This week both Nifty futures and Bank Nifty futures ends on the positive note with a weekly gains of 36.55 points(0.43%) and 141.3 points (0.8%) respectively. The cheer the retail positive sentiments turned up. Economic Factors like Retail inflation down from 6.5% to 5.5%, Industrial production up from 0.4% to 2.5%

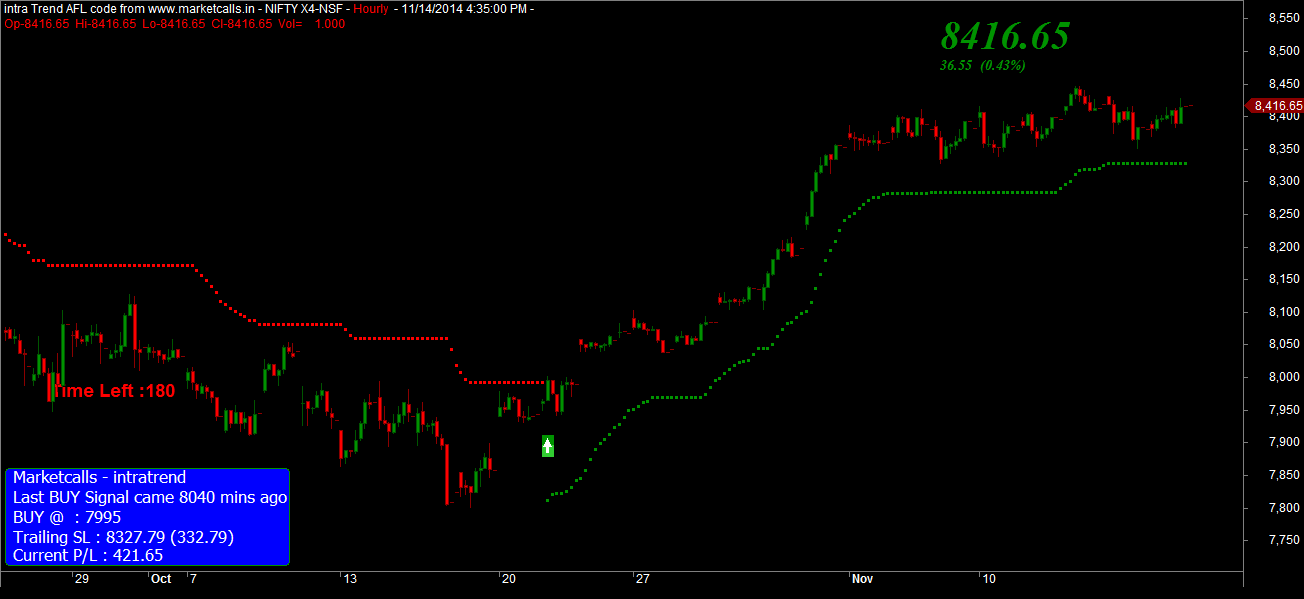

Nifty Hourly Charts

Nifty and Bank Nifty futures on the hourly charts maintains the positional buy mode with the supports coming around 8327 and 17335 respectively. Reverse the strategy to positional sell mode if the support zone breaks on the hourly closing basis.

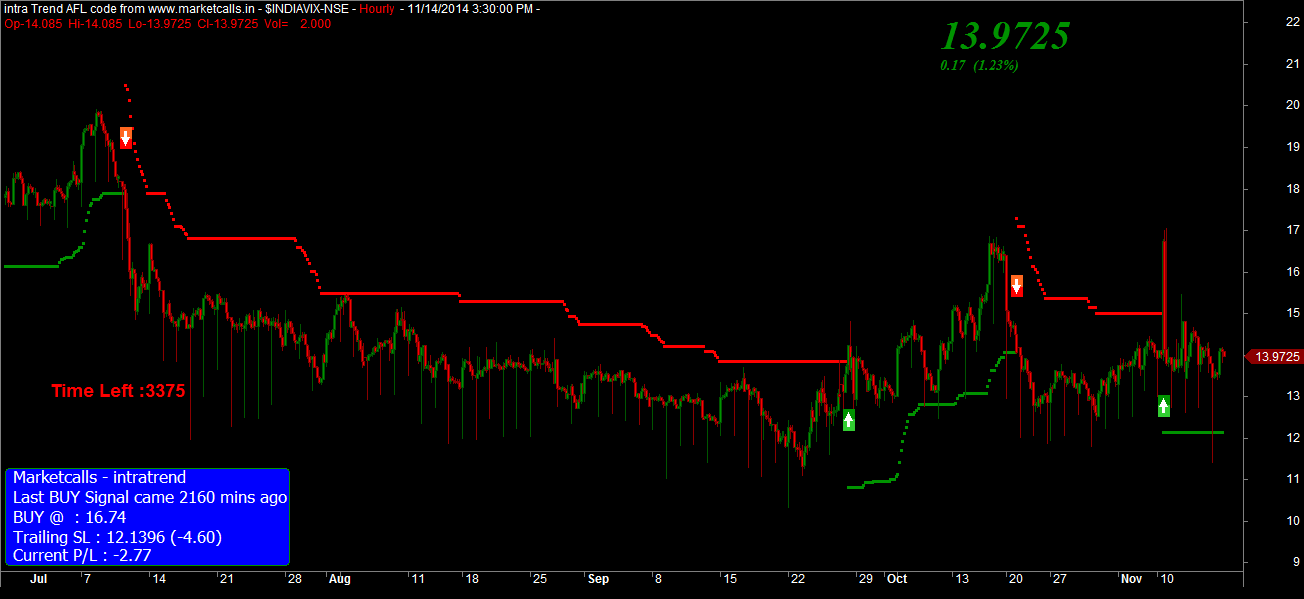

India VIX Hourly Charts

India VIX turned to positional buy mode and we can expect a little bit of volatility in the market with a bullish sentiment and India VIX supports comes around 12.13 levels. Market might enter into the limbo mode if it breaks the support zone which generally hurts the naked option players.

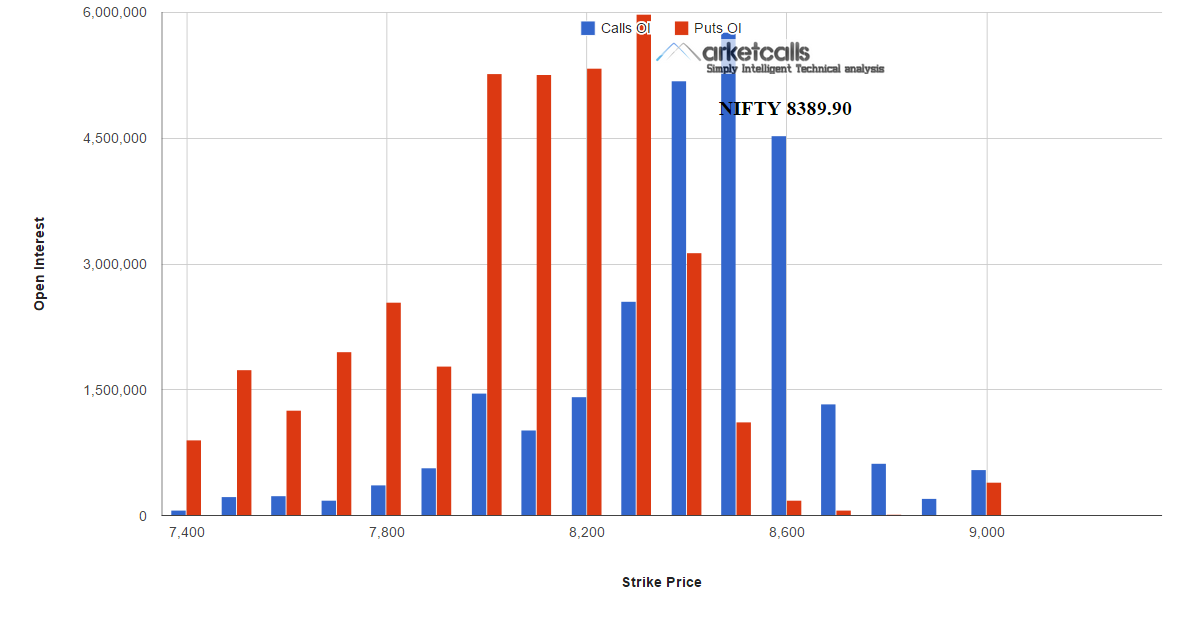

Nifty Options Open Interest

Currently after multiple flip flops in the higher open interest built up 8300PE is been in written heavily as the market sentiment oscillates in a sinusoidal fashion so far this month. Currently Option Players believe that 8300PE is the support zone for current month expiry.

Related Readings and Observations

The post Will 8300 Act as Support for Nifty this Expiry? appeared first on Marketcalls.