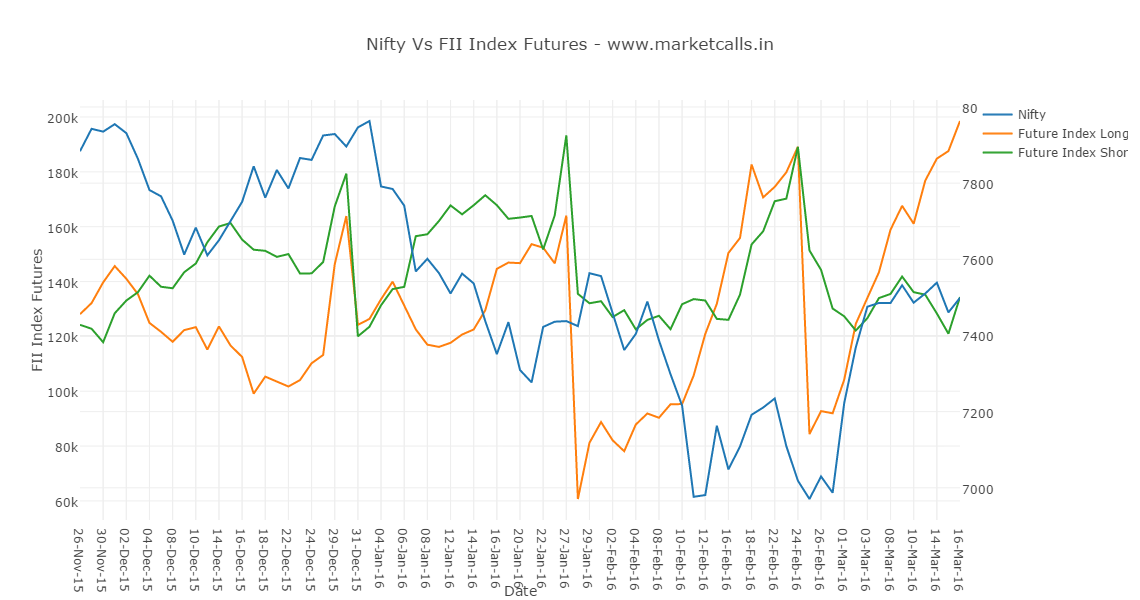

If you understand the participation wise open interest post the budget retail traders are keep on building their shorts till to date and the FII’s are building their longs to the extreme till to date. This is a clear tug of war between retail traders and FII/FPI’s in index futures.

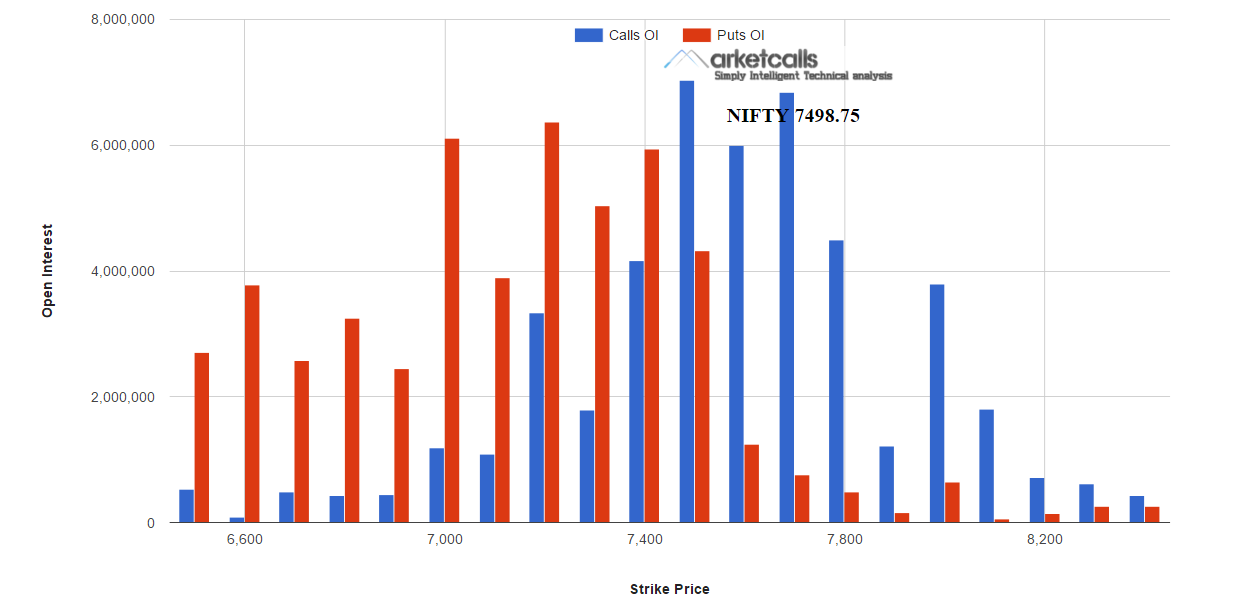

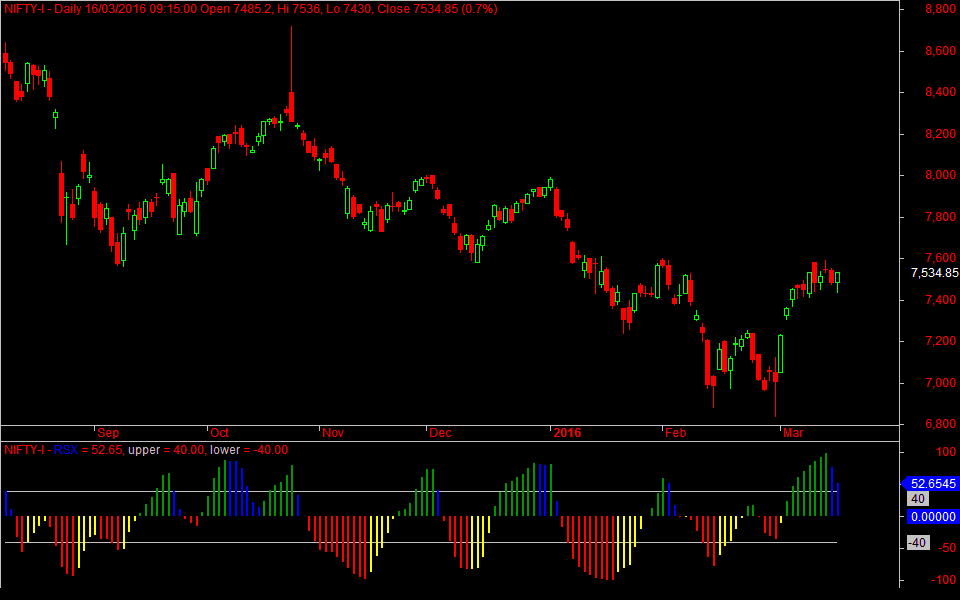

Nifty EOD sentiment is holding negative for the last two days and also 7500PE holds the highest open interest in the march series which indicates retails are so far defending the 7500 zone. And the tug of war is making the nifty to move in a sideways either one of the future participants has to give up post the FED event.

What is my take?

Sharp dip in Nifty followed by a sharp reversal is still there in my thoughts. Which is already presented in the previous Tradezilla Complementary Webinar.

The post What is happening in the Index Futures and Options Open Interest? appeared first on Marketcalls.