The steep fall in Nifty and Bank Nifty futures got arrested after S&P revises India’s sovereign credit outlook from ‘negative’ to ‘stable’. The global rating agency added that India could possibly see upward revision of its ratings from BBB-/A-3, provided it reverts to real per capita GDP growth of 5.5%, and its fiscal, external, and inflation metrics improve. However FIIs have sold equities worth more than Rs 3,150 crore in the last four consecutive trading sessions.

The Reserve Bank of India’s (RBI) monetary policy review on 30th September would be the key trigger for market movement. Indian Stock Exchanges will remain closed on Thursday and Friday for Mahatma Gandhi Jayanthi and Dussehra respectively.

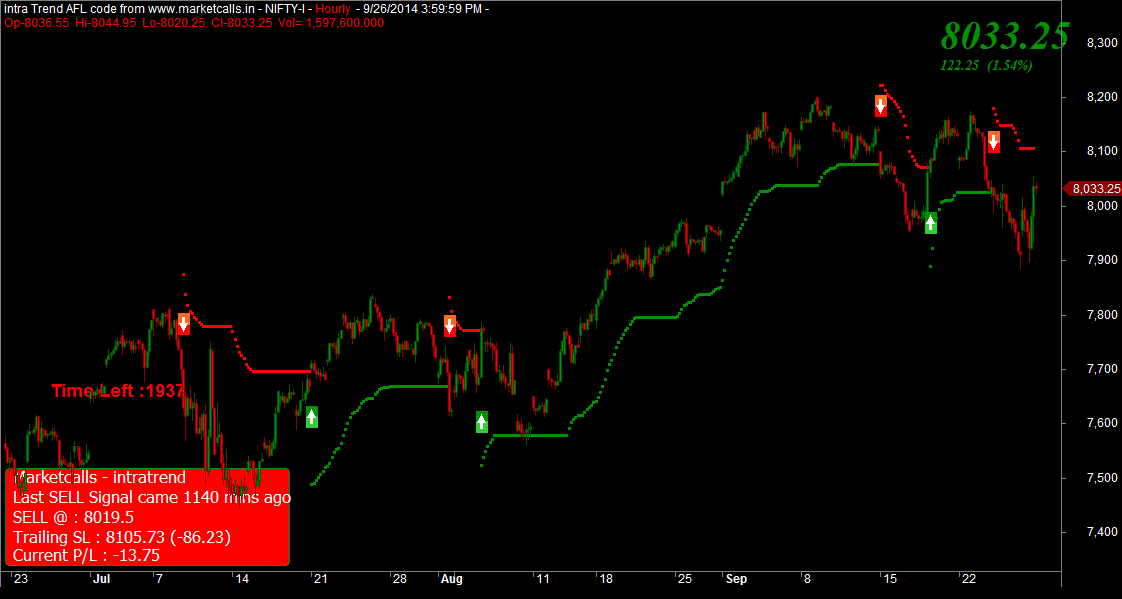

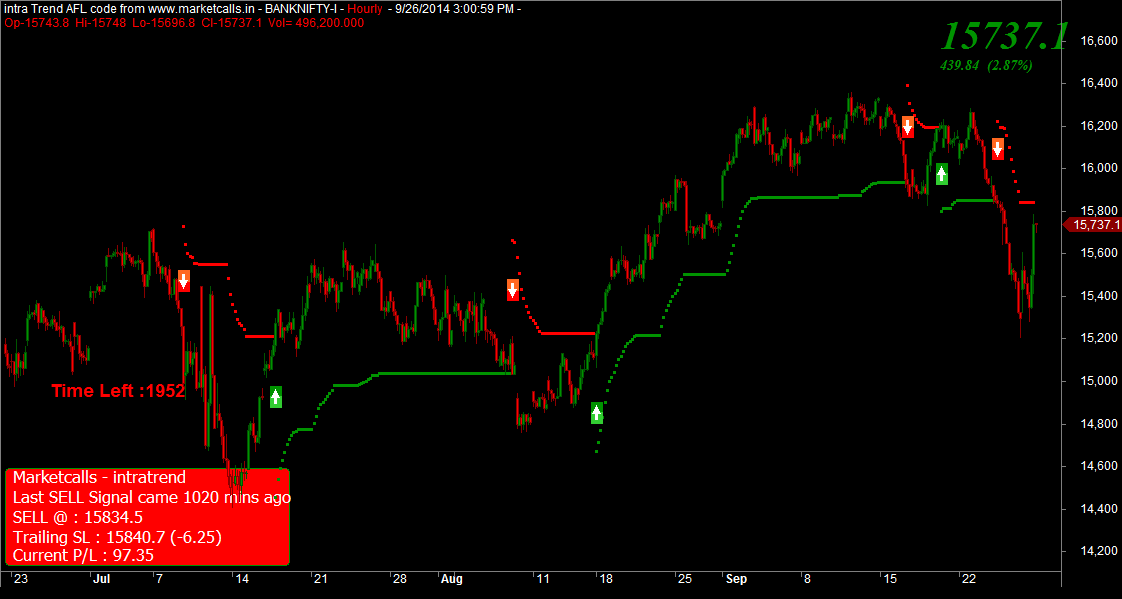

Nifty and Bank Nifty futures turned to positional sell mode on 23rd of September and currently the resistance zone comes around 8105.73 and 15840 respectively reverse your position to positional buy mode if the resistance zone breaks on the hourly charts.

