The Complete March month Marketcalls decided to focus more on Implementing Option Strategies in Amibroker. As a kickstart thought of coding simple concepts before turning out with Complex Ideas. As a initiative, thought of starting with implementing Option Spreads with Strangle and Straddle.

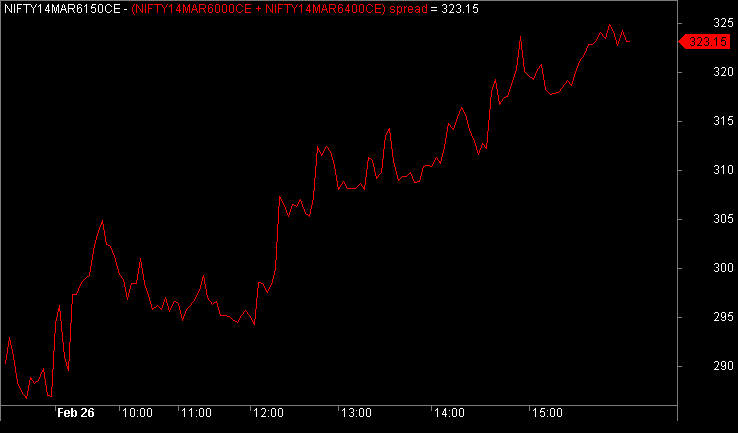

If you are a Options Strategic Player then probably you would be interested in monitoring the Option Spread in Realtime. However a time series option spread is even more interesting. The below image shows the Option Spread of 6000CE + 6400CE long straddle strategy for march option series.

Visit here for Live Nifty Option Charts

Procedure to Setup the Strangle and Straddle Option Spread

1.Download Strangle and Straddle Option Spread AFL code to Amibroker/Formulas/Options Spread directory

and Unzip the file. Create Options Spread Directory if it doesn’t exist.

2.Open Amibroker->Open New Blank Chart

3.Now on the Left Pane goto Charts->Option Spread and drang and drop Strangle and Straddle Spread to the blank chart.

4.Bingo! you got the Spread chart.

5.To Change the spread right click over the charts and goto Parameters where you have control to change the strike1 and strike2 prices as shown below

What Strategies are covered in the AFL Code?

1.Long Strangle – Volatility Strategy

2.Long Straddle – Volatility Strategy

3.Short Straddle – Neutral Strategy

4.Short Straddle – Neutral Strategy

Prerequesite

Realtimedatafeed for Amibroker which Supports NSE Options.

Every day we are planning to release a set of Option spread strategies. Put you ideas to bring more stuff here. Stay Tuned!

Related Readings and Observations

The post Strangle and Straddle Option Spread – Amibroker AFL code appeared first on Marketcalls.