National Stock Exchange (NSE) has decided to launch float futures contracts based on its volatility index (India VIX) with effect from February 26 as the market regulator SEBI had approved the long-pending demand of the NSE to commence derivatives trading on the volatility index also known as ‘India VIX’

Key Points

- there will be three weekly futures contracts expiring on every Tuesday of the week and the market hours will be same as that of the Futures &Options (F&O) segment.

- The India VIX futures can be used to hedge equity portfolios and held investors to take directional views on volatility, among others.

- All market participants currently permitted in the F&O segment are permitted to participate

Specifications:

Instrument name – FUTIVX.

Expiry date – Every Tuesday.

Contract cycle - Weekly – 3 serial contracts. New fut contract will be introduced for every week.

Contract value – Min 10 lac at the time of introduction.

Price steps - Rs. 0.25.

Daily close price – volume weighted average fut price of trades in last 30 min.

VIX value – will be computed upto 4 decimals with a tick value of 0.0025.

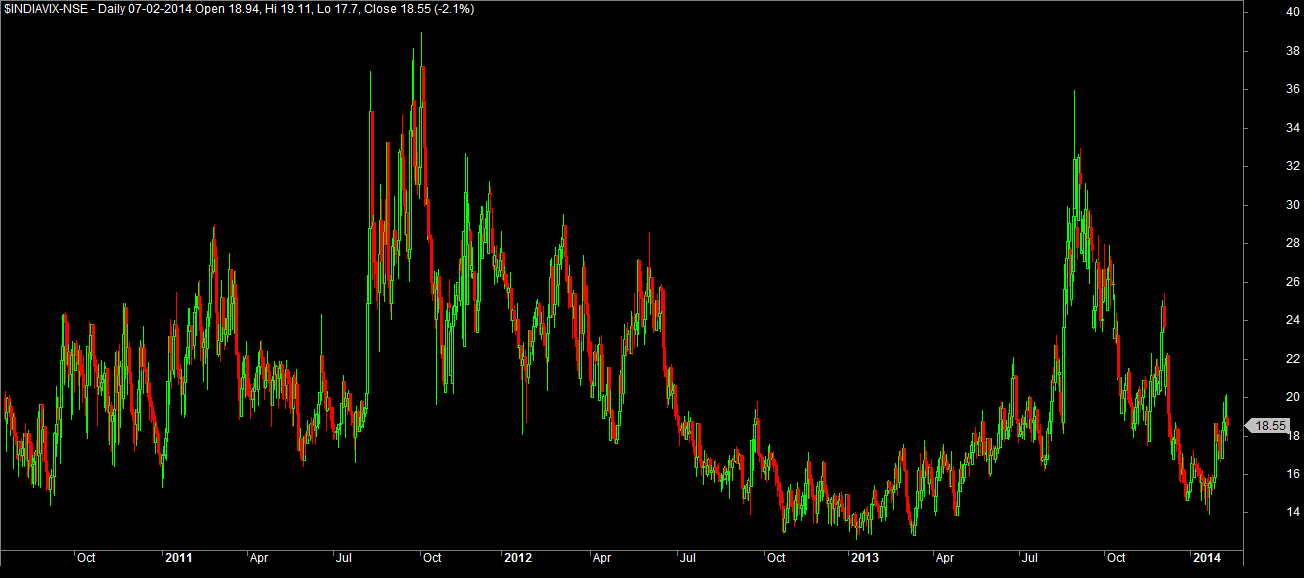

About India VIX

India VIX indicates the investor’s perception of the market’s volatility over the next 30 calendar days. Higher the India VIX values, higher is the expected volatility. The ‘India VIX’ is computed using “the best bid and ask quote of the out-of-the-money near and mid-month NIFTY options contracts which are traded on the futures and options segment of NSE”.

-

Related Readings and Observations

The post NSE to launch India VIX Futures by February 26 appeared first on Marketcalls.