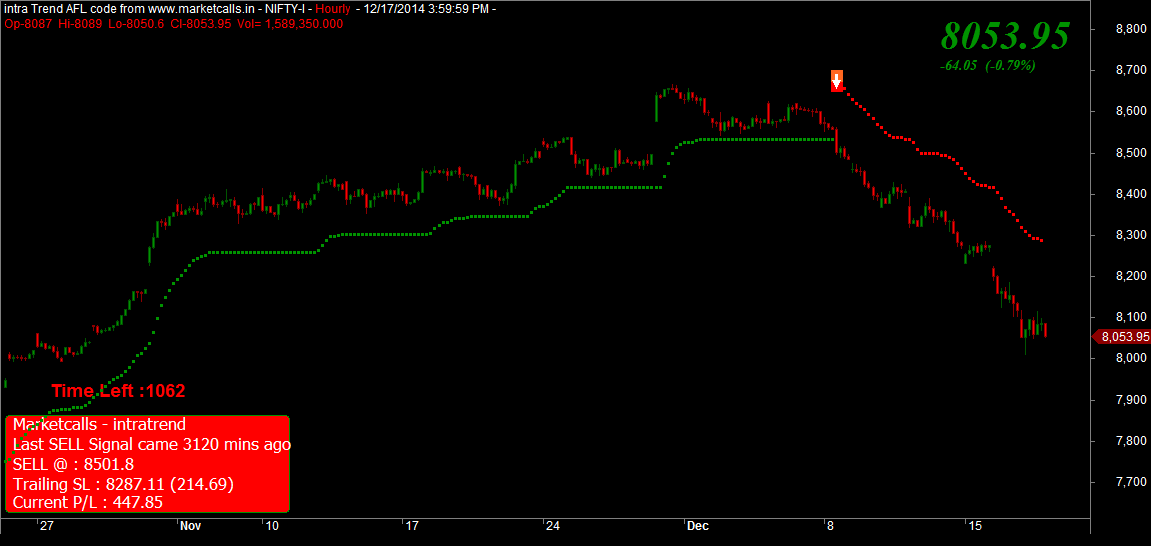

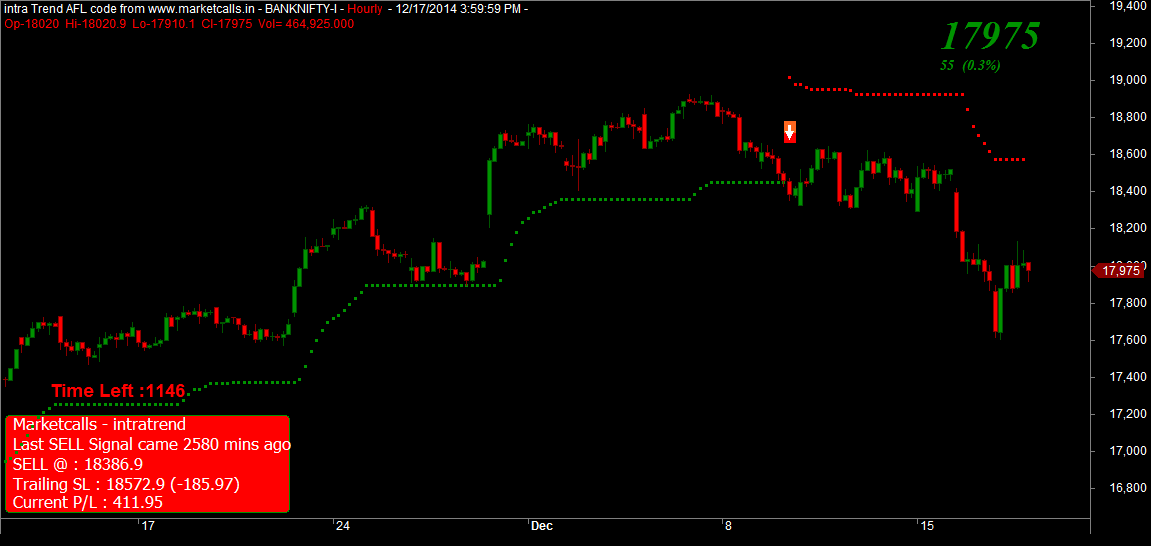

Nifty futures and Bank Nifty futures taken a steep fall from the peak and so far nifty is leading the fall compared to Bank Nifty futures. Current resistance zone on the hourly charts comes around 8287 and 18572. Closing above the resistance levels might turn the trend towards the upper side.

