Here is a Easy Language based simple Volatility based intraday scalping strategy testing in 1-min bars of ES mini futures(US Markets) with 76% winning ratio. Easy Language supports both Tradestation and Multicharts Software.

Easylanguage code for ES scalping strategy

About the Creator of the Indicator

Dr Jonathan Kinlay is the Head of Quantitative Trading at Systematic Strategies, LLC, a systematic hedge fund that deploys high frequency trading strategies using news-based algorithms.

The creator splits the volatility into upside volatility and downside volatility using True Range.

Long Volatility: Profit Target = 8 ticks, Stop Loss = 2 ticks

Short Volatility: Profit Target = 2 ticks, Stop Loss = 30 ticks

Buy/Sell Rules

LONG VOLATILITY

If upsideVolatilityForecast > upperVolThrehold, buy at the market with wide PT and tight ST (long market, long volatility)

If downsideVolatilityForecast > upperVolThrehold, sell at the market with wide PT and tight ST (short market, long volatility)

SHORT VOLATILITY

If upsideVolatilityForecast < lowerVolThrehold, sell at the Ask on a limit with tight PT and wide ST (short market, short volatility)

If downsideVolatilityForecast < lowerVolThrehold, buy at the Bid on a limit with tight PT and wide ST (long market, short volatility)

PT Represents Profit Taget and SL Represent Stop Target.

Iam not gonna say more about this strategy as his site explains How to create a Scalping Strategy based on Volatility a lot more than what i could brief here.

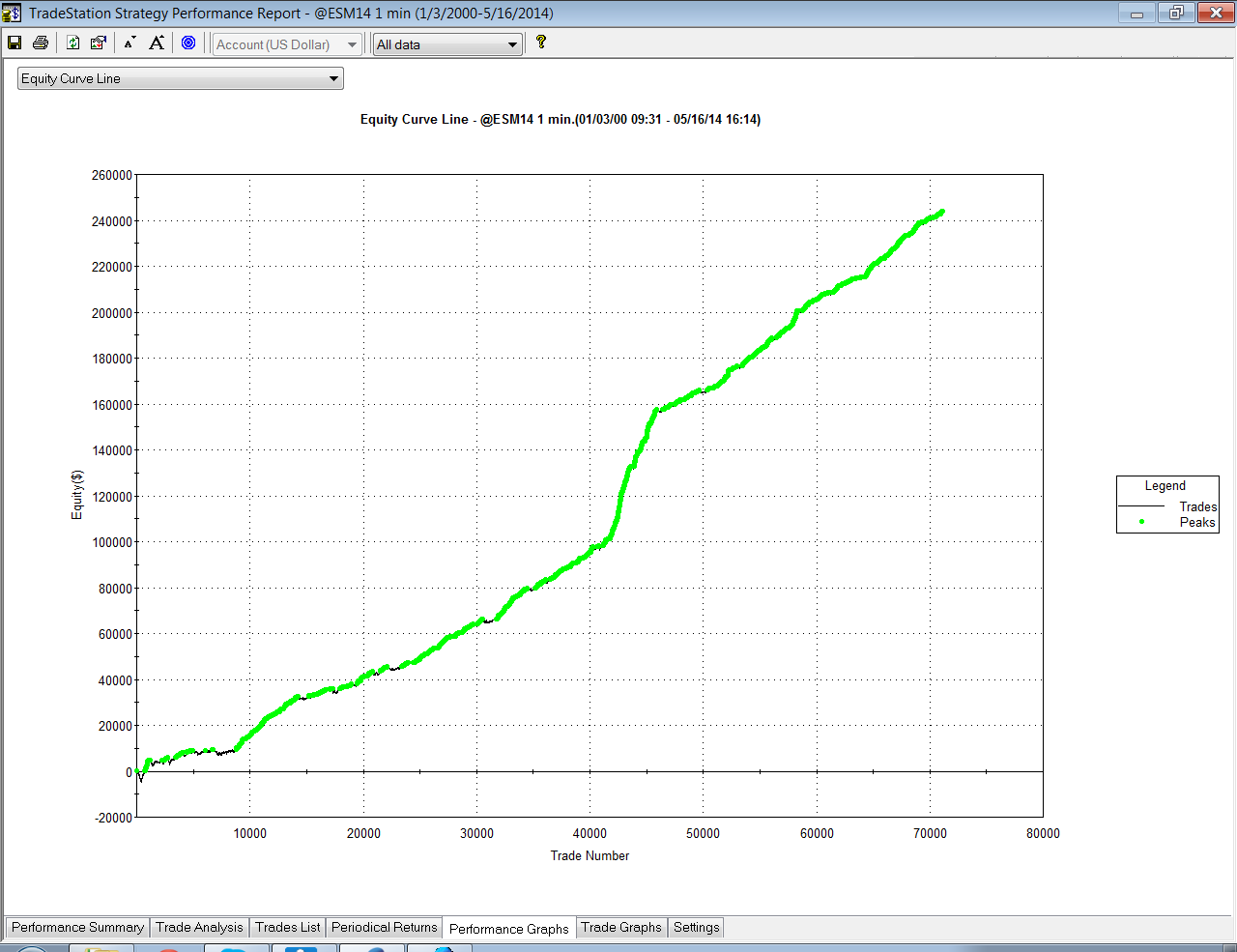

Backtesting on ES-Mini 1-min bar from 2000-2014

The strategy includes fees and commissions of $3 per contract, or $6 for two legs.

Equity Curve

As you can see, the strategy produces a smooth, upward sloping equity curve, the slope of which increases markedly during the period of high market volatility in 2008. Net profits after commissions for a single ES contract amount to $243,000 ($3.42 per contract) with a win rate of 76% and Profit Factor of 1.24.

Related Readings and Observations

The post Simple Volatility based Intraday Scalping Strategy appeared first on Marketcalls.