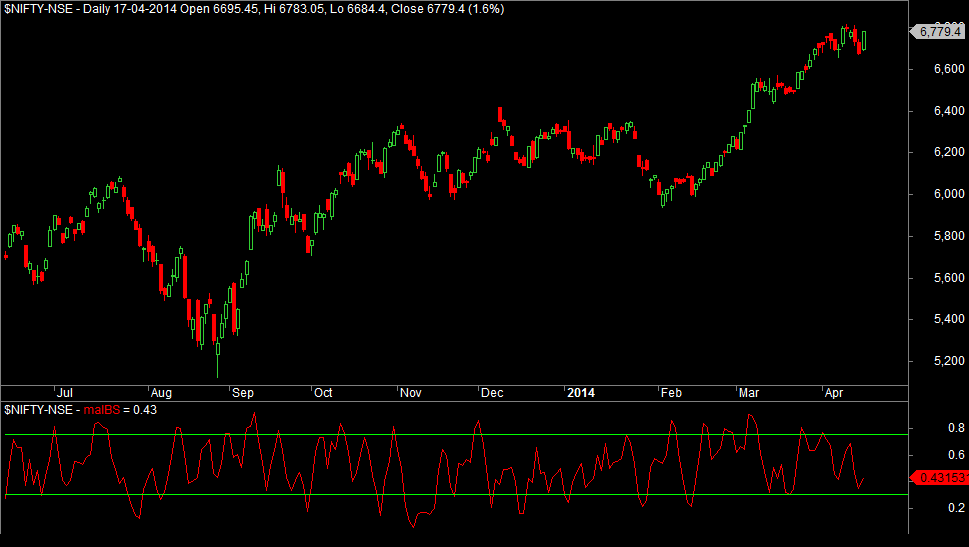

IBS Mean Reversion System

Here is a simple mean reversion system adapted from IBS reversion edge with QuantShare. And our IBS mean reversion strategy is a slight variation of the Internal Bar Strength by taking a three day moving average to IBS (maIBS) and looking for IBS crossovers to derive the trading conditions.

Internal Bar strength is calculated using a simple formula,

IBS = (close-low)/(High-Low)

IBS takes values between 0 and 1 and simply indicates at which point along the day’s range the closing price is located.

Buy and Sell Rules

Adapted timeframe : Daily

Holding Period : 1 day.

Go Long : If maIBS crosses below 0.3 and buy next day open

Long Exit : Exit the Same day at CloseGo Short : If maIBS crosses above 0.75 and buy next day open

Short Exit : Exit the Same day at Close

Amibroker AFL code

Download IBS AFL code

Backtest Results

For those who are interested here are the backtested results.

Bactesting Period : May 2007 – April 2014

Commisions – Rs200 per trade included for 2 lots of Nifty (includes both buy and sell transaction)

Equity Curve

Underwater Equity

Profit Table

Related Readings and Observations

The post Internal Bar Strength – Mean Reversion Trading AFL code appeared first on Marketcalls.