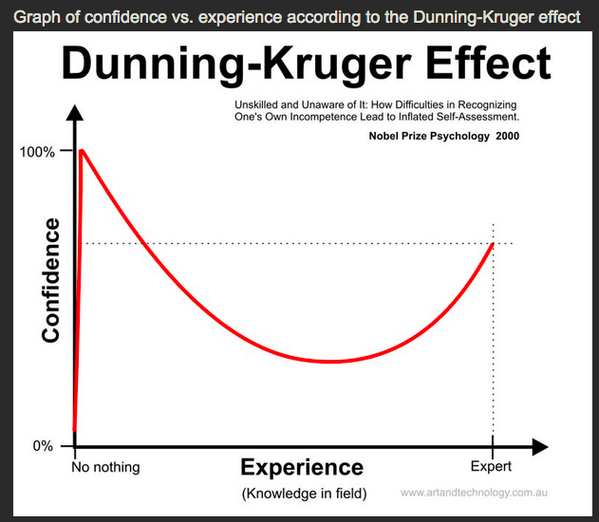

Few things that you come across randomly have the potential to kindle your thoughts from deep within. This happened to me recently as I landed up on the “The Dunning-Kruger Effect”. This curve holds good in most of the cases. For example, my three year old knows sun as a fire ball. She feels that she is an expert after seeing a few youtube videos and is extremely happy that she can identify The Sun and that the sun is a big ball of fire in the sky. Call it ignorance or innocence(cute in daughter’s case), very little knowledge and extreme confidence of knowing that!! While my 7th grade niece, studies science as a part of her curriculum and holds a lot of questions & feels fuzzy about the Sun. Hoping that she might learn about the Sun, she keeps reading a lot about the universe (though the matter is actually Sun) to understand the science behind the Sun. SO just as the learning has began to happen, confidence has started to decrease. Funny! Over a period of time with constant learning, it gets easier to understand the real Sun and the confidence of knowing something starts!! While me, an enthusiast(call it expert wrt to the image) in space have gone through a minimum of 50+ odd youtube videos and documentaries about the Sun,space and the universe. However my confidence of understanding the Sun is way lagging behind my daughter

This curve holds good in the trading/investing scenario too! The confidence level exhibited by the unskilled trader who is new to the market is enormous in most of the cases and after few trades they will start behaving like an expert. Most of the traders who are young to financial markets would have experienced such tremendous confidence in financial markets during their initial stage of trading/investing.

So where does the tremendous confidence comes for the unskilled trader/investor? What makes a new trader feel superior and over estimate his confidence level in trading/investing decisions?

-Possibly a MBA Graduate or a Businessmen who is new to trading could think that he is good in his business logic and trading/investing is all about understanding business logic, following the news and the fundamental to the close so its easy for him to win in this market than anyone else in the planet.

-An Engineer or a maths teacher could think that trading is all about statistics and number game and with his math skills it is going to be easier for him to crack financial markets.

-My Friend is making money in the market. I am much more intelligent that him and why not me?

-Making money in financial market is easy because it is all about timing the market to buy low and sell high.

-If you are a newbie trader you may feel superior when you learn new stuff like fundamental analysis, candlesticks patterns, trendlines, fibonacci, RSI, MACD, EMA…etc and you come to a conclusion that most of the people are unware about such tools in the market and that is going to give real edge in the market.

-probably you would have started reading books about the financial guru’s and their success stories and love to follow their methodologies with extreme confidence without even validating it.

– the search for the holy grail is on and probably scratching the head most of the times in figuring out multibagger stocks or predicting the market with little earned knowledge.

Graduation to Experienced Trader

Not many make up from beginner level to experience trader/investor due to lack of constant self education about financial markets. Repeated mistakes and understanding about the reality of market returns make his confidence level lower than ever but still his knowledge about the market increases constantly with respect to time.

An Experienced trader could think that strategic approach with right money management is the right way to make descent returns in the market and tries to learn and play with the dynamic nature of the markets rather than thinking uni-directional strategies. His trading skills are better and improved than ever but still he is not completely aware about the unseen risk and not mentally prepared for any worst case drawdown in his portfolio.

The Expert Trader

The confidence level is still lower than the unskilled trader but the amount of knowledge about the markets, volatility, market participants, money management, dynamic position sizing are abundant and has full control over his trades most of the times. Well aware about constantly changing markets and their competitors. But one not changed right from the beginning – his constant learning!

If you are a newbie trader make sure you take more knowledge from the market constantly and be a humble student of the market forever and trade with moderate amount of risk during initial phases. Go and figure out how to control your risk rather than how to bring money to your table.

Related Readings and Observations

The post The Dunning-Kruger Effect : What Differentiates Novice and Expert Traders? appeared first on Marketcalls.