barros of Trading Sucess. Failed Auction provides trader a great oppurtunity to trade with dynamic mindset and constructing his/her trading rules accordingly

Poor High and Poor Low Market Profile Structure Explained

Poor low and Poor High are market profile structure which generally indicates a market that is too long or too short and the shorter timeframe players in the market has low confidence about the current market direction

Market Profile – Excess (End of Auction)

Excess generally indicates end of auction and the start of another. Generally Excess is seen in the extremes of the profile with strong pullback as shown below. Excess occurs across various timeframes (Hourly, Daily, Weekly Charts)

The post Learn to Trade Any Markets Using Market Profile appeared first on Marketcalls.