Market Sentiments

The short term Market Sentiment(Index Futures) is ultra bullish and retail players are quite aggressive in nature in playing the index longs. Bank Nifty shows extreme sentiment and possibly could signal a short term top. And the overall volatility in the market is down and remains below sub 14 levels indicates naked players are in neutral state not much aggressive on naked longs/shorts. Banking stocks/index might show increased volatility as upcoming economic event RBI’s monetary policy review on December 2.

Nifty Futures Hourly Charts

Nifty and Bank Nifty futures both ends the week with a gains of 0.9% and 2.4% respectively. And Bank Nifty futures shown 7 weeks of continuous positive gains.

Nifty and Bank Nifty futures both maintain the prolong positional buy mode(more than a month in case of Bank Nifty) with the support zone comes around 8344 and 17719 respectively. Reverse your positions to Positional sell mode if the support zone breaks on the hourly charts.

Bank Nifty Futures Hourly Charts

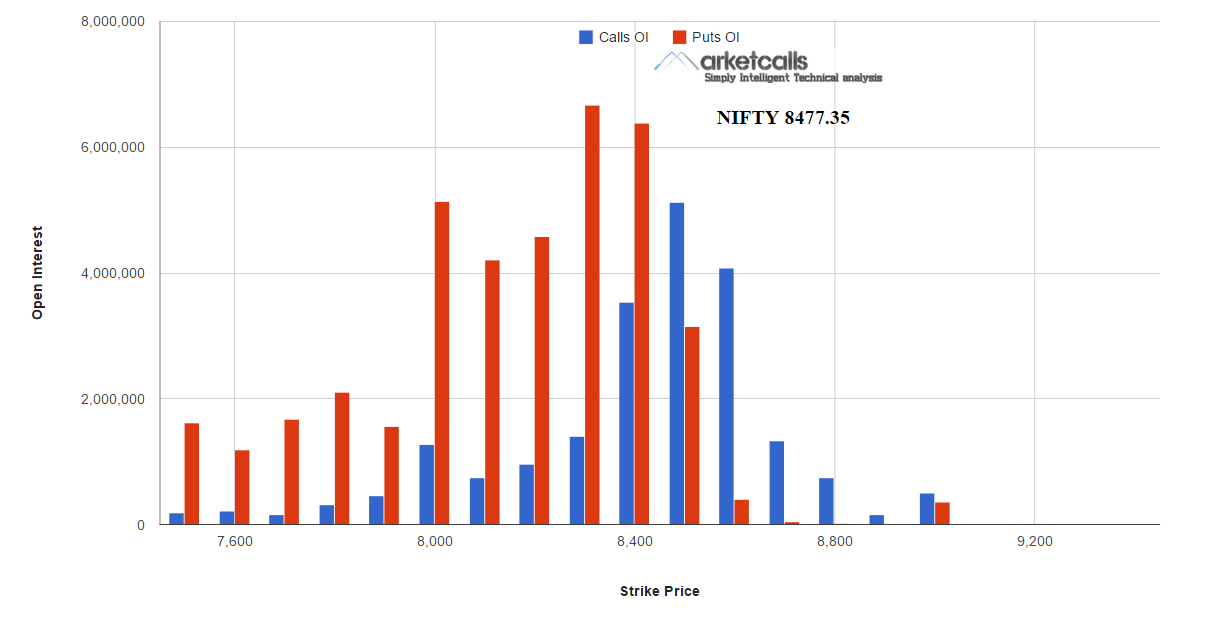

Nifty Open Interest

The Open Interest paints a bullish picture as both 8300PE and 8400PE writers remain strong so far. And 8400 could be the support zone for current month expiry.

Related Readings and Observations

The post Is Bank Nifty Signalling a Short Term Top? appeared first on Marketcalls.