Nifty Daily Charts with Smoothed RSI crossover Signals

Here is the simple smoothed RSI crossover Long only strategy can be practiced on higher timeframes especially with daily timeframe with controlled risk. It catches the big trends and gets little losses during sideways movement with a descent amount of winning ratio. Strategy suits for Nifty and Bank Nifty future traders willing to take positional trades based on EOD chart.

Buy or Sell Rules

1)Buy on Positive Smoothed RSI crossover.(indicated by Green Arrow)

2)Exit on Negative Smoothed RSI crossover.(indicated by Red Arrow)

It is recommended to take Buy or Long Exit decision should be taken close to EOD (between 3:20p.m-3.30p.m). To take decision on the next day after the signal settradedelays(1,1,1,1) should be defined in the afl code.

Recommended Timeframe

Daily – Long and Exit Strategy

StopLoss

Preferred static Stoploss(intraday Exit Stop) is 2.5*ATR of the close price.

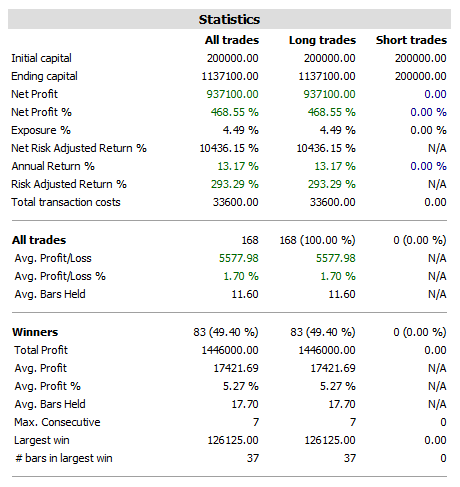

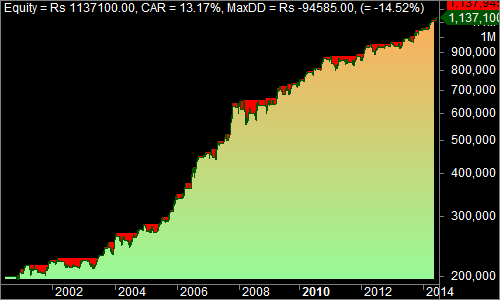

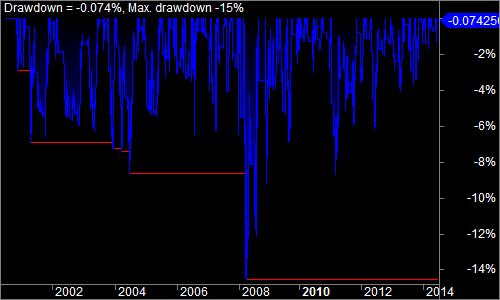

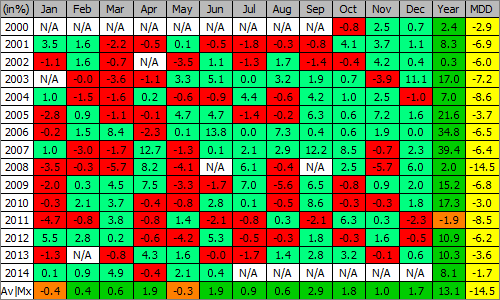

Backtested Results (Nifty Futures EOD-timeframe)

Backtesting done for the 14years of nifty futures with Initial Capital of Rs2,00,000 , 2 lots of fixed nifty lot size with Rs100/leg brokerage included.

Download Smoothed RSI Strategy- Backtested Results

Smoothed RSI Crossover Strategy – Amibroker AFL code

Related Readings and Observations

The post Simple Smoothed RSI Crossover Strategy appeared first on Marketcalls.