Bank Nifty Futures Hourly Charts

Nifty Spot Daily Charts

1 Year Returns of Nifty Spot at 30% despite a sharp December sell off. Overall 2014 is likely to end as a good year for the investors.

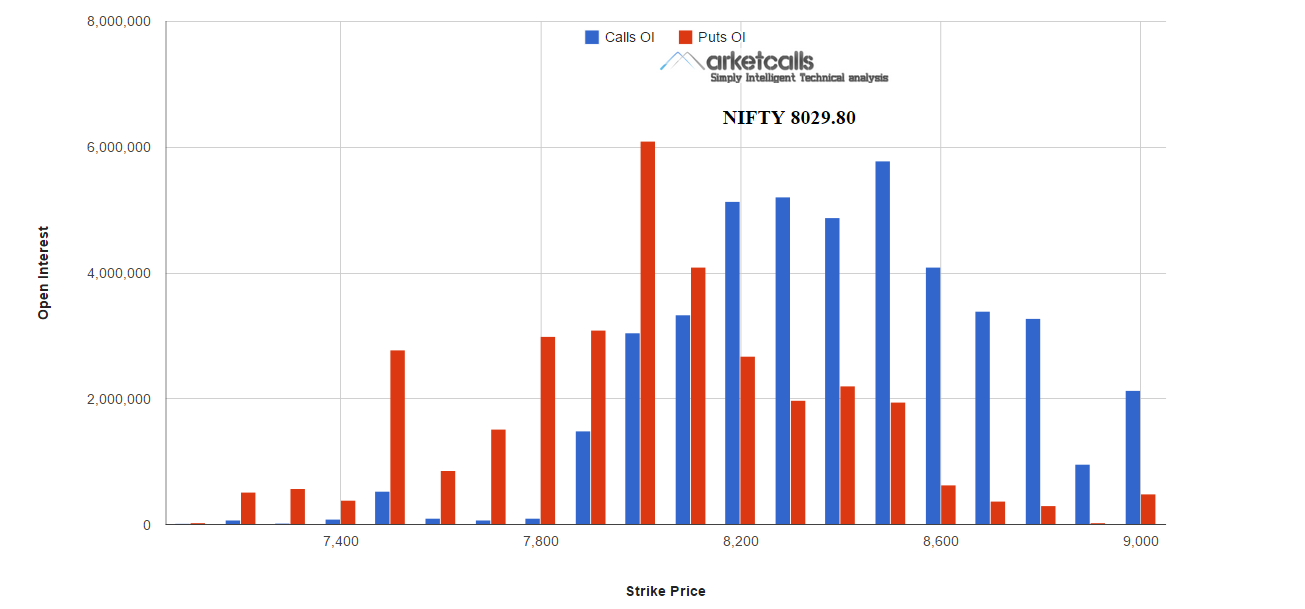

Nifty Options Open Interest

Currently 8000PE holds the higher open interest and option writers are expecting nifty to close above 8000 for the december month expiry. And still 5 more days are left for the expiry.

Key News Factors

The government has raised import tariff value on gold to $396 per 10 grams and on silver to $561 per kg in line with volatile global price trends.

The cabinet today approved the Constitution Amendment Bill on Goods and Services Tax (GST).

India VIX jumped 3.79% to 16.92. Markets Shows increase in Volatility.

Russian Rouble turmoil leads to Apple halting online sales in Russia.

USDINR Closed at 63.38.

Crude OIL Rallies 4% and Dow Jones Rallies 146 points ahead of FED announcement.

1 Rupee = 1 Russian Rouble

Related Readings and Observations

The post Nifty and Bank Nifty Futures – Mid December Overview appeared first on Marketcalls.