Gaps are always interesting to me! I gives directional clues and also trading ideas. However each and every gaps should be treated differently. In the last tutorial we had discussed which gaps need to be given preference and which one should be ignored. Only the Gaps which opens above or below the previous days high low range gains importance from a traders perspective.

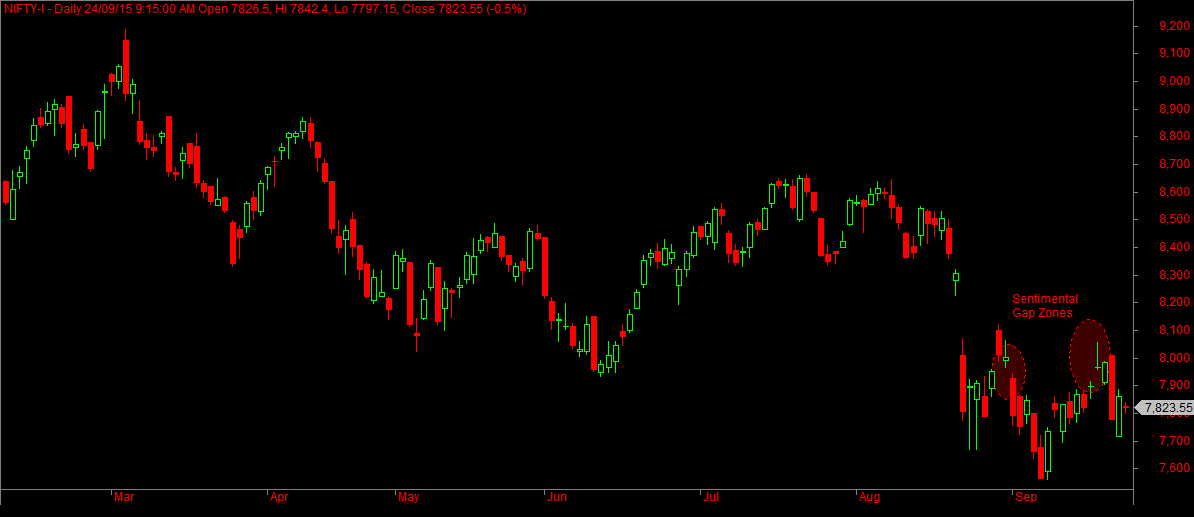

In this tutorial we will be focusing on the recent gaps in Nifty Futures and Bank Nifty Futures how those gaps got faded.

A Simple Gap trading rule is when markets are highly oversold and unidirectional (you can figure out from your Daily momentum indicators and oscillators with extreme readings) followed by gap up or down due to global sentiment on the same direction such gaps are expected to be faded faster. These gaps are called exhaustion gaps as they generally occur at the end of the trend and mainly driven by retail traders sentiment.

