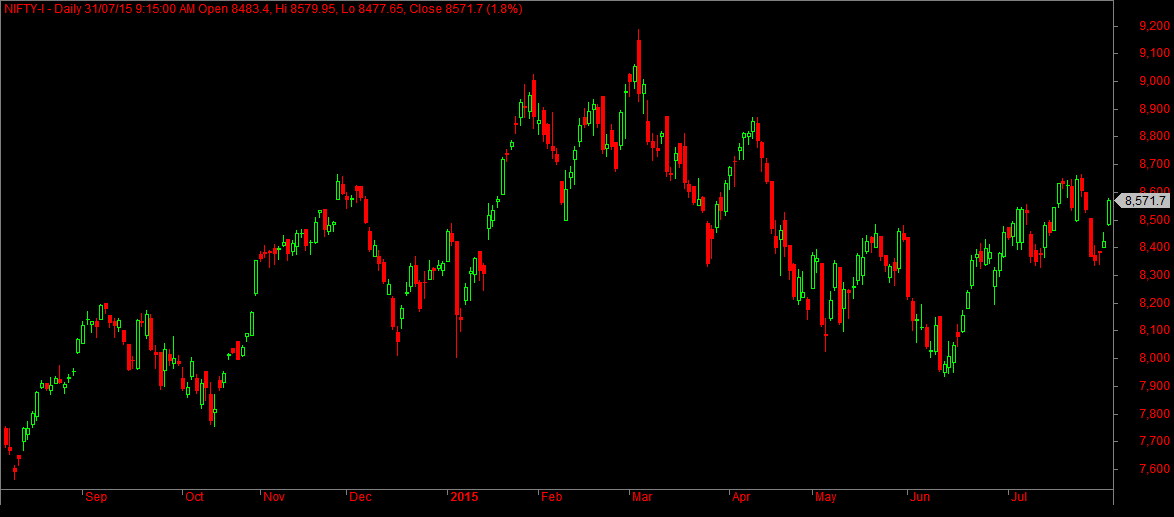

Daily Sentiment is Positive in Nifty futures and in Bank Nifty futures. However RBI policy announcement on 4th Aug will dictate the trend. Any Interest rate cut might induce negative sentiment in the markets. Net FII (FPI) investment in Equity market stood at 5,319 crore in July. It should be noted that FPI are net sellers and pulled 9112 crores from equity market during the month of May and June 2015. The Recent high in Nifty Futures (8664.75) and Bank Nifty Futures (19280) will be the near term resistance zone.

Bank Nifty Futures – Daily Charts

Nifty Futures – Weekly Charts

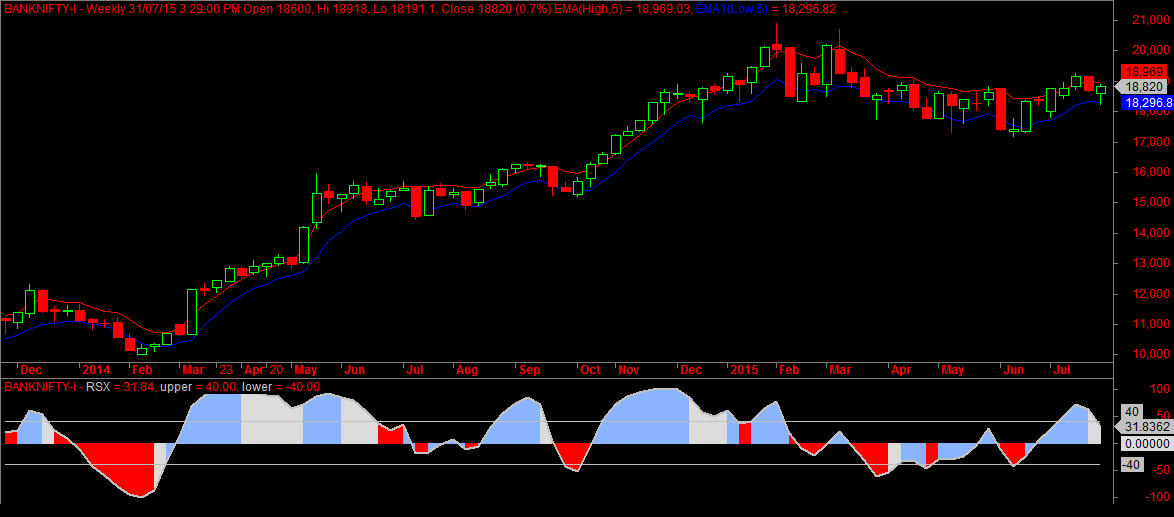

Nifty Futures and Bank Nifty futures on the weekly charts trading below the 5EMA(high) and RSX turning down from the top suggests a possible sideways to downtrend movement on the weekly charts with the 5EMA(low) support zone 8336 and 18296.

Bank Nifty Futures – Weekly Charts

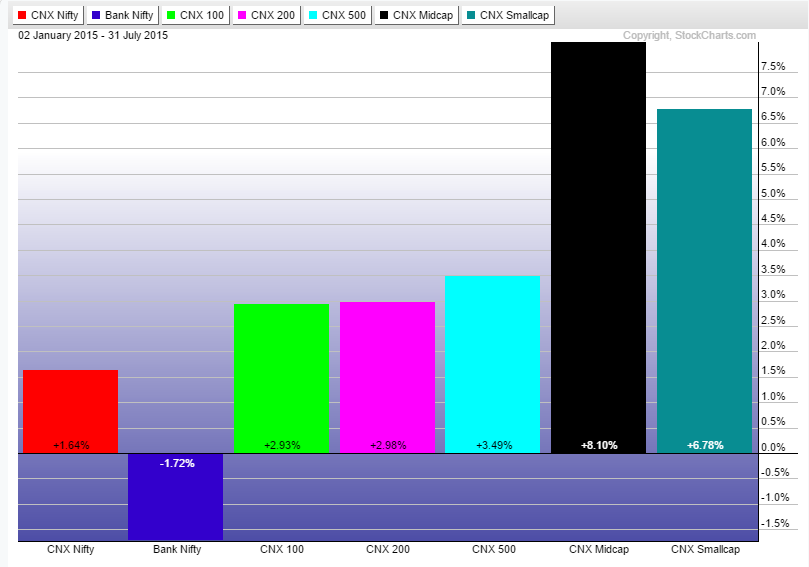

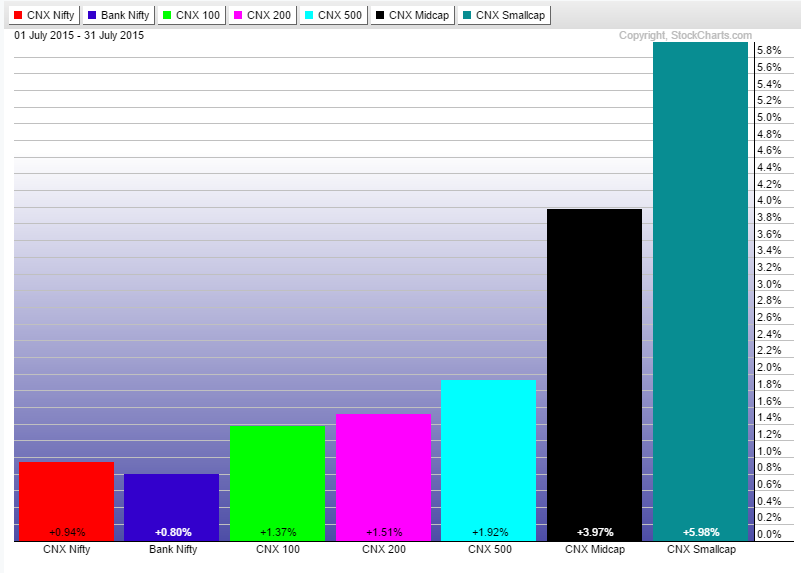

Index Performance – YTD

CNX Midcap and CNX Smallcap indices are the real outperformers during the month of july gained 4% and 6% respectively. Bank Nifty is the real laggard with YTD negative returns of -1.6% underperforming the benchmark index Nifty. Clearly Mid Caps are the top gainer with 8.1% returns Year to Date.

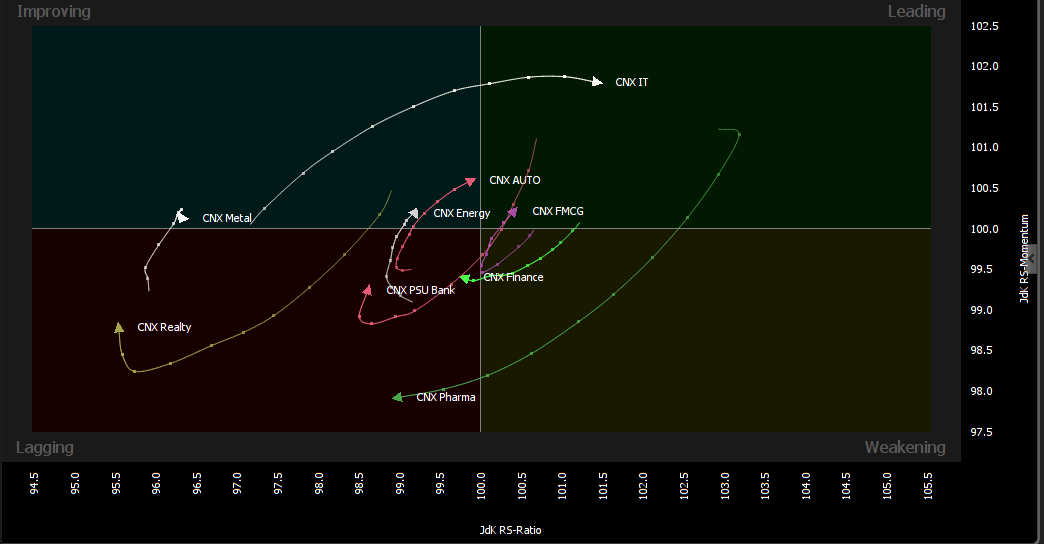

Indian Sectors – RRG Graph

RRG Study shows that the pharma and finance sectors could under perform nifty for sometime in the short run as it enters the lagging quadrant. CNX Realty , CNX PSU though in the laggard quadrant looks for a rebound as JDK-RS momentum keeps increasing. CNX-IT, CNX Auto, CNX Energy, CNX FMCG sectors could be the possible outperformers in the short term.

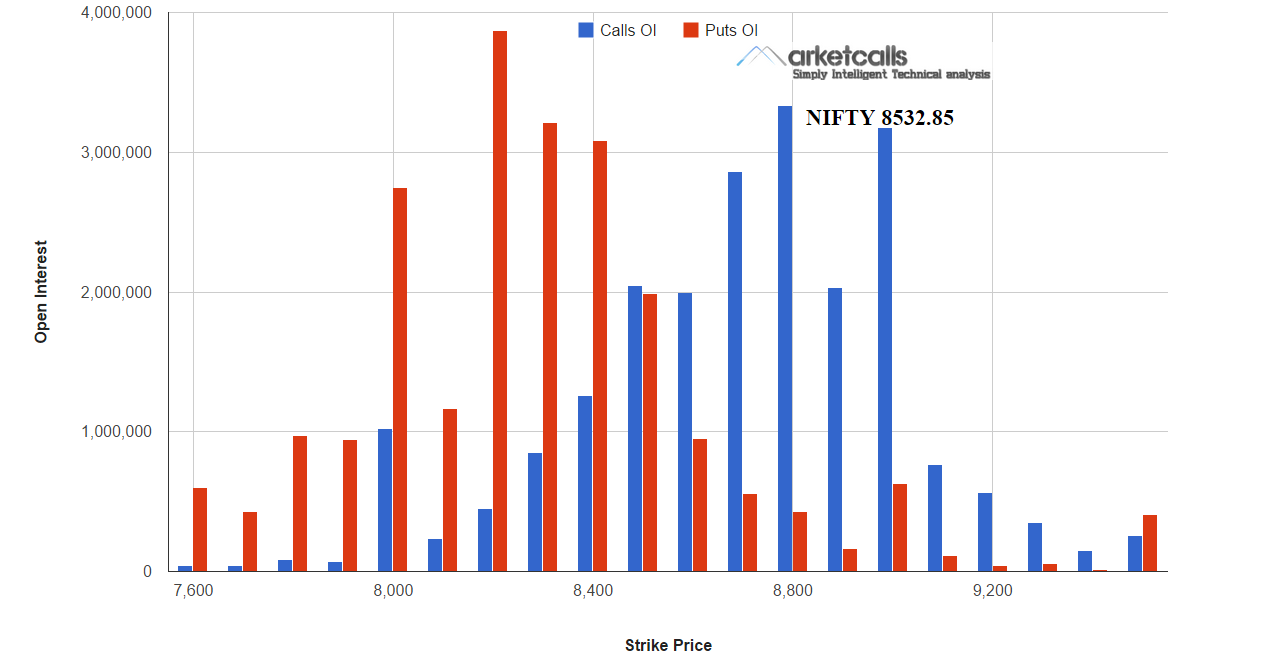

Nifty Open Interest Lookup

We are in the very early stage of the New expiry season so open interest from options doesnt gives much clues about current expiry. As of now 8200PE and 8800CE holds higher open interest but less than 40 lakh contracts shows a very weak confidence so far in writing option contracts. Such confidence occurs during start of new expiry season typically in range bound markets. One can expect Nifty spot to trade in broader range between 8300-8600

Related Readings and Observations

The post Nifty and Bank Nifty August 2015 Overview appeared first on Marketcalls.