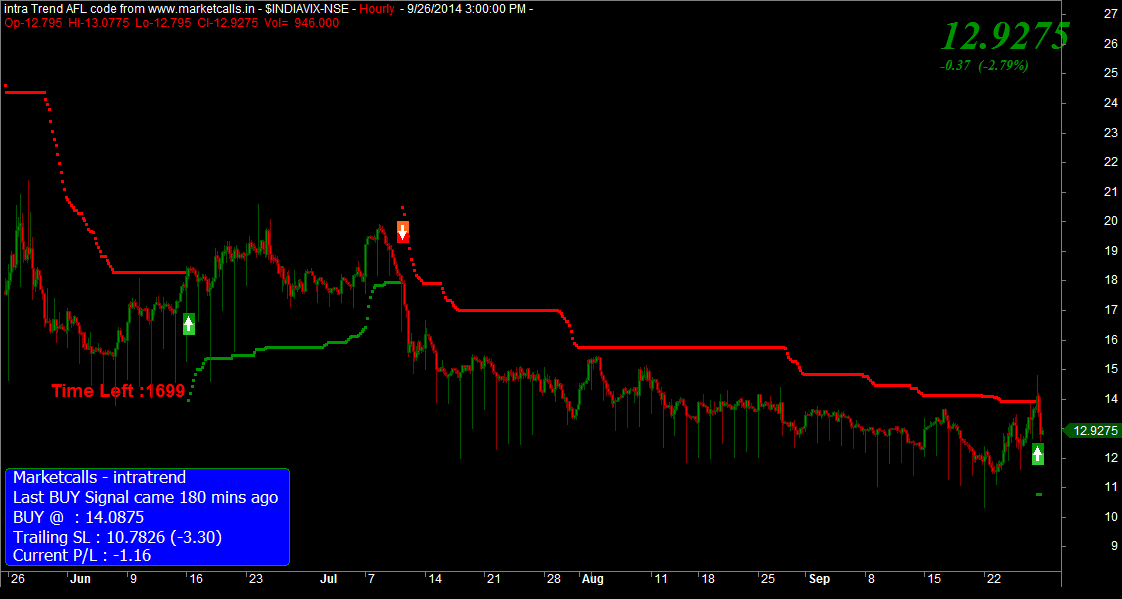

India VIX Hourly Charts

After a prolong sell mode in India VIX finally there is some volatility on cards and turned to positional buy mode and currently the support zone for India VIX comes around 10.78 and we can expect a little descent increase in volatility in the upcoming sessions.

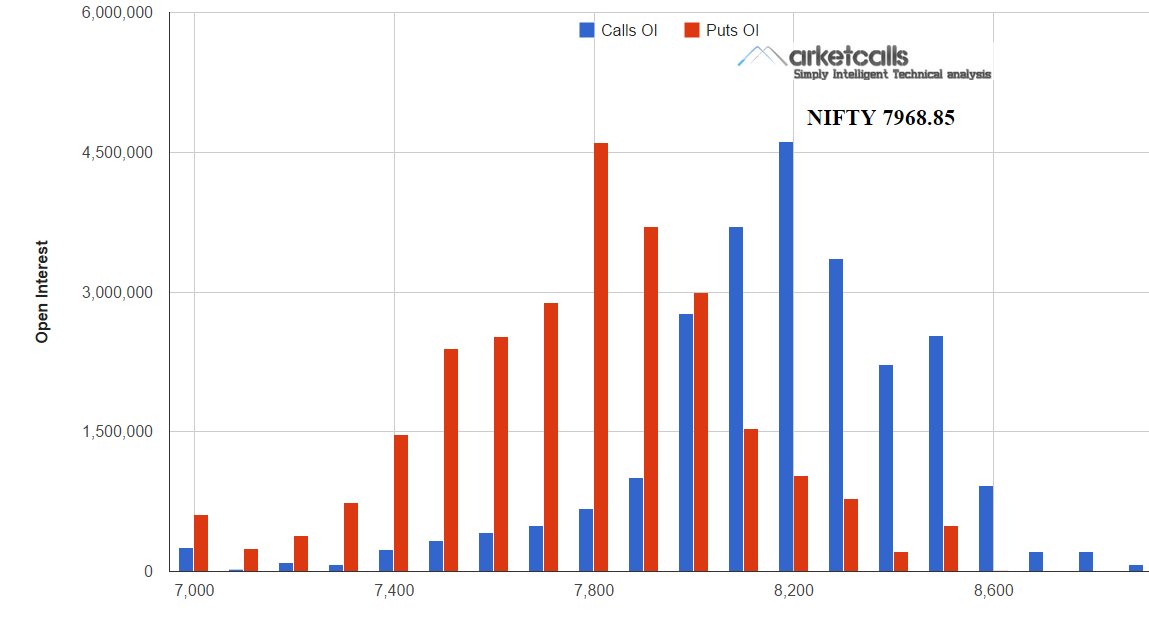

Nifty Open Interest Build Up

The Higher open interest build up is seen in 7800PE and 8200CE and the expected market range as of now is between 7800-8200 for this expiry however as the october expiry is very young it is good to observe the development of open interest positions to get further cues from it.

Upcoming Economic Events

Related Readings and Observations

The post Nifty and Bank Nifty Futures October Overview appeared first on Marketcalls.