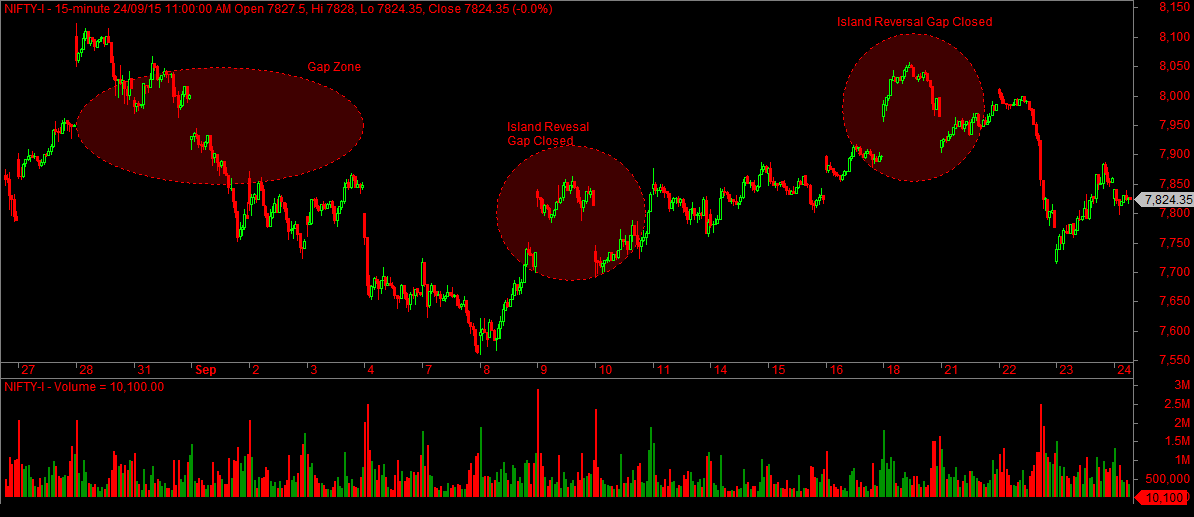

Last three gaps in nifty futures are tricky to play where to fade one gap it re-opens another gap and provides opportunity for traders to play towards the gap as target zone. Generally island reversal formation at the top is a negative sentiment as per classical technical analysis. However last two island reversal patterns in nifty futures are faded faster on the same day and fading all the gaps and thus weaker hands who are emotionally driven are tend to take wrong trading decisions and the global sentiment makes them to play towards the gap direction instead of against the gap followed by elimination game.

Multiple Gaps created in Nifty Futures in the zone 7853 and further created the island reversal pattern on lower timeframe charts and got faded on the same day (21st september) and some trading activity was done finally in the gap zone.

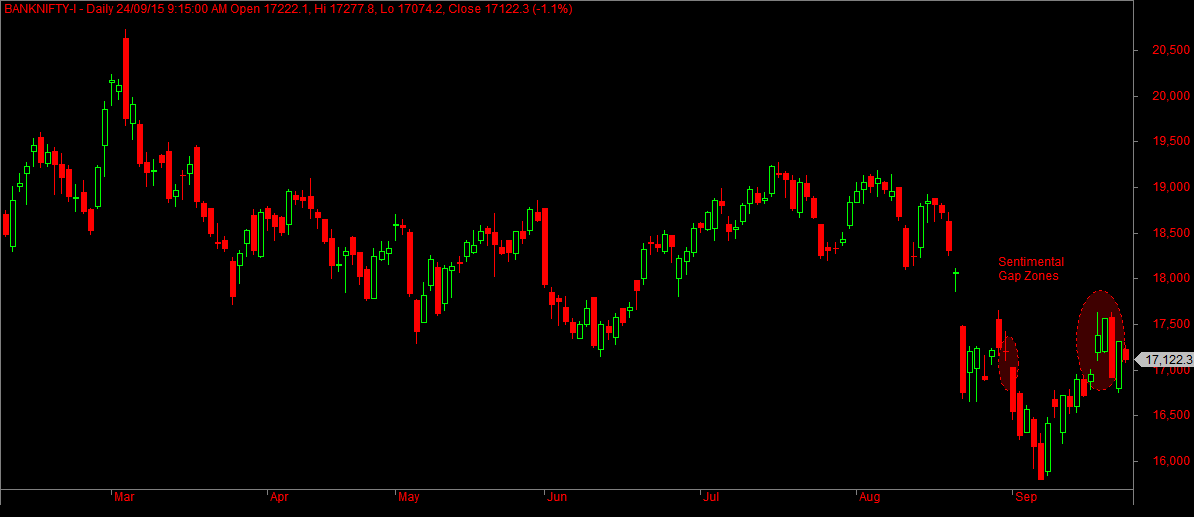

Bank Nifty Futures Daily Charts

After making a high of 17642 Banknifty futures gap down to close the gap at 17018 finally. I should say the fall attempt is just to close the gap.

Sentimental Gaps are easy to spot by understanding the sentiment in the market mostly driven by retail crowd and thus your trading opportunity.

In the next tutorial we will be focusing on the professional gaps.

[Gap tutorial continued….]

The post Trading the Gap Up and Gap Down – Part 2 appeared first on Marketcalls.