USDINR spot on last friday closed at 61.37 which is a two week low. The currency depreciated on the back of the US Federal Reserve meeting on Wednesday winded up its QE tapering program and Yen fell to a seven-year low against the dollar on Friday as the Bank of Japan surprised financial markets by significantly expanding its massive stimulus programme which is followed by global rally in the equity market. Almost all the MCX currencies (USDINR, EURINR, GBPINR, JPYINR) November month futures maintains a positional sell mode and we can expect rupee strengthening across all the major currencies trading in MCX-SX Exchange.

USDINR Hourly ChartsUSDINR Hourly Charts

Positional resistance zone for USDINR comes around 61.90

Positional resistance zone for EURINR comes around 78.03

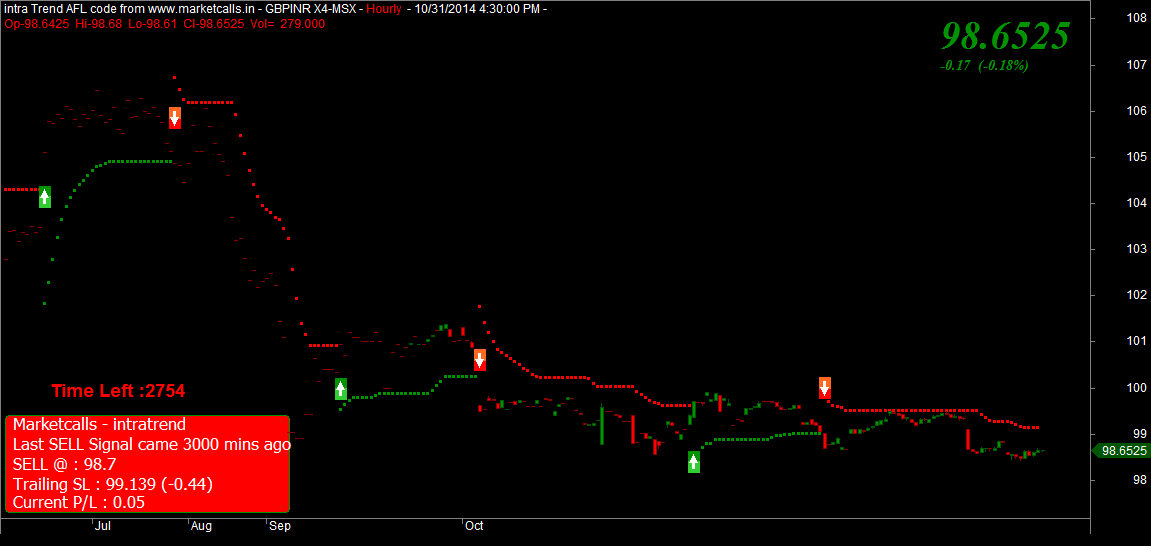

Positional resistance zone for GBPINR comes around 99.13

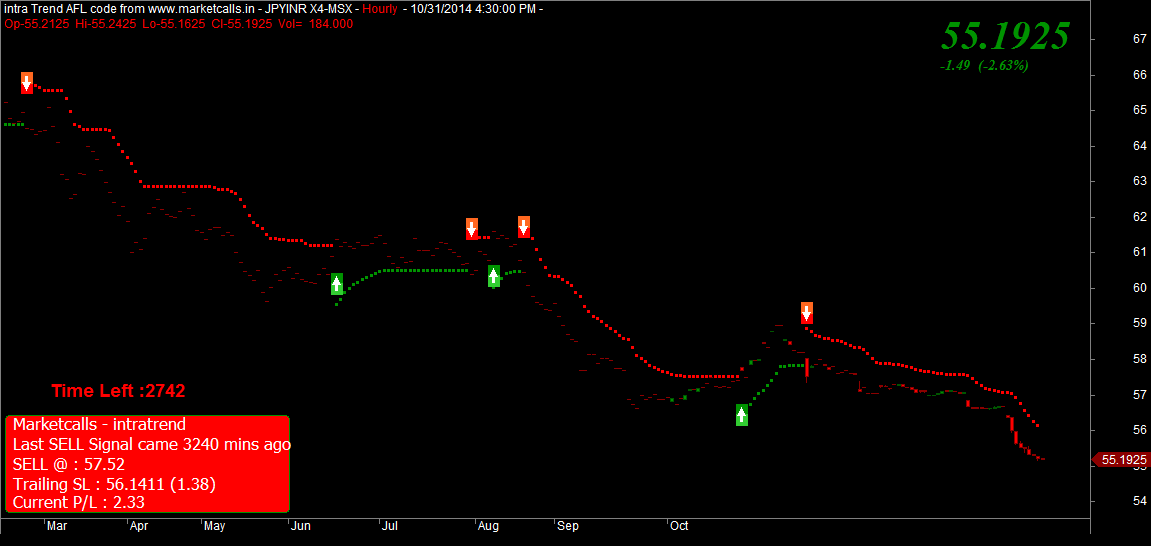

Positional resistance zone for JPYINR comes around 56.14

Strategy will turn to positional long mode if the resistance zone breaks above on the hourly charts.

EURINR Hourly ChartsUSDINR Hourly Charts

Related Readings and Observations

The post MCX Currency Novemeber Futures Trend Overview appeared first on Marketcalls.