Image may be NSFW.

Clik here to view. Whether you’re an Investor or a speculator Knowledge,Experience and discipline are the keys for successful market profits.Every serious market player travelling along the path understands the value of knowledge,Some serious knowledge about markets accomplished by reading books-articles or by gaining experience along the way of ups and downs. Unfortunately, not all of us will be a profitable market player,Some usually give up after continuous obstacles while others hold goals till they are achieved.Majority of the traders took my training program have two things in common,They lack the knowledge that is essential for success and their mind filled with useless information loads obtained through various means. Players from institutional background look the market totally in a different way than average retail player. Some of the conventional quotes like “never pick tops and bottoms”,”Investment is different from speculation” etc are nothing but just a belief or assumption propagated through people’s own experience and subjectivity so from that point it is unjustifiable because everyone will be a personality type, Some may do well by picking tops and bottoms than trading trends.Some People like me never felt any difference between speculation and Investment.In one way or around,we are all betting on the odds, it doesn’t make sense to hold the investment during market crashes or panic since you’re an investor!.

Whether you’re an Investor or a speculator Knowledge,Experience and discipline are the keys for successful market profits.Every serious market player travelling along the path understands the value of knowledge,Some serious knowledge about markets accomplished by reading books-articles or by gaining experience along the way of ups and downs. Unfortunately, not all of us will be a profitable market player,Some usually give up after continuous obstacles while others hold goals till they are achieved.Majority of the traders took my training program have two things in common,They lack the knowledge that is essential for success and their mind filled with useless information loads obtained through various means. Players from institutional background look the market totally in a different way than average retail player. Some of the conventional quotes like “never pick tops and bottoms”,”Investment is different from speculation” etc are nothing but just a belief or assumption propagated through people’s own experience and subjectivity so from that point it is unjustifiable because everyone will be a personality type, Some may do well by picking tops and bottoms than trading trends.Some People like me never felt any difference between speculation and Investment.In one way or around,we are all betting on the odds, it doesn’t make sense to hold the investment during market crashes or panic since you’re an investor!.

An average retail trader/Investor is completely bombarded with dozens of books released everyday like “how to trade”, “How to Invest”etc confusing enough to choose the right material, One often end up with looking for reviews and by the most popular one’s like best sellers, Highly recommended,5 star rating etc., If you are choosing the book based on the above method then seriously making a mistake! Yes, books become bestsellers or highly recommended not because of its original content or value, but due to marketing, paying more sums for reputation management.

Leaving all this controversies aside, I have listed top 5 books which I felt essential for every market players. Before I get into the list, Here’s a warning those looking for books like how to trade, how to invest etc. You will find none of them in my list! and some of the books I listed might be unpopular!

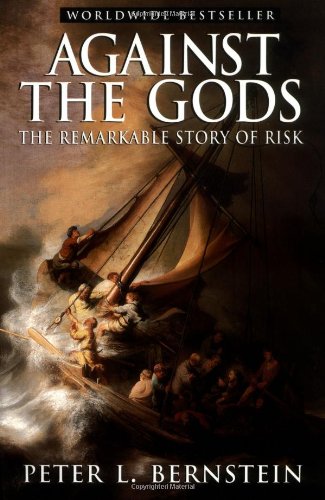

5.Against the Gods: The Remarkable story of Risk by Peter.L.Bernstein

Image may be NSFW.

Clik here to view.

It’s an outstanding book,takes towards ancient times and finally leads all the way to the present financial markets Deals with chance,Uncertainty and Human Irrationality

4.Trader Vic: Methods of a Wall Street Master by Victor sperandeo

Image may be NSFW.

Clik here to view.

This book explains the methods and techniques of a most famous trader Victor Sperandeo- A 2008 inductee into trader’s Hall of fame

3.Irrational Exuberance by Robert J shiller

Image may be NSFW.

Clik here to view.

Written by nobel prize-winning economist, Robert shiller takes a detailed view,analysis and explanation of Irrational human behaviour,its impact on financial markets

2.Dao of Capital:Austrian Investing in a distorted world by Mark Spitznagel

Image may be NSFW.

Clik here to view.

One of very few investors who made fortunes during the sub-prime crises, Mark spitznagel explains his method in this book known as “Austrian investing” also called as “roundabouts” derived from Austrian school of economics

1.Fooled by Randomness by Nassim Taleb

Image may be NSFW.

Clik here to view.

Radical philosopher and Former Hedge fund manager,Nassim Taleb is one of my favourite authors. Known for bringing the light from dark literature. This book will turnaround your overall thinking about financial markets.

Note:We teach Highly Profitable Price action and Institutional strategies in our premium course. If you are interested in learning these techniques please Kindly contact on arulbalaji184@yahoo.com

Related Readings and Observations

The post Top 5 Must Read Books For Every Market player appeared first on Marketcalls.

Image may be NSFW.Clik here